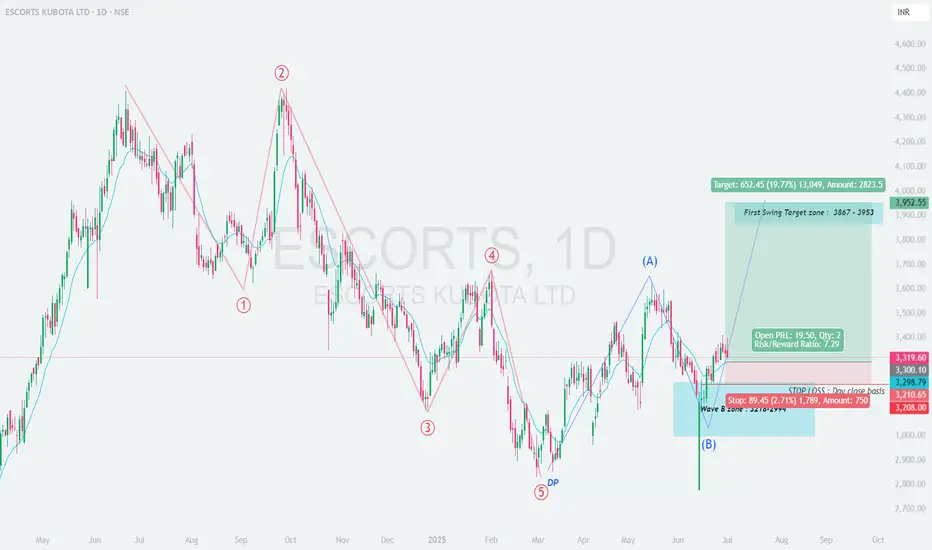

# 📊 \ESCORTS – Positional Swing Trade Setup (Daily Chart)\

🧩 \Elliott Wave Completion + ABC Corrective Breakout\

---

## 🌀 \Wave Structure Insight:\

• Completed \5-wave impulsive decline\

• Followed by an \ABC corrective pattern\

• Wave (B) appears to have bottomed in the \₹3120–3190\ Demand Zone

➡️ Reversal signs seen with strong price rejection and higher-low formation

---

## 🟦 \Support Zone – ₹3120 to ₹3190\

🔹 Strong confluence support

🔹 Marked Demand Zone + ABC Wave (B) low

🔹 Bullish structure forming above this zone

---

## 🟩 \Swing Target Zone: ₹3867 – ₹3953+\

🎯 Target 1: ₹3867

🎯 Target 2: ₹3953+ (full ABC projection)

⚡️ \~20% potential upside from breakout zone

---

## 📝 \Trade Setup & Plan:\

📈 \Entry:\ Around ₹3319–₹3330 (Post-breakout confirmation)

🎯 \Targets:\

• T1: ₹3867

• T2: ₹3953+

❌ \Stop Loss:\ Close below ₹3208 (below Wave B low)

📏 \Risk-Reward Ratio:\ \~7.29 (ideal for positional traders)

---

## 🧠 \Trade Logic:\

• Wave (B) has likely completed with a volume-backed reversal

• A sustained move above ₹3330 confirms bullish bias

• Pullback to ₹3240–₹3280 zone may offer a second entry

• Suitable for swing/positional setups with trend-following bias

---

📌 \Conclusion:\

ESCORTS is setting up for a probable medium-term rally with a strong base in place. A move above ₹3330 with volume confirms the breakout. As long as ₹3208 holds, the trade offers high reward potential toward ₹3953.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.