⊣

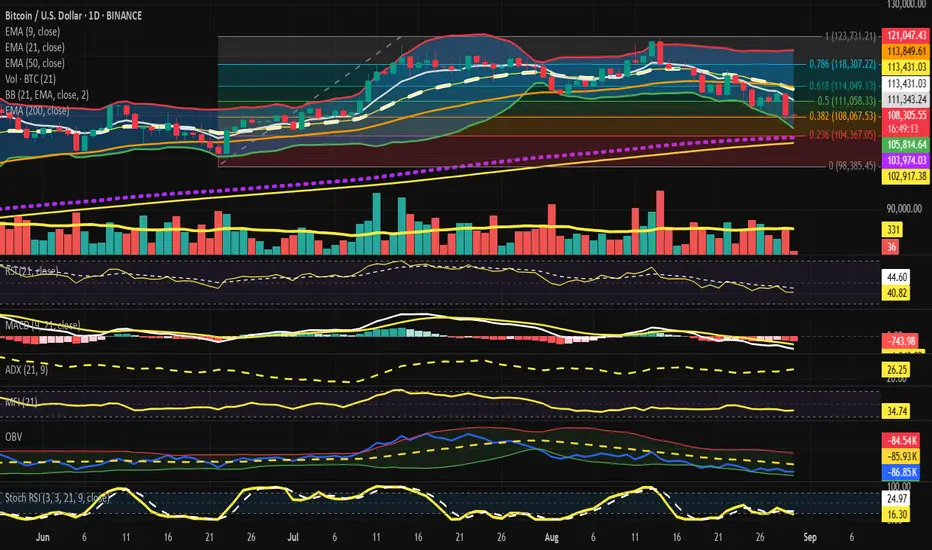

⟁ BTC/USD – BINANCE – (CHART: 1D) – (Aug 30, 2025).

◇ Analysis Price: $108,377.41.

⊣

⨀ I. Temporal Axis – Strategic Interval – (1D):

▦ EMA9 – $111,357.61:

∴ Price remains below EMA9, confirming immediate bearish control;

∴ EMA9 has flipped into dynamic resistance after multiple failed retests;

∴ Short-term recovery requires a clean daily close above EMA9.

✴️ Conclusion: EMA9 acts as near-term resistance, bearish short bias intact. Logic sealed.

⊢

▦ EMA21 – $113,437.56:

∴ EMA21 aligns with Fib 0.618 ($114,049), forming a resistance cluster;

∴ Persistent rejection since Aug 21 emphasizes mid-term weakness;

∴ Reclaiming EMA21 is the first real bullish trigger.

✴️ Conclusion: EMA21 = critical pivot to shift from bearish to neutral. Logic sealed.

⊢

▦ EMA50 – $113,852.43:

∴ Slightly above EMA21, adding weight to the $113.4 / 113.9k resistance zone;

∴ Until broken, this confluence acts as a bearish supply wall;

∴ A reclaim here reopens upside toward Fib 0.786 ($118.3k).

✴️ Conclusion: EMA50 reinforces resistance cluster. Logic sealed.

⊢

▦ EMA200 – $102,917.45:

∴ Long-term fortress, still untested in this cycle;

∴ Confluence with Fib 0.236 ($104,367) = macro defense zone;

∴ Bears’ ultimate target if current supports give way.

✴️ Conclusion: EMA200 stands as macro citadel. Logic sealed.

⊢

▦ Bollinger Bands (21, 2) – $121,042 / $113,437 / $105,833:

∴ Price riding lower band at $105.8k;

∴ Bands widening = volatility expansion with bearish tilt;

∴ Failure to revert to midline confirms continuation risk.

✴️ Conclusion: Bands highlight bearish volatility regime. Logic sealed.

⊢

▦ RSI (21, 9) – 40.90 / 44.62:

∴ RSI below neutral 50, momentum bearish;

∴ Not oversold (<30), leaving room for more downside;

∴ No bullish divergence present.

✴️ Conclusion: RSI validates sellers’ momentum. Logic sealed.

⊢

▦ MACD (9, 21, 9) – Line: –2,079.96 / Signal: –1,342.25 / Histogram: –737.71:

∴ Bearish cross intact below zero-line;

∴ Histogram remains deeply negative, no sign of contraction;

∴ Momentum acceleration still favors bears;

✴️ Conclusion: MACD entrenched in bearish phase. Logic sealed.

⊢

▦ ADX (21, 9) – 26.25:

∴ Above 25 confirms trend strength;

∴ With DI– dominance, direction is bearish;

∴ Indicates continuation rather than reversal.

✴️ Conclusion: ADX confirms strengthening bearish trend. Logic sealed.

⊢

▦ MFI (21) – 34.75:

∴ Below 50 = capital outflows dominate;

∴ No oversold signal (<20) yet;

∴ Market still has selling pressure capacity.

✴️ Conclusion: MFI aligns with distribution bias. Logic sealed.

⊢

▦ OBV (21, BB2) – (–86.84K):

∴ OBV trending lower, confirming distribution;

∴ Volume does not show accumulation footprint;

∴ Confirms sellers dominate liquidity.

✴️ Conclusion: OBV validates distribution regime. Logic sealed.

⊢

▦ Stoch RSI (3, 3, 21, 9) – K: 16.30 / D: 24.97:

∴ In oversold territory (<20);

∴ No confirmed bullish crossover yet;

∴ Relief bounce possible if crossover occurs.

✴️ Conclusion: Oversold condition may allow relief, but not structural reversal. Logic sealed.

⊢

▦ Fibonacci Retracements (0 = $98,385 -> 1 = $123,731):

✴️ Conclusion: Market clings to 0.382; Loss exposes 0.236 + EMA200 fortress; Logic sealed.

⊢

🜎 Strategic Insight - Technical Oracle:

∴ Short-term structure: price pinned under EMA9 and EMA21/50 cluster, bearish dominance confirmed;

∴ Momentum: RSI below 50, MACD negative, ADX >25 = sellers in control;

∴ Capital flows: MFI <50, OBV falling = distribution not yet exhausted;

∴ Only counterpoint: Stoch RSI oversold; potential for technical bounce, not structural reversal.

✴️ Conclusion: The battlefield is 0.382 Fib ($108k). Bulls must reclaim $111k -> $113.4k to neutralize; failure drags price toward ($104 / 103k). Logic sealed.

⊢

∫ II. On-Chain Intelligence - (Source: CryptoQuant):

▦ Exchange Inflow Total + EMA9 - (All Exchanges):

∴ Current inflow readings remain low-to-moderate, no spikes comparable to 2022 capitulation phases (>200K BTC);

∴ EMA9 of inflows trending stable/declining since Q2 2025;

∴ Lack of exchange deposits suggests no broad panic selling.

✴️ Conclusion: Inflows do not confirm capitulation; sellers are present but not aggressive. Logic sealed.

⊢

▦ Historical Context:

∴ Spikes above ~150K BTC inflow (e.g. 2022–2023) correlated with sharp price drawdowns;

∴ 2024–2025 shows inflows mostly <50K BTC/day, even during corrections;

∴ Current cycle corrections appear orderly rather than panic-driven.

✴️ Conclusion: Current inflow regime supports controlled distribution, not mass liquidation. Logic sealed.

⊢

▦ Liquidity Implications:

∴ Absence of exchange inflow surges implies supply pressure limited to tactical sellers;

∴ On-chain wallets continue holding, whales not rushing coins into exchanges;

∴ Technical breakdowns (EMA clusters, Fib 0.382) would require derivative/liquidation cascades rather than spot-led panic.

✴️ Conclusion: Structural downside must be driven by futures leverage, not spot panic flows. Logic sealed.

⊢

𓂀 Stoic-Structural Interpretation and On-Chain Oracle:

∴ Structure: EMA stack inverted; Fib 0.382 ($108k) = present bastion; EMA200 ($103k) = macro citadel;

∴ Momentum: RSI, MACD, ADX in alignment with descent, affirming stoic acceptance of downward will;

∴ Capital Flow: OBV and MFI declare liquidity leaving, distribution sealing bearish fate;

∴ Oracle: Oversold Stoch RSI whispers of fleeting respite, not salvation;

∴ Structure of Flow: Unlike past cycles, inflow discipline holds; coins remain largely in cold storage;

∴ Momentum of Will: Market decline is technical, not yet forced by whales. Bears act by structure, not by panic;

∴ Fate of Distribution: Without inflow surges, spot-driven capitulation remains unlikely; path to $103K relies on derivative liquidation.

⊢

✦ Structure Thus:

∴ The market embodies stoic compression;

∴ Only a reclaim >$113.4k reopens neutrality;

∴ Loss of $108k pulls destiny to ($104 / 103k);

∴ Fate sealed in bearish compression, awaiting expansion - logic sealed;

∴ On-chain inflows confirm the absence of mass panic;

∴ Technical charts dominate destiny;

∴ Bears have structure, but not yet blood;

∴ Bulls retain a chance if they defend $108K with low inflows sustained.

⊢

⚚ Unified Insight (Technical + On-Chain):

∴ Technical: Bitcoin clings to Fib 0.382 ($108K); failure = ($104 / 103K). Momentum + OBV favor bears.

∴ On-Chain: No whale capitulation; inflows remain muted, meaning downside is not spot-led.

✴️ Consequence: If inflows stay low, bulls may engineer a bounce at $108K -> $111K. If derivatives trigger cascade, EMA200 ($103K) becomes the stoic fortress.

⊢

· Cryptorvm Dominvs · MAGISTER ARCANVM · Vox Primordialis ·

· Dominivm Cardo Gyratio Omnivm · Silence precedes the next force. Structure is sacred ·

⊢

⟁ BTC/USD – BINANCE – (CHART: 1D) – (Aug 30, 2025).

◇ Analysis Price: $108,377.41.

⊣

⨀ I. Temporal Axis – Strategic Interval – (1D):

▦ EMA9 – $111,357.61:

∴ Price remains below EMA9, confirming immediate bearish control;

∴ EMA9 has flipped into dynamic resistance after multiple failed retests;

∴ Short-term recovery requires a clean daily close above EMA9.

✴️ Conclusion: EMA9 acts as near-term resistance, bearish short bias intact. Logic sealed.

⊢

▦ EMA21 – $113,437.56:

∴ EMA21 aligns with Fib 0.618 ($114,049), forming a resistance cluster;

∴ Persistent rejection since Aug 21 emphasizes mid-term weakness;

∴ Reclaiming EMA21 is the first real bullish trigger.

✴️ Conclusion: EMA21 = critical pivot to shift from bearish to neutral. Logic sealed.

⊢

▦ EMA50 – $113,852.43:

∴ Slightly above EMA21, adding weight to the $113.4 / 113.9k resistance zone;

∴ Until broken, this confluence acts as a bearish supply wall;

∴ A reclaim here reopens upside toward Fib 0.786 ($118.3k).

✴️ Conclusion: EMA50 reinforces resistance cluster. Logic sealed.

⊢

▦ EMA200 – $102,917.45:

∴ Long-term fortress, still untested in this cycle;

∴ Confluence with Fib 0.236 ($104,367) = macro defense zone;

∴ Bears’ ultimate target if current supports give way.

✴️ Conclusion: EMA200 stands as macro citadel. Logic sealed.

⊢

▦ Bollinger Bands (21, 2) – $121,042 / $113,437 / $105,833:

∴ Price riding lower band at $105.8k;

∴ Bands widening = volatility expansion with bearish tilt;

∴ Failure to revert to midline confirms continuation risk.

✴️ Conclusion: Bands highlight bearish volatility regime. Logic sealed.

⊢

▦ RSI (21, 9) – 40.90 / 44.62:

∴ RSI below neutral 50, momentum bearish;

∴ Not oversold (<30), leaving room for more downside;

∴ No bullish divergence present.

✴️ Conclusion: RSI validates sellers’ momentum. Logic sealed.

⊢

▦ MACD (9, 21, 9) – Line: –2,079.96 / Signal: –1,342.25 / Histogram: –737.71:

∴ Bearish cross intact below zero-line;

∴ Histogram remains deeply negative, no sign of contraction;

∴ Momentum acceleration still favors bears;

✴️ Conclusion: MACD entrenched in bearish phase. Logic sealed.

⊢

▦ ADX (21, 9) – 26.25:

∴ Above 25 confirms trend strength;

∴ With DI– dominance, direction is bearish;

∴ Indicates continuation rather than reversal.

✴️ Conclusion: ADX confirms strengthening bearish trend. Logic sealed.

⊢

▦ MFI (21) – 34.75:

∴ Below 50 = capital outflows dominate;

∴ No oversold signal (<20) yet;

∴ Market still has selling pressure capacity.

✴️ Conclusion: MFI aligns with distribution bias. Logic sealed.

⊢

▦ OBV (21, BB2) – (–86.84K):

∴ OBV trending lower, confirming distribution;

∴ Volume does not show accumulation footprint;

∴ Confirms sellers dominate liquidity.

✴️ Conclusion: OBV validates distribution regime. Logic sealed.

⊢

▦ Stoch RSI (3, 3, 21, 9) – K: 16.30 / D: 24.97:

∴ In oversold territory (<20);

∴ No confirmed bullish crossover yet;

∴ Relief bounce possible if crossover occurs.

✴️ Conclusion: Oversold condition may allow relief, but not structural reversal. Logic sealed.

⊢

▦ Fibonacci Retracements (0 = $98,385 -> 1 = $123,731):

- 0.786 -> $118,307 – (upper resistance);

- 0.618 -> $114,049 – (current battlefield, confluence EMA21/50);

- 0.500 -> $111,058 – (reclaim point for neutralization);

- 0.382 -> $108,067 – (current support pivot);

- 0.236 -> $104,367 – (deeper target, near EMA200).

✴️ Conclusion: Market clings to 0.382; Loss exposes 0.236 + EMA200 fortress; Logic sealed.

⊢

🜎 Strategic Insight - Technical Oracle:

∴ Short-term structure: price pinned under EMA9 and EMA21/50 cluster, bearish dominance confirmed;

∴ Momentum: RSI below 50, MACD negative, ADX >25 = sellers in control;

∴ Capital flows: MFI <50, OBV falling = distribution not yet exhausted;

∴ Only counterpoint: Stoch RSI oversold; potential for technical bounce, not structural reversal.

✴️ Conclusion: The battlefield is 0.382 Fib ($108k). Bulls must reclaim $111k -> $113.4k to neutralize; failure drags price toward ($104 / 103k). Logic sealed.

⊢

∫ II. On-Chain Intelligence - (Source: CryptoQuant):

▦ Exchange Inflow Total + EMA9 - (All Exchanges):

∴ Current inflow readings remain low-to-moderate, no spikes comparable to 2022 capitulation phases (>200K BTC);

∴ EMA9 of inflows trending stable/declining since Q2 2025;

∴ Lack of exchange deposits suggests no broad panic selling.

✴️ Conclusion: Inflows do not confirm capitulation; sellers are present but not aggressive. Logic sealed.

⊢

▦ Historical Context:

∴ Spikes above ~150K BTC inflow (e.g. 2022–2023) correlated with sharp price drawdowns;

∴ 2024–2025 shows inflows mostly <50K BTC/day, even during corrections;

∴ Current cycle corrections appear orderly rather than panic-driven.

✴️ Conclusion: Current inflow regime supports controlled distribution, not mass liquidation. Logic sealed.

⊢

▦ Liquidity Implications:

∴ Absence of exchange inflow surges implies supply pressure limited to tactical sellers;

∴ On-chain wallets continue holding, whales not rushing coins into exchanges;

∴ Technical breakdowns (EMA clusters, Fib 0.382) would require derivative/liquidation cascades rather than spot-led panic.

✴️ Conclusion: Structural downside must be driven by futures leverage, not spot panic flows. Logic sealed.

⊢

𓂀 Stoic-Structural Interpretation and On-Chain Oracle:

∴ Structure: EMA stack inverted; Fib 0.382 ($108k) = present bastion; EMA200 ($103k) = macro citadel;

∴ Momentum: RSI, MACD, ADX in alignment with descent, affirming stoic acceptance of downward will;

∴ Capital Flow: OBV and MFI declare liquidity leaving, distribution sealing bearish fate;

∴ Oracle: Oversold Stoch RSI whispers of fleeting respite, not salvation;

∴ Structure of Flow: Unlike past cycles, inflow discipline holds; coins remain largely in cold storage;

∴ Momentum of Will: Market decline is technical, not yet forced by whales. Bears act by structure, not by panic;

∴ Fate of Distribution: Without inflow surges, spot-driven capitulation remains unlikely; path to $103K relies on derivative liquidation.

⊢

✦ Structure Thus:

∴ The market embodies stoic compression;

∴ Only a reclaim >$113.4k reopens neutrality;

∴ Loss of $108k pulls destiny to ($104 / 103k);

∴ Fate sealed in bearish compression, awaiting expansion - logic sealed;

∴ On-chain inflows confirm the absence of mass panic;

∴ Technical charts dominate destiny;

∴ Bears have structure, but not yet blood;

∴ Bulls retain a chance if they defend $108K with low inflows sustained.

⊢

⚚ Unified Insight (Technical + On-Chain):

∴ Technical: Bitcoin clings to Fib 0.382 ($108K); failure = ($104 / 103K). Momentum + OBV favor bears.

∴ On-Chain: No whale capitulation; inflows remain muted, meaning downside is not spot-led.

✴️ Consequence: If inflows stay low, bulls may engineer a bounce at $108K -> $111K. If derivatives trigger cascade, EMA200 ($103K) becomes the stoic fortress.

⊢

· Cryptorvm Dominvs · MAGISTER ARCANVM · Vox Primordialis ·

· Dominivm Cardo Gyratio Omnivm · Silence precedes the next force. Structure is sacred ·

⊢

Giao dịch đang hoạt động

⊣⟁ BTC Derivatives Layer – Amberdata – Market Gamma (Calls) – (Aug 30, 2025).

⊣

⨀ III. Options Gamma Exposure (Call Side):

▦ Gamma Concentration – Current (Aug 30):

∴ Peak gamma clustered tightly around strikes (107.5K / 108K);

∴ This creates a strong “pinning” effect near spot ($108.3K);

∴ Market-makers likely hedge aggressively around this level.

✴️ Conclusion: Spot is magnetized at 108K by call gamma exposure. Logic sealed.

⊢

▦ Short-Term Expiries (Aug 31 – Sep 02):

∴ Gamma surface shows immediate expiry crowding near 108K;

∴ Implies high sensitivity to small spot moves into month-end;

∴ Elevated hedging flows may suppress volatility near 108K.

✴️ Conclusion: Short-term expiries reinforce pinning pressure.

⊢

▦ Medium-Term Expiries (Sep 19 – Sep 26):

∴ Broader gamma curve flattens across (110K / 115K strikes;

∴ Suggests dealers less exposed further up the curve;

∴ If price escapes (111K / 113K) resistance cluster, gamma exposure thins, allowing volatility release.

✴️ Conclusion: Above 113K, dealer hedging impact fades, enabling breakout potential.

⊢

𓂀 Stoic-Structural Interpretation – Gamma Oracle:

∴ Structure: Market pinned by dealer gamma around $108K, enforcing stagnation;

∴ Momentum: As expiries roll off, gamma grip weakens, restoring directional freedom;

∴ Fate: Bulls require reclaim >$113K to escape gamma gravity; bears require <105K to ignite downside flows.

✦ Thus: Gamma acts as invisible fetters - binding Bitcoin to the $108K axis until expiration releases volatility.

✴️ Conclusion: Gamma discipline enforces equilibrium at $108K; volatility resumes only beyond hedging bands. Logic sealed.

⊢

Bài đăng liên quan

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Bài đăng liên quan

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.