PROTECTED SOURCE SCRIPT

DUOT OSCILLATOR

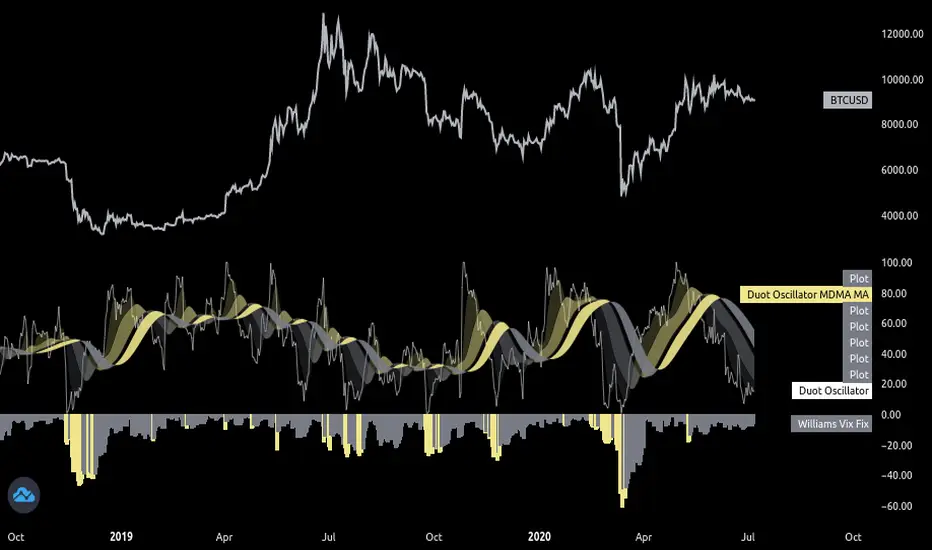

Duot Oscillator is an indicator combining the performance of multiple differential oscillators (RSI, ROC, WCCI, MACD, BBB)

The oscillators are normalized and triple smoothed using a variant of McGuinley Dynamic MA formula, the final result is also then triple smoothed over a fib series.

The final oscillator was found to produce higher success rate when detecting divergence over using either individual signals for each of the oscillators on its own, or a weighted signal of a subset of the mentioned oscillators.

We were not able to verify, hypothesis, or find a reasoning for that claim, but following the divergences of that oscillator were more accurate at least in our setups since Feb 2019 on BTCUSD

Duot oscillator along with William Vix fix and Simple 3 MAs are the main decision makers behind Duot Strategy

Settings:

- Date Selectors

- Normalize Lookback (for all oscillators)

- Minimize parameters (this will use the same MAs Lookbacks for all oscillators, should be fine but if you want to use any parameters optimizers, you can disable that setting and fine tune each individually)

- Oscillators Lookback: if the above checkbox is checked then this value will be used for all oscillators(generally fine except for RSI)

- MAs Lookback for individual oscillators

- William Vix Fix Settings

The oscillators are normalized and triple smoothed using a variant of McGuinley Dynamic MA formula, the final result is also then triple smoothed over a fib series.

The final oscillator was found to produce higher success rate when detecting divergence over using either individual signals for each of the oscillators on its own, or a weighted signal of a subset of the mentioned oscillators.

We were not able to verify, hypothesis, or find a reasoning for that claim, but following the divergences of that oscillator were more accurate at least in our setups since Feb 2019 on BTCUSD

Duot oscillator along with William Vix fix and Simple 3 MAs are the main decision makers behind Duot Strategy

Settings:

- Date Selectors

- Normalize Lookback (for all oscillators)

- Minimize parameters (this will use the same MAs Lookbacks for all oscillators, should be fine but if you want to use any parameters optimizers, you can disable that setting and fine tune each individually)

- Oscillators Lookback: if the above checkbox is checked then this value will be used for all oscillators(generally fine except for RSI)

- MAs Lookback for individual oscillators

- William Vix Fix Settings

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.