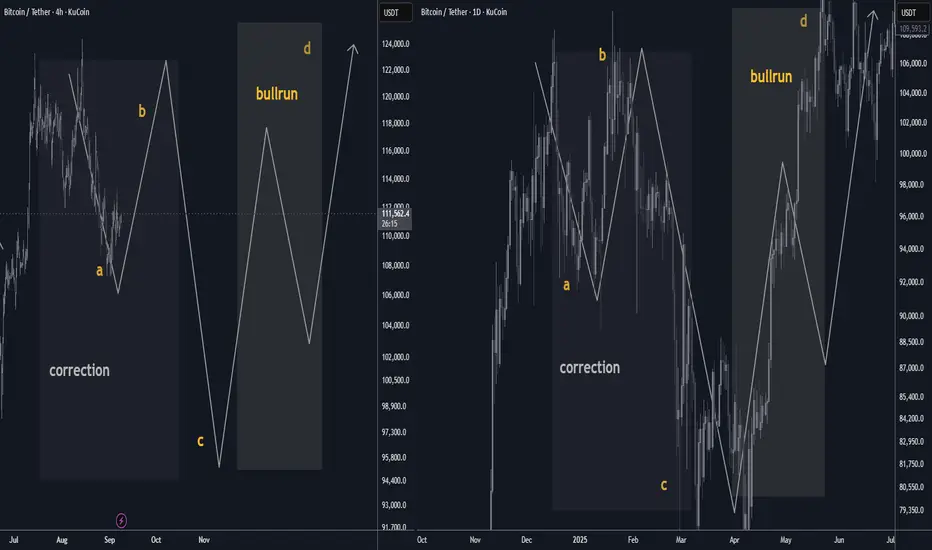

BTC enters September post-ATH with a seasonal headwind. Base case: a ~10% A-leg dip toward $108k, a B-bounce into ~$122k, then a C-flush near ~$94k—echoing April’s ABC rhythm. Once complete, the uptrend should re-assert into year-end. 📉🔁📈 #Bitcoin #Seasonality #Crypto

🟠 Bitcoin September Outlook: Seasonality vs. Structure

After a fresh ATH, September’s historical bias skews mildly red. Base case is a ~10% A-leg dip that develops into an A/B/C correction before trend continuation. Think controlled pullback → consolidation → next markup. 📉➡️🔁➡️📈

________________________________________

🗓️ Seasonality Snapshot (2015–2024)

• Mean (10-yr): −2.55% · Median: −4.52%

• Red months: 6/10

• Worst September: 2019 (−13.88%)

• Best September: 2024 (+7.39%)

• Last 3 yrs avg: +2.8% (2024 +7.39%, 2023 +3.99%, 2022 −3.09%)

• Last 5 yrs avg (2020–2024): −1.3%

Read: September has tended to be weak, but the last two years printed green. Seasonality is a headwind—not a handbrake. 🌬️

________________________________________

🧩 Structure Thesis (Fractal Analog)

You’re looking for a repeat of April 2025’s A/B/C rhythm—scaled up:

• April 2025 reference: A ≈ $92k → B ≈ $106k → C ≈ $80k

• Now (projected):

o A ≈ $108k (≈ 10% pullback from recent highs) 📉

o B ≈ $122k (relief rally / lower high) 🔁

o C ≈ $94k (final flush into demand, completing the correction) 🧱

Interpretation: A measured September fade aligns with the A-leg. A reflexive B-bounce can follow as funding resets and late longs get cleaned up, with a C-leg completing the pattern before the next expansion. 🚀

________________________________________

📊 How Seasonality Supports the Call

• Typical drag: Median −4.5% and multiple red Septembers justify a down-bias.

• Volatility window: The historical 21-point spread (best +7.39% vs worst −13.88%) means a 10% dip sits well within normal bounds.

• Cycle context: With a new ATH just printed, a shallow corrective phase is constructive—not bearish regime change.

________________________________________

🧭 Levels & Triggers

• Bias line: Momentum cools into $108k → watch for seller absorption and open interest reset.

• Relief cap: $122k acts as B-rally resistance; sustained closes above $122k would invalidate the ABC idea and argue for immediate continuation. ✅

• Completion zone: $94k (C) is the buy-the-dip completion area; clean breaks below raise risk of a deeper time correction rather than a swift V-reversal. ⚠️

________________________________________

🧪 What to Monitor (Confirmation/Invalidation)

• Liquidity & OI: De-leveraging into A, controlled OI rebuild into B, washout into C.

• Spot-ETF flows / stablecoin issuance: Weakening into A, stabilizing by late month supports B→C rhythm.

• Funding/basis: Overheated → normalize during A; negative spikes near C often mark capitulation.

• Breadth (alts): Underperform into A/C; broad risk-on breadth usually returns post-C.

________________________________________

📝 Base Case Path (Textbook)

September: drift to $108k (A) → bounce toward $122k (B) → final tag of ~$94k (C) → reset + markup into Q4.

(If price reclaims and holds above $122k early, treat that as trend continuation—not a correction.)

________________________________________

🔒 Risk Notes

• Seasonality is a tendency, not a rule. Macro catalysts (CPI, policy, liquidity) can dominate calendar effects.

• This is market commentary, not financial advice. Manage risk and invalidation levels. 🛡️

🟠 Bitcoin September Outlook: Seasonality vs. Structure

After a fresh ATH, September’s historical bias skews mildly red. Base case is a ~10% A-leg dip that develops into an A/B/C correction before trend continuation. Think controlled pullback → consolidation → next markup. 📉➡️🔁➡️📈

________________________________________

🗓️ Seasonality Snapshot (2015–2024)

• Mean (10-yr): −2.55% · Median: −4.52%

• Red months: 6/10

• Worst September: 2019 (−13.88%)

• Best September: 2024 (+7.39%)

• Last 3 yrs avg: +2.8% (2024 +7.39%, 2023 +3.99%, 2022 −3.09%)

• Last 5 yrs avg (2020–2024): −1.3%

Read: September has tended to be weak, but the last two years printed green. Seasonality is a headwind—not a handbrake. 🌬️

________________________________________

🧩 Structure Thesis (Fractal Analog)

You’re looking for a repeat of April 2025’s A/B/C rhythm—scaled up:

• April 2025 reference: A ≈ $92k → B ≈ $106k → C ≈ $80k

• Now (projected):

o A ≈ $108k (≈ 10% pullback from recent highs) 📉

o B ≈ $122k (relief rally / lower high) 🔁

o C ≈ $94k (final flush into demand, completing the correction) 🧱

Interpretation: A measured September fade aligns with the A-leg. A reflexive B-bounce can follow as funding resets and late longs get cleaned up, with a C-leg completing the pattern before the next expansion. 🚀

________________________________________

📊 How Seasonality Supports the Call

• Typical drag: Median −4.5% and multiple red Septembers justify a down-bias.

• Volatility window: The historical 21-point spread (best +7.39% vs worst −13.88%) means a 10% dip sits well within normal bounds.

• Cycle context: With a new ATH just printed, a shallow corrective phase is constructive—not bearish regime change.

________________________________________

🧭 Levels & Triggers

• Bias line: Momentum cools into $108k → watch for seller absorption and open interest reset.

• Relief cap: $122k acts as B-rally resistance; sustained closes above $122k would invalidate the ABC idea and argue for immediate continuation. ✅

• Completion zone: $94k (C) is the buy-the-dip completion area; clean breaks below raise risk of a deeper time correction rather than a swift V-reversal. ⚠️

________________________________________

🧪 What to Monitor (Confirmation/Invalidation)

• Liquidity & OI: De-leveraging into A, controlled OI rebuild into B, washout into C.

• Spot-ETF flows / stablecoin issuance: Weakening into A, stabilizing by late month supports B→C rhythm.

• Funding/basis: Overheated → normalize during A; negative spikes near C often mark capitulation.

• Breadth (alts): Underperform into A/C; broad risk-on breadth usually returns post-C.

________________________________________

📝 Base Case Path (Textbook)

September: drift to $108k (A) → bounce toward $122k (B) → final tag of ~$94k (C) → reset + markup into Q4.

(If price reclaims and holds above $122k early, treat that as trend continuation—not a correction.)

________________________________________

🔒 Risk Notes

• Seasonality is a tendency, not a rule. Macro catalysts (CPI, policy, liquidity) can dominate calendar effects.

• This is market commentary, not financial advice. Manage risk and invalidation levels. 🛡️

Giao dịch đang hoạt động

BOOM. DONE.Ghi chú

called it before fact periodtaplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

Bài đăng liên quan

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

Bài đăng liên quan

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.