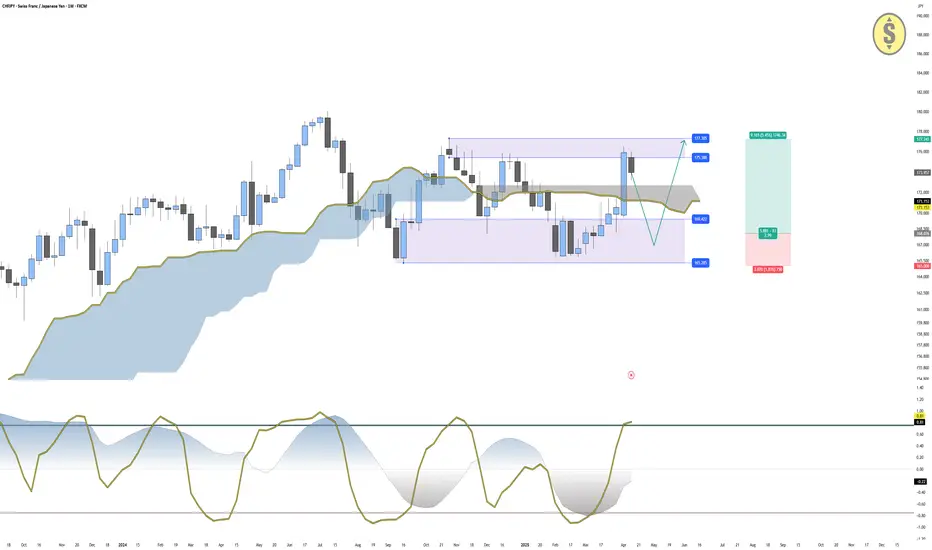

CHF/JPY is currently trading at 173.95, having recently rejected the resistance area between 175.00 and 177.00. The rejection aligns with a Trend Strength Index (TSI 10) reading of 0.81, indicating short-term overbought conditions and suggesting that a pullback is likely before any new bullish continuation.

The price is trading above the Ichimoku cloud (Span A at 171.15 and Span B at 171.40), which supports a bullish bias. However, price action over the past months shows a clear sideways consolidation range between 165.00 and 177.00, where bullish momentum has recently weakened (TSI 20 at -0.22).

Given this context, the optimal approach is to wait for a pullback into the support zone between 169.00 and 165.00, where the market has historically found demand. A bullish reaction from this zone could offer a high-quality trend continuation setup toward the upper boundary of the range at 177.00, and potentially toward the range extension at 179.30.

Trade Setup Summary:

Buy Zone: 169.00 – 165.00 (support + range bottom)

Target 1: 177.00 (range resistance)

Target 2: 179.30 (extension above range)

Invalidation: Break below 165.00

Bias: Bullish while above range bottom

TSI: Wait for a reset into neutral or oversold zone for confirmation

The Swiss franc continues to be supported by its safe-haven status, though recent SNB rate cuts have slightly weakened its strength. Meanwhile, the Japanese yen remains fundamentally weak due to the Bank of Japan's persistent ultra-loose monetary policy. This macro backdrop favors CHF strength in the medium term, aligning with the technical setup for a bullish continuation, especially if global risk sentiment remains stable or tilts positive.

Disclaimer: This content is for educational and informational purposes only. It does not represent financial advice or a recommendation to buy or sell any financial instrument. Trading involves risk, and you should only trade with money you can afford to lose.

The price is trading above the Ichimoku cloud (Span A at 171.15 and Span B at 171.40), which supports a bullish bias. However, price action over the past months shows a clear sideways consolidation range between 165.00 and 177.00, where bullish momentum has recently weakened (TSI 20 at -0.22).

Given this context, the optimal approach is to wait for a pullback into the support zone between 169.00 and 165.00, where the market has historically found demand. A bullish reaction from this zone could offer a high-quality trend continuation setup toward the upper boundary of the range at 177.00, and potentially toward the range extension at 179.30.

Trade Setup Summary:

Buy Zone: 169.00 – 165.00 (support + range bottom)

Target 1: 177.00 (range resistance)

Target 2: 179.30 (extension above range)

Invalidation: Break below 165.00

Bias: Bullish while above range bottom

TSI: Wait for a reset into neutral or oversold zone for confirmation

The Swiss franc continues to be supported by its safe-haven status, though recent SNB rate cuts have slightly weakened its strength. Meanwhile, the Japanese yen remains fundamentally weak due to the Bank of Japan's persistent ultra-loose monetary policy. This macro backdrop favors CHF strength in the medium term, aligning with the technical setup for a bullish continuation, especially if global risk sentiment remains stable or tilts positive.

Disclaimer: This content is for educational and informational purposes only. It does not represent financial advice or a recommendation to buy or sell any financial instrument. Trading involves risk, and you should only trade with money you can afford to lose.

Trade forex, indices, stocks and metals with up to US$100.000 in company's funding.

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Trade forex, indices, stocks and metals with up to US$100.000 in company's funding.

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.