BANK NIFTY TRADING PLAN – 09-Sep-2025

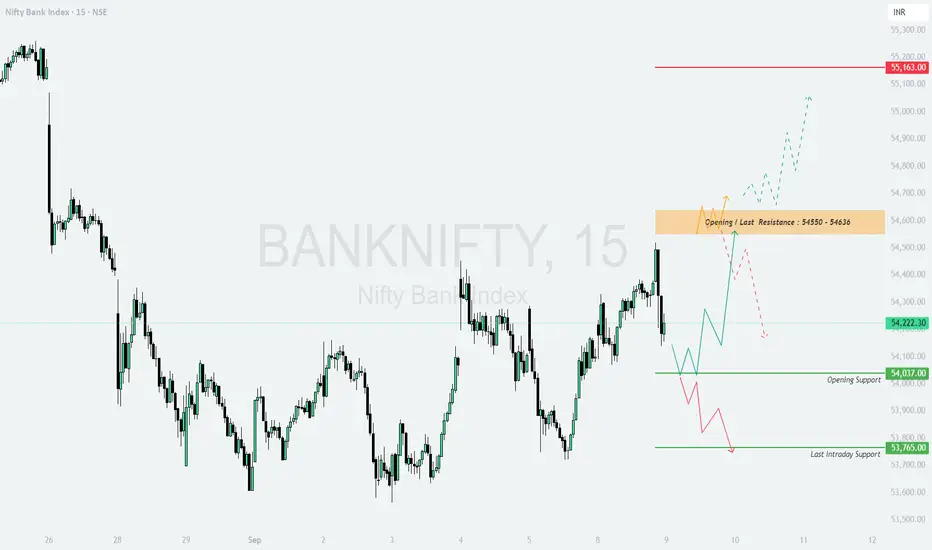

📌 Key Levels to Watch:

Major Resistance Zone: 54,550 – 54,636

Upside Extension Resistance: 55,163

Opening Support: 54,037

Last Intraday Support: 53,765

The index is now trading near a decision-making point. Price behavior around the resistance zone and support levels will set the tone for the next move.

🔼 1. Gap-Up Opening (200+ points above 54,636)

If Bank Nifty opens above 54,636, it will open doors for bullish continuation.

📌 Plan of Action:

👉 Educational Note: Gap-ups above resistance zones often trap late sellers. But fresh longs should be added only if the price sustains for 15–30 mins above resistance.

➖ 2. Flat Opening (Around 54,200 – 54,300)

A flat start gives traders an opportunity to observe early market sentiment.

📌 Plan of Action:

👉 Educational Note: Flat openings are ideal for option sellers in the first hour. Buyers should wait for confirmation of breakout/breakdown before initiating trades.

🔽 3. Gap-Down Opening (200+ points below 54,000)

If the index opens sharply lower, bearish momentum may dominate.

📌 Plan of Action:

👉 Educational Note: Gap-downs create panic, but seasoned traders wait for a reversal signal near strong support zones to capture short-covering rallies.

🛡️ Risk Management Tips for Options Traders

📌 Summary & Conclusion

🟢 Above 54,636 → Bullish trend continuation towards 55,163+.

🟧 Flat Opening → Range-bound play; above 54,300 bullish, below 54,037 weak.

🔴 Below 54,000 → Bearish momentum, testing 53,765 and possibly lower.

⚠️ Critical Zone: 54,550 – 54,636 (Major Resistance). A clear breakout here will define the bullish trend continuation.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This analysis is purely for educational purposes and should not be considered as financial advice. Please consult your financial advisor before making trading decisions.

📌 Key Levels to Watch:

Major Resistance Zone: 54,550 – 54,636

Upside Extension Resistance: 55,163

Opening Support: 54,037

Last Intraday Support: 53,765

The index is now trading near a decision-making point. Price behavior around the resistance zone and support levels will set the tone for the next move.

🔼 1. Gap-Up Opening (200+ points above 54,636)

If Bank Nifty opens above 54,636, it will open doors for bullish continuation.

📌 Plan of Action:

- [] Sustaining above 54,636 can lead to a strong rally towards 55,163.

[] If momentum continues, the index may even attempt new highs beyond 55,200+. - Watch for early profit booking near 55,163, as this level could act as a supply zone.

👉 Educational Note: Gap-ups above resistance zones often trap late sellers. But fresh longs should be added only if the price sustains for 15–30 mins above resistance.

➖ 2. Flat Opening (Around 54,200 – 54,300)

A flat start gives traders an opportunity to observe early market sentiment.

📌 Plan of Action:

- [] If Bank Nifty sustains above 54,300, expect a test of the 54,550 – 54,636 resistance zone.

[] A clean breakout above 54,636 can extend the move towards 55,163. - On the downside, a failure to hold 54,037 (opening support) may drag prices towards 53,765.

👉 Educational Note: Flat openings are ideal for option sellers in the first hour. Buyers should wait for confirmation of breakout/breakdown before initiating trades.

🔽 3. Gap-Down Opening (200+ points below 54,000)

If the index opens sharply lower, bearish momentum may dominate.

📌 Plan of Action:

- [] Immediate support lies at 53,765 (last intraday support).

[] A breakdown below 53,765 can accelerate selling, targeting 53,500 – 53,400 levels. - However, if Bank Nifty takes support at 53,765 and rebounds strongly, expect a short-covering rally back towards 54,037.

👉 Educational Note: Gap-downs create panic, but seasoned traders wait for a reversal signal near strong support zones to capture short-covering rallies.

🛡️ Risk Management Tips for Options Traders

- [] Always trade with a pre-defined stop-loss on hourly closing basis.

[] Keep position sizing under control — risk only 1–2% of total capital per trade.

[] On volatile days, prefer option spreads (bull call spread, bear put spread) over naked options to manage time decay.

[] Avoid chasing gap-ups or gap-downs blindly; wait for confirmation candles. - Scale out profits near resistance zones like 54,636 and trail stop-losses on remaining positions.

📌 Summary & Conclusion

🟢 Above 54,636 → Bullish trend continuation towards 55,163+.

🟧 Flat Opening → Range-bound play; above 54,300 bullish, below 54,037 weak.

🔴 Below 54,000 → Bearish momentum, testing 53,765 and possibly lower.

⚠️ Critical Zone: 54,550 – 54,636 (Major Resistance). A clear breakout here will define the bullish trend continuation.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This analysis is purely for educational purposes and should not be considered as financial advice. Please consult your financial advisor before making trading decisions.

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.