OPEN-SOURCE SCRIPT

Cập nhật Sharpe Ratio Z-Score

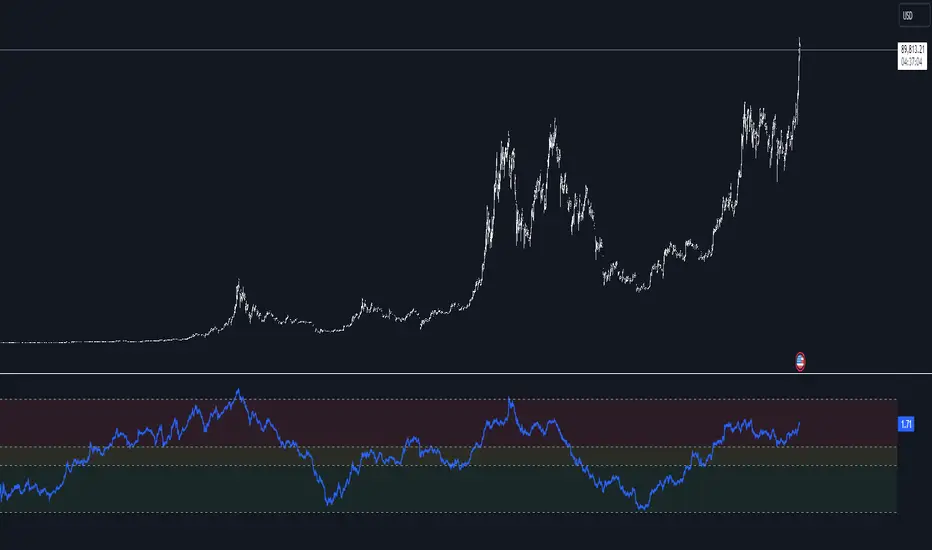

The "Sharpe Ratio Z-Score" indicator is a powerful tool designed to measure risk-adjusted returns in financial assets. This script helps investors evaluate the performance of a security relative to its risk, using a Z-score based modification of the Sharpe Ratio. The indicator is suitable for assessing market environments and understanding periods of underperformance or overperformance relative to historical standards.

Features:

Risk Assessment and Scaling: The indicator calculates a modified version of the Sharpe Ratio

over a user-defined period. By using scaling and mean offset adjustments, it allows for better

fitting to different market conditions.

Customizable Settings:

Period Length: The number of bars used to calculate the Sharpe Ratio.

Mean Adjustment: Offset value to adjust the average return of the calculated Sharpe ratio.

Scale Factor: A multiplier for emphasizing or reducing the calculated score's impact.

Line Color: Easily customize the plot's appearance.

Visual Cues:

Plots horizontal lines and fills specific regions to visually represent significant Z-score levels.

Highlighted zones include risk thresholds, such as overbought (positive Z-scores) and oversold

(negative Z-scores) areas, using intuitive color fills:

Green for areas below -0.5 (potential buy opportunities).

Red for areas above 0.5 (potential sell opportunities).

Yellow for neutral zones between -0.5 and 0.5.

Use Cases:

Risk-Adjusted Decision Making: Understand when returns are favorable compared to risk, especially during volatile market conditions.

Timing Reversion to Mean: Use highlighted zones to identify potential reversion-to-mean scenarios.

Trend Analysis: Identify times when an asset's performance is significantly deviating from its

average risk-adjusted return.

How It Works:

The script computes the daily returns over a set period, calculates the standard deviation of

those returns, and then applies a modified Sharpe Ratio approach. The Z-score transformation

helps to visualize how far an asset's risk-adjusted return deviates from its historical average.

This "Sharpe Ratio Z-Score" indicator is well-suited for investors seeking to combine quantitative metrics with visual cues, enhancing decision-making for long and short positions while maintaining a risk-adjusted perspective.

Features:

Risk Assessment and Scaling: The indicator calculates a modified version of the Sharpe Ratio

over a user-defined period. By using scaling and mean offset adjustments, it allows for better

fitting to different market conditions.

Customizable Settings:

Period Length: The number of bars used to calculate the Sharpe Ratio.

Mean Adjustment: Offset value to adjust the average return of the calculated Sharpe ratio.

Scale Factor: A multiplier for emphasizing or reducing the calculated score's impact.

Line Color: Easily customize the plot's appearance.

Visual Cues:

Plots horizontal lines and fills specific regions to visually represent significant Z-score levels.

Highlighted zones include risk thresholds, such as overbought (positive Z-scores) and oversold

(negative Z-scores) areas, using intuitive color fills:

Green for areas below -0.5 (potential buy opportunities).

Red for areas above 0.5 (potential sell opportunities).

Yellow for neutral zones between -0.5 and 0.5.

Use Cases:

Risk-Adjusted Decision Making: Understand when returns are favorable compared to risk, especially during volatile market conditions.

Timing Reversion to Mean: Use highlighted zones to identify potential reversion-to-mean scenarios.

Trend Analysis: Identify times when an asset's performance is significantly deviating from its

average risk-adjusted return.

How It Works:

The script computes the daily returns over a set period, calculates the standard deviation of

those returns, and then applies a modified Sharpe Ratio approach. The Z-score transformation

helps to visualize how far an asset's risk-adjusted return deviates from its historical average.

This "Sharpe Ratio Z-Score" indicator is well-suited for investors seeking to combine quantitative metrics with visual cues, enhancing decision-making for long and short positions while maintaining a risk-adjusted perspective.

Phát hành các Ghi chú

The Adjusted Risk-Return Score is a customized metric designed to evaluate an asset's risk-adjusted returns in a non-traditional yet insightful way. Inspired by the principles of the Sharpe Ratio, this indicator modifies the standard formula to offer a more flexible perspective on returns relative to volatility. It aims to provide traders with a dynamic view of market performance, incorporating scaling and mean adjustments to better fit various market conditions.Key Features:

Custom Risk-Return Evaluation: This indicator builds on the idea of the Sharpe Ratio, using average returns and volatility to measure how effectively an asset compensates for risk. Unlike the traditional Sharpe Ratio, it includes transformations for flexibility and custom scaling.

Adjustable Parameters:

Period Length: Define the length of historical data used for the calculation (default is 400).

Mean Adjustment: Shift the calculated score to customize it for different market expectations.

Scaling Factor: Amplify or reduce the influence of the score based on personal preference or market behavior.

Custom Line Color: Easily adjust the color to suit your charting style.

Visual Guidance:

Key risk-return thresholds are highlighted using colored zones to indicate overbought, oversold, and neutral conditions:

Green Zone: Represents negative values beyond -0.5, which may indicate potential opportunities for buying.

Red Zone: Represents positive values beyond 0.5, indicating possible overbought conditions.

Yellow Zone: Represents the neutral area between -0.5 and 0.5, signaling a balanced risk-return state.

How to Use:

Identifying Market Extremes: Use the green and red highlighted areas to identify potential market reversals or extremes.

Risk-Adjusted Decisions: This score helps traders make decisions by evaluating the balance between return and associated risk, giving a non-standardized but practical perspective for timing entries and exits.

Adaptive Insights: By using the scaling and mean parameters, you can fine-tune the score to adapt to different asset classes or volatility regimes.

How It Works:

The indicator calculates daily returns over a specified period, evaluates their average, and divides by the standard deviation to derive a basic risk-return metric. This value is then adjusted using a scaling factor and mean offset, resulting in a versatile metric that helps capture the dynamics of risk-adjusted performance across different market phases.

Note: The Adjusted Risk-Return Score is a modified version of the Sharpe Ratio concept, offering a unique perspective that may not align exactly with conventional financial risk metrics. It is designed for traders who are seeking a fresh way to measure and visualize returns in the context of risk.

Use the "Adjusted Risk-Return Score" to gain a deeper, adaptive understanding of an asset's performance relative to the inherent risk, helping you to identify favorable opportunities while staying aware of potential reversals.

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.