INVITE-ONLY SCRIPT

Ema-Weighted-Gain

Strategy Inputs: Capital=$10,000, Pyramiding=3, Default Quantity=1

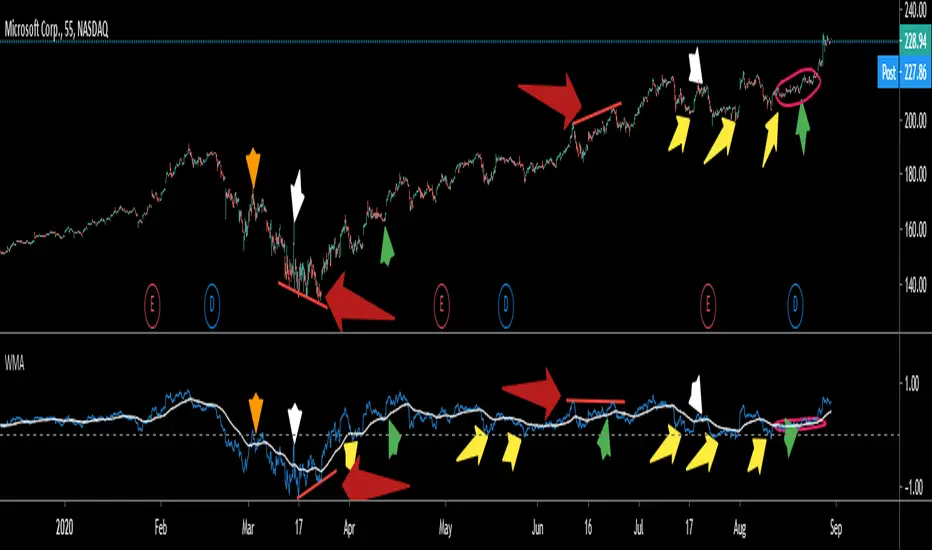

Please note that the strategy buys when the WMA (Blue line) cross under zero and sell above it, your experience is very important in using this indicator. Do not follow the buy/sell signals. Read the plot as I explain in the Uses Section and make your own conclusion on how to use it.

Description,

This Strategy uses multiple Ema’s to calculate Weighted HPR's.

I have calculated the weight numbers based on Fibonacci.

Uses:

NOTE!! (Please Do not take those uses to be 100% Guaranteed. User your experience and judgment to decide your trade).

Zoom out to see all the arrows

White line (MA)

Blue line (WMA)

First

Ride Trends,

1-Downtrend: short

a-MA IS going down

b-Entry: WMA cross above or near the MA (White Arrows).

2-Uptrend:long

a-MA is going up

b-Entry: WMA goes below MA or Near it(Green Arrows).

Second

Trend Reversal

1-buy entry.

WMA at zero, or very close to it, in pullback (Yellow Arrows).

2-short entry

WMA at zero, or very close to it, in a bounce (Orange Arrows).

Third

Divergence as explained in the Red Arrows.

Conclusion,

Red Arrows= Divergence

Green Arrows= Buy entry (The stock is in uptrend)

Yellow Arrows= Buy entry (the stock is in downtrend and could reverse)

White arrows= short entry (the stock is in downtrend)

Orange arrows=short entry (the stock in uptrend and can reverse)

If you are interested, send a private message

Please note that the strategy buys when the WMA (Blue line) cross under zero and sell above it, your experience is very important in using this indicator. Do not follow the buy/sell signals. Read the plot as I explain in the Uses Section and make your own conclusion on how to use it.

Description,

This Strategy uses multiple Ema’s to calculate Weighted HPR's.

I have calculated the weight numbers based on Fibonacci.

Uses:

NOTE!! (Please Do not take those uses to be 100% Guaranteed. User your experience and judgment to decide your trade).

Zoom out to see all the arrows

White line (MA)

Blue line (WMA)

First

Ride Trends,

1-Downtrend: short

a-MA IS going down

b-Entry: WMA cross above or near the MA (White Arrows).

2-Uptrend:long

a-MA is going up

b-Entry: WMA goes below MA or Near it(Green Arrows).

Second

Trend Reversal

1-buy entry.

WMA at zero, or very close to it, in pullback (Yellow Arrows).

2-short entry

WMA at zero, or very close to it, in a bounce (Orange Arrows).

Third

Divergence as explained in the Red Arrows.

Conclusion,

Red Arrows= Divergence

Green Arrows= Buy entry (The stock is in uptrend)

Yellow Arrows= Buy entry (the stock is in downtrend and could reverse)

White arrows= short entry (the stock is in downtrend)

Orange arrows=short entry (the stock in uptrend and can reverse)

If you are interested, send a private message

Tập lệnh chỉ hiển thị cho người được mời

Quyền truy cập vào tập lệnh này bị hạn chế đối với người dùng được tác giả ủy quyền và thường yêu cầu thanh toán. Bạn có thể thêm nó vào mục yêu thích của mình, nhưng bạn sẽ chỉ có thể sử dụng nó sau khi yêu cầu sự cho phép từ tác giả. Liên hệ malrawi để thêm thông tin, hoặc làm theo hướng dẫn của tác giả bên dưới.

TradingView gợi ý bạn không trả tiền để sử dụng tập lệnh trừ khi bạn tin tưởng 100% vào tác giả của tập lệnh và hiểu cách hoạt động của tập lệnh. Trong nhiều trường hợp, bạn có thể tìm thấy giải pháp thay thế nguồn mở tốt miễn phí trong Tập lệnh cộng đồng của chúng tôi.

Bạn muốn sử dụng tập lệnh này trên biểu đồ?

Cảnh báo: vui lòng đọc trước khi yêu cầu quyền truy cập.

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.