# NIFTY FUTURES - High Probability Channel Bounce Setup 📈

## Current Price: 26,252.70 (+11.40, +0.04%)

---

## Technical Setup Summary

**BULLISH BIAS** - Multiple confluence factors suggesting a move toward channel high

---

## Key Observations

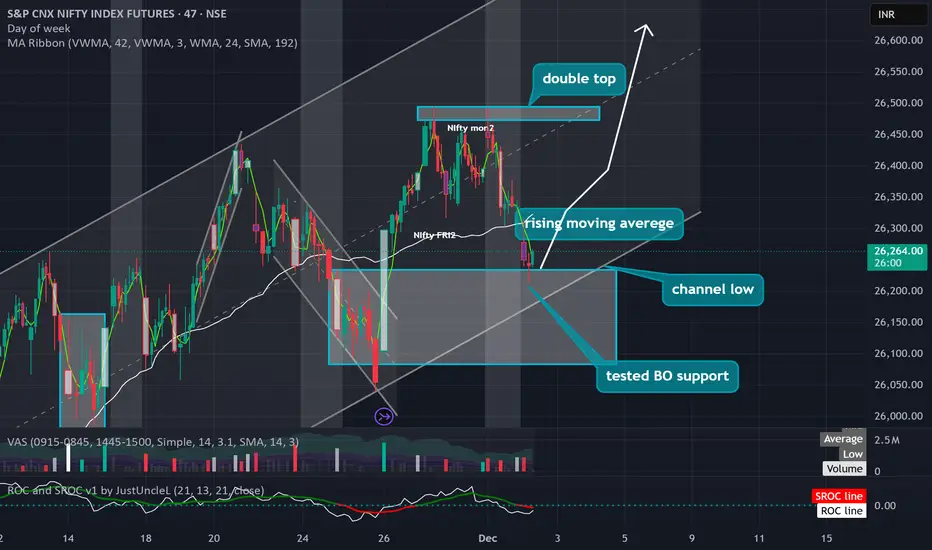

### 1. **Channel Structure**

- Price currently at the **bottom of the ascending channel**

- Channel has been respected multiple times, providing reliable support/resistance zones

- Clean breakout and retest pattern visible

### 2. **Support Confirmation**

- Price has **tested the breakout (BO) support level** and held

- This previous resistance (around 26,250 zone) is now acting as support

- Strong bounce from this level indicates buyer interest

### 3. **Double Top as Poor Low**

- The double top formation at the channel high is creating a **poor low structure**

- This often leads to price retracement to fill the inefficiency

- Suggests potential for upward move to retest those highs

### 4. **Volume Weighted Moving Average (VWMA)**

- **Rising VWMA** indicating increasing participation with upward bias

- VWMA acting as dynamic support

- Price trading above key moving averages (42, 3, 24)

### 5. **Risk-Reward Profile**

- **Entry Zone**: Current levels (26,250-26,260)

- **Stop Loss**: Today's low (very tight risk)

- **Target**: Channel high (~26,500-26,550)

- **Risk-Reward Ratio**: Excellent (approximately 1:5 or better)

---

## Trade Plan

### Long Setup:

- **Entry**: 26,250-26,270

- **Stop Loss**: Below today's low (26,200-26,220 area)

- **Target 1**: 26,400 (Previous resistance zone)

- **Target 2**: 26,500-26,550 (Channel high)

- **Risk**: Very low due to tight stop

### Key Levels to Watch:

- **Support**: 26,239 (Today's low), 26,200 (Channel low), 26,050 (Tested BO support)

- **Resistance**: 26,400 (Nifty FRI2), 26,500+ (Channel high/Double top)

---

## Confluence Factors ✅

✓ Bottom of ascending channel

✓ Tested BO support holding

✓ Double top creating inefficiency

✓ Rising VWMA showing strength

✓ Tight stop loss = Low risk

✓ Multiple timeframe alignment

✓ Volume confirmation at support

---

## Conclusion

All technical indicators align for a potential move to the channel high. The setup offers an asymmetric risk-reward with a tight stop loss at today's low. The combination of channel support, breakout retest, and rising moving averages suggests buyer strength at these levels.

**Bias**: Bullish for a move toward 26,500+

**Risk Level**: Low (tight stop at today's low)

**Timeframe**: Short to medium term

---

*Disclaimer: This is for educational purposes only. Please do your own analysis and risk management before taking any trades.*

**#NIFTY #NiftyFutures #TechnicalAnalysis #ChannelTrading #SwingTrading #NSE**

## Current Price: 26,252.70 (+11.40, +0.04%)

---

## Technical Setup Summary

**BULLISH BIAS** - Multiple confluence factors suggesting a move toward channel high

---

## Key Observations

### 1. **Channel Structure**

- Price currently at the **bottom of the ascending channel**

- Channel has been respected multiple times, providing reliable support/resistance zones

- Clean breakout and retest pattern visible

### 2. **Support Confirmation**

- Price has **tested the breakout (BO) support level** and held

- This previous resistance (around 26,250 zone) is now acting as support

- Strong bounce from this level indicates buyer interest

### 3. **Double Top as Poor Low**

- The double top formation at the channel high is creating a **poor low structure**

- This often leads to price retracement to fill the inefficiency

- Suggests potential for upward move to retest those highs

### 4. **Volume Weighted Moving Average (VWMA)**

- **Rising VWMA** indicating increasing participation with upward bias

- VWMA acting as dynamic support

- Price trading above key moving averages (42, 3, 24)

### 5. **Risk-Reward Profile**

- **Entry Zone**: Current levels (26,250-26,260)

- **Stop Loss**: Today's low (very tight risk)

- **Target**: Channel high (~26,500-26,550)

- **Risk-Reward Ratio**: Excellent (approximately 1:5 or better)

---

## Trade Plan

### Long Setup:

- **Entry**: 26,250-26,270

- **Stop Loss**: Below today's low (26,200-26,220 area)

- **Target 1**: 26,400 (Previous resistance zone)

- **Target 2**: 26,500-26,550 (Channel high)

- **Risk**: Very low due to tight stop

### Key Levels to Watch:

- **Support**: 26,239 (Today's low), 26,200 (Channel low), 26,050 (Tested BO support)

- **Resistance**: 26,400 (Nifty FRI2), 26,500+ (Channel high/Double top)

---

## Confluence Factors ✅

✓ Bottom of ascending channel

✓ Tested BO support holding

✓ Double top creating inefficiency

✓ Rising VWMA showing strength

✓ Tight stop loss = Low risk

✓ Multiple timeframe alignment

✓ Volume confirmation at support

---

## Conclusion

All technical indicators align for a potential move to the channel high. The setup offers an asymmetric risk-reward with a tight stop loss at today's low. The combination of channel support, breakout retest, and rising moving averages suggests buyer strength at these levels.

**Bias**: Bullish for a move toward 26,500+

**Risk Level**: Low (tight stop at today's low)

**Timeframe**: Short to medium term

---

*Disclaimer: This is for educational purposes only. Please do your own analysis and risk management before taking any trades.*

**#NIFTY #NiftyFutures #TechnicalAnalysis #ChannelTrading #SwingTrading #NSE**

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.