### 🍏 AAPL EARNINGS TRADE SIGNAL (JULY 31) 🚀

📊 **AAPL Call Play** — Earnings Strategy

🧠 Multi-model conviction: **75% Bullish Bias**

---

### 🔍 Fundamental Drivers

✅ TTM Revenue: +5.1%

✅ Gross Margin: 46.6%

✅ 8 straight earnings beats

⚠️ Sector shift: growth → value = caution

📉 TTM EPS Est: \$8.31 (+29.4% growth est.)

🧮 **Score**: 8/10

---

### 💰 Options Flow Breakdown

🔥 IV Rank: 0.70

🔵 Bullish OI @ \$220C = 25,950 contracts

🔻 Skew: Heavy puts @ \$197.5 / \$200

⚠️ Gamma squeeze possible near \$220

📈 **Score**: 8/10

---

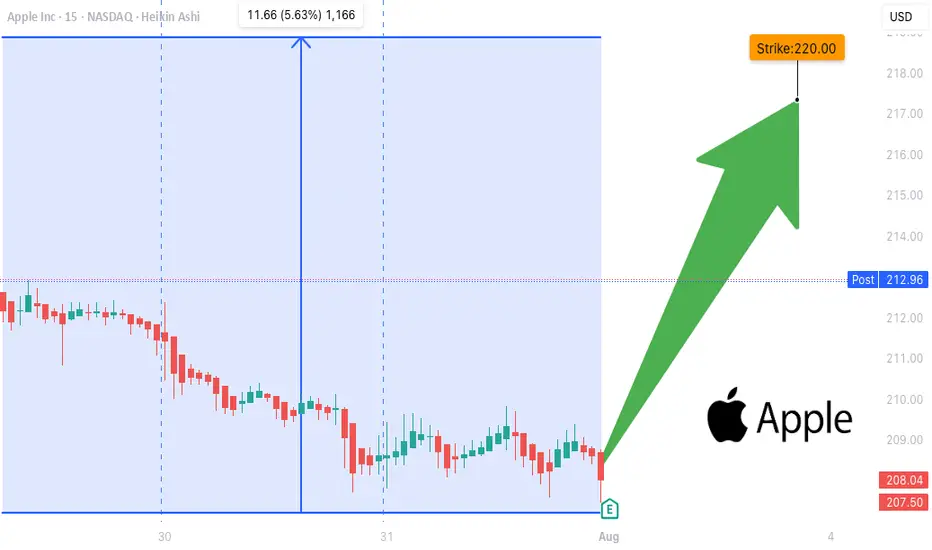

### 📉 Technicals

📍 RSI: 39.3 (Oversold)

📉 Trading below 20DMA (\$211.64)

🟥 Low volume pre-earnings = low conviction

📌 Support: \$207.5 | Resistance: \$220

📉 **Score**: 6/10

---

### 🌐 Macro Setup

⚠️ Supply chain pressures

⚠️ Regulatory risk ongoing

🔄 Growth → Value rotation still underway

🌐 **Score**: 5/10

---

### 🧠 Trade Setup (Call Option)

* 🎯 **Strike**: \$220

* 💵 **Entry**: \$0.87

* 📅 **Expiry**: 08/01 (2DTE)

* 📈 **Target**: \$2.61

* 🛑 **Stop**: \$0.43

* ⚖️ **Risk**: 2% of portfolio

* ⏰ **Timing**: Enter before close, report after market

🧮 Expected Move: ±5.0%

🔒 Confidence Level: 75%

---

### ⚙️ Exit Plan

✅ Profit: Exit @ \$2.61

❌ Stop: Exit @ \$0.43

🕒 Time Exit: Force close within 2 hours post-earnings

---

📣 **EARNINGS SCALP PLAY**

— AAPL is oversold w/ strong EPS beat history

— Bullish OI stacking at \$220

— High gamma setup, low IV risk = 💥

\#AAPL #EarningsTrade #CallOption #TradingView #0DTE #OptionsFlow #GammaSqueeze #UnusualOptions #AppleEarnings #SwingTrade #TechStocks

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.