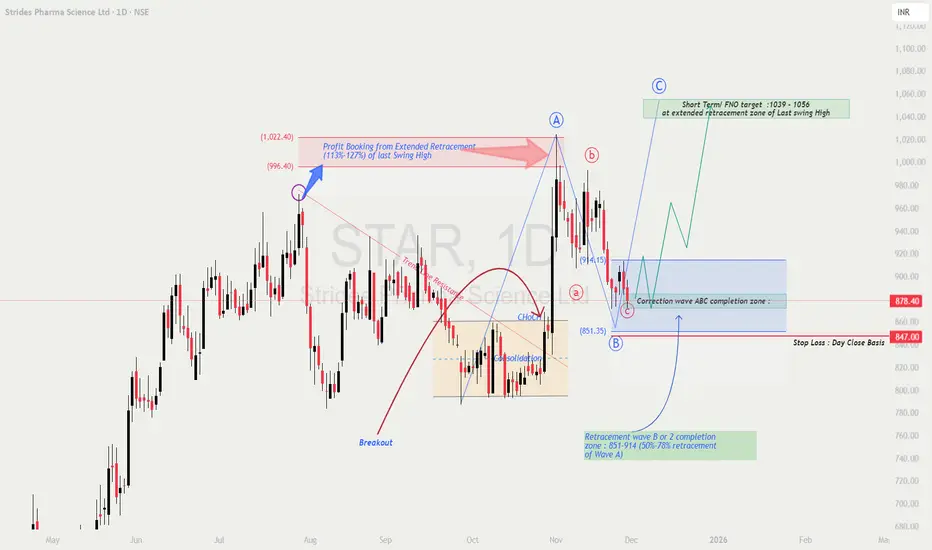

STRIDES PHARMA (STAR) – Wave C Completion Zone Hit | Bullish Reversal & Target 1039–1056 Loading?

🧠 Market Structure & Elliott Wave Context

Strides Pharma has completed a classic A–B–C corrective pattern following a strong impulsive Wave A.

Price has now entered the crucial Wave C completion zone → ₹851–₹914, which aligns perfectly with the 50%–78% Fibonacci retracement of Wave A 🔥.

Key structure observations:

Profit booking earlier happened at the 113–127% extended retracement of the last swing high (textbook Elliott Wave Wave A exhaustion).

Price broke out of a consolidation block, then sharply retraced into Wave C.

The current pullback is healthy and controlled, not a trend reversal.

This is exactly where reversal setups typically appear before Wave C → Wave C extension impulses.

📚 Educational Breakdown

🎯 Price Prediction & Upside Targets

If STAR reverses from the ₹851–₹914 Wave C demand zone, bullish upside opens toward:

🎯 Short-Term Target: ₹1039 – ₹1056 (F&O / extended retracement target)

🎯 Medium-Term Target: ₹1085+ (if momentum continues)

Upside activation strengthens if price crosses ₹914–₹920 with volume.

📈 Risk–Reward Perspective

Entry Zone: ₹851 – ₹914

Stop Loss: ₹847 (daily close)

Target: ₹1039–₹1056

Risk: ~₹20–₹40

Reward: ₹125–₹200

👉 Risk–Reward Ratio: Approx 1 : 3.5 to 1 : 6 🚀

(Excellent R:R for swing traders)

💡 Trading Strategy (Educational Only)

🧩 Summary

STAR is showing a high-probability bullish reversal after completing its Wave C at the ideal Fibonacci confluence zone.

If the structure flips bullish, a strong move toward ₹1039 → ₹1056 is likely next.

This setup offers excellent risk–reward and aligns cleanly with Elliott Wave and Fibonacci principles ⚡.

⚠️ Disclaimer

I am not a SEBI-registered analyst.

This analysis is for educational and informational purposes only — not investment advice.

🧠 Market Structure & Elliott Wave Context

Strides Pharma has completed a classic A–B–C corrective pattern following a strong impulsive Wave A.

Price has now entered the crucial Wave C completion zone → ₹851–₹914, which aligns perfectly with the 50%–78% Fibonacci retracement of Wave A 🔥.

Key structure observations:

Profit booking earlier happened at the 113–127% extended retracement of the last swing high (textbook Elliott Wave Wave A exhaustion).

Price broke out of a consolidation block, then sharply retraced into Wave C.

The current pullback is healthy and controlled, not a trend reversal.

This is exactly where reversal setups typically appear before Wave C → Wave C extension impulses.

📚 Educational Breakdown

- 📘 A–B–C Corrective Wave Structure:

Wave A = initial drop

Wave B = retracement (profit taking / liquidity grab)

Wave C = final flush into demand

Once Wave C completes, price usually begins a fresh impulse. - 🔄 50%–78% Fib Retracement (Wave B/2 Zone):

This zone is statistically one of the most reliable reversal regions in corrective legs.

STAR is sitting exactly inside this zone → high-probability bounce area. - 🌀 Extended Retracement Targets (113%–128%):

Wave C → Wave C extension often targets these levels.

Your chart reflects this perfectly for the upside projection. - 📉 Stop-Loss Logic (Risk Control):

A close below ₹847 breaks the structural logic of Wave C completion → invalidation level.

🎯 Price Prediction & Upside Targets

If STAR reverses from the ₹851–₹914 Wave C demand zone, bullish upside opens toward:

🎯 Short-Term Target: ₹1039 – ₹1056 (F&O / extended retracement target)

🎯 Medium-Term Target: ₹1085+ (if momentum continues)

Upside activation strengthens if price crosses ₹914–₹920 with volume.

📈 Risk–Reward Perspective

Entry Zone: ₹851 – ₹914

Stop Loss: ₹847 (daily close)

Target: ₹1039–₹1056

Risk: ~₹20–₹40

Reward: ₹125–₹200

👉 Risk–Reward Ratio: Approx 1 : 3.5 to 1 : 6 🚀

(Excellent R:R for swing traders)

💡 Trading Strategy (Educational Only)

- 🟢 Entry Strategy:

Enter in the ₹851–₹914 zone.

Wait for bullish reversal candles → Hammer, Engulfing, or ChoCH on lower timeframes. - 📈 Confirmation Strategy:

A break above ₹914–₹920 confirms buyer strength → safer entry for wave continuation. - 🎯 Profit Booking Plan:

• Book partial at ₹1039–₹1056

• Trail SL to cost after breakout

• Hold runners for extended move - ⚖️ Risk Management:

• Keep SL strictly below ₹847

• Risk max 1–2% capital

• Don’t average below structure break

🧩 Summary

STAR is showing a high-probability bullish reversal after completing its Wave C at the ideal Fibonacci confluence zone.

If the structure flips bullish, a strong move toward ₹1039 → ₹1056 is likely next.

This setup offers excellent risk–reward and aligns cleanly with Elliott Wave and Fibonacci principles ⚡.

⚠️ Disclaimer

I am not a SEBI-registered analyst.

This analysis is for educational and informational purposes only — not investment advice.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.