Support and Resistance Levels:

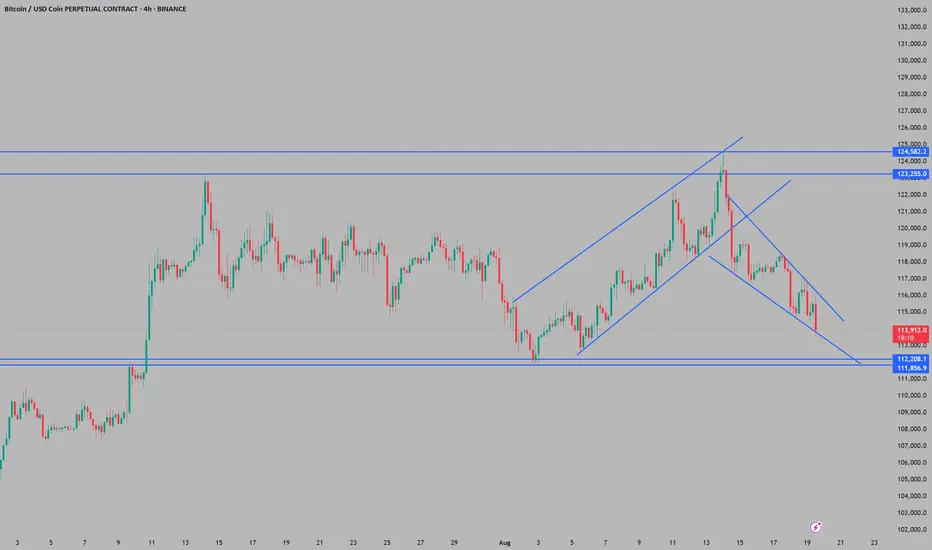

Major support appears to be around 111k–112k, which has held previously after a strong upward move.

Resistance levels marked at 123k and 124k indicate prior highs and significant selling pressure.

Price Action & Structure:

The price recently had formed an ascending channel, which was broken to the downside, suggesting the bullish momentum has faded.

Currently, price is inside a descending channel, moving lower after the recent drop from the highs. This typically indicates continued bearish pressure in the short term.

Trend:

With the breakdown of the ascending channel and price forming lower highs and lower lows, the short-term trend is bearish.

The price is approaching the major support zone (near 112,000). If this holds, a bounce is possible; if it breaks, further downside could occur.

Outlook:

Bearish bias short-term: Price is trending downward inside the channel.

Key zones to watch: The 111k–112k area for support. Bulls need to defend this level; failure likely leads to deeper corrections.

If the price recovers and breaks above the descending channel, it would be the first sign of potential reversal or consolidation.

Summary

Right now, Bitcoin’s 4H chart suggests weakness, with sellers in control short-term. Watch for reactions at the 111-112k zone—this will likely decide the next directional move. Bulls have to defend this area, or further decline is likely. Bulls should wait for signs of strength or a channel breakout before re-entering aggressively.

Major support appears to be around 111k–112k, which has held previously after a strong upward move.

Resistance levels marked at 123k and 124k indicate prior highs and significant selling pressure.

Price Action & Structure:

The price recently had formed an ascending channel, which was broken to the downside, suggesting the bullish momentum has faded.

Currently, price is inside a descending channel, moving lower after the recent drop from the highs. This typically indicates continued bearish pressure in the short term.

Trend:

With the breakdown of the ascending channel and price forming lower highs and lower lows, the short-term trend is bearish.

The price is approaching the major support zone (near 112,000). If this holds, a bounce is possible; if it breaks, further downside could occur.

Outlook:

Bearish bias short-term: Price is trending downward inside the channel.

Key zones to watch: The 111k–112k area for support. Bulls need to defend this level; failure likely leads to deeper corrections.

If the price recovers and breaks above the descending channel, it would be the first sign of potential reversal or consolidation.

Summary

Right now, Bitcoin’s 4H chart suggests weakness, with sellers in control short-term. Watch for reactions at the 111-112k zone—this will likely decide the next directional move. Bulls have to defend this area, or further decline is likely. Bulls should wait for signs of strength or a channel breakout before re-entering aggressively.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.