PROTECTED SOURCE SCRIPT

Consolidation and Breakout Strategy

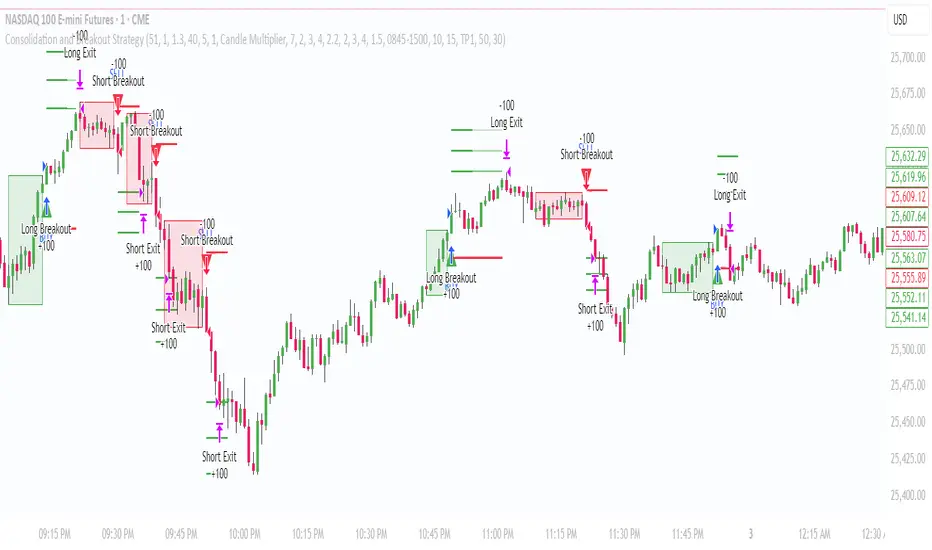

Consolidation and Breakout Strategy

This strategy is designed to detect tight consolidation zones followed by a strong breakout, allowing traders to capture explosive moves with high precision.

It works on every instrument (indices, stocks, crypto, futures, FX) and on every timeframe, as the consolidation logic is fully dynamic and adapts automatically based on volatility.

How It Works

The strategy finds periods of low volatility using a candle-body volatility filter.

When candles remain small for several bars, the script marks a consolidation box.

A valid breakout occurs only when:

The breakout candle is significantly larger (volatility expansion), and

Price closes outside the consolidation range with strong momentum.

A position is opened immediately on the breakout (on bar close).

Predefined TP/SL levels, with optional partial exits, manage the trade.

Default Performance (NQ 1-Minute Example)

With default parameters, using NASDAQ Futures (NQ) on the 1-minute chart, the strategy historically shows:

Win Rate: ~62.75%

Profit Factor: ~1.70

These numbers vary by provider and data source, but they highlight how well this structure performs in high-volatility markets.

Fully Customizable

Every key parameter is adjustable:

Consolidation detection sensitivity

Breakout strength threshold

TP/SL multipliers or percentages

Session filters

Partial exit logic

Visuals (boxes, colors, signals)

You can fine-tune the settings for your preferred instrument and timeframe.

Recommended Markets

This breakout structure works especially well on:

Index futures (NQ, ES, YM, DAX, FTSE)

Major crypto pairs

High-volume stocks

FX pairs with clean intraday movement

This strategy is designed to detect tight consolidation zones followed by a strong breakout, allowing traders to capture explosive moves with high precision.

It works on every instrument (indices, stocks, crypto, futures, FX) and on every timeframe, as the consolidation logic is fully dynamic and adapts automatically based on volatility.

How It Works

The strategy finds periods of low volatility using a candle-body volatility filter.

When candles remain small for several bars, the script marks a consolidation box.

A valid breakout occurs only when:

The breakout candle is significantly larger (volatility expansion), and

Price closes outside the consolidation range with strong momentum.

A position is opened immediately on the breakout (on bar close).

Predefined TP/SL levels, with optional partial exits, manage the trade.

Default Performance (NQ 1-Minute Example)

With default parameters, using NASDAQ Futures (NQ) on the 1-minute chart, the strategy historically shows:

Win Rate: ~62.75%

Profit Factor: ~1.70

These numbers vary by provider and data source, but they highlight how well this structure performs in high-volatility markets.

Fully Customizable

Every key parameter is adjustable:

Consolidation detection sensitivity

Breakout strength threshold

TP/SL multipliers or percentages

Session filters

Partial exit logic

Visuals (boxes, colors, signals)

You can fine-tune the settings for your preferred instrument and timeframe.

Recommended Markets

This breakout structure works especially well on:

Index futures (NQ, ES, YM, DAX, FTSE)

Major crypto pairs

High-volume stocks

FX pairs with clean intraday movement

Mã được bảo vệ

Tập lệnh này được đăng dưới dạng mã nguồn đóng. Tuy nhiên, bạn có thể sử dụng tự do và không giới hạn – tìm hiểu thêm tại đây.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Mã được bảo vệ

Tập lệnh này được đăng dưới dạng mã nguồn đóng. Tuy nhiên, bạn có thể sử dụng tự do và không giới hạn – tìm hiểu thêm tại đây.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.