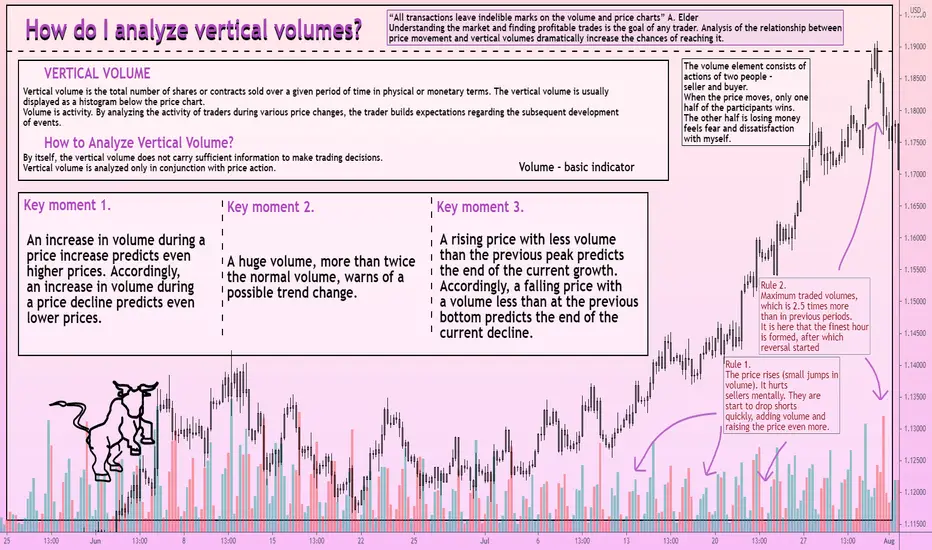

“All transactions leave indelible marks on the volume and price charts” A. Elder

Understanding the market and finding profitable trades is the goal of any trader. Analysis of the relationship between price movement and vertical volumes dramatically increase the chances of reaching it.

The volume element consists of actions of two people - seller and buyer. When the price moves, only one half of the participants wins. The other half is losing money

feels fear and dissatisfaction with myself.

VERTICAL VOLUME

Vertical volume is the total number of shares or contracts sold over a given period of time in physical or monetary terms. The vertical volume is usually

displayed as a histogram below the price chart.

Volume is activity. By analyzing the activity of traders during various price changes, the trader builds expectations regarding the subsequent development of events.

How to Analyze Vertical Volume?

By itself, the vertical volume does not carry sufficient information to make trading decisions.

Vertical volume is analyzed only in conjunction with price action.

1) An increase in volume during a price increase predicts even higher prices. Accordingly, an increase in volume during a price decline predicts even lower prices.

2) A huge volume, more than twice the normal volume, warns of a possible trend change.

3) A rising price with less volume than the previous peak predicts the end of the current growth. Accordingly, a falling price with a volume less than at the previous bottom predicts the end of the current decline.

Traders, if you like this idea or have your own opinion about it, write in the comments. I will be glad👩💻

Understanding the market and finding profitable trades is the goal of any trader. Analysis of the relationship between price movement and vertical volumes dramatically increase the chances of reaching it.

The volume element consists of actions of two people - seller and buyer. When the price moves, only one half of the participants wins. The other half is losing money

feels fear and dissatisfaction with myself.

VERTICAL VOLUME

Vertical volume is the total number of shares or contracts sold over a given period of time in physical or monetary terms. The vertical volume is usually

displayed as a histogram below the price chart.

Volume is activity. By analyzing the activity of traders during various price changes, the trader builds expectations regarding the subsequent development of events.

How to Analyze Vertical Volume?

By itself, the vertical volume does not carry sufficient information to make trading decisions.

Vertical volume is analyzed only in conjunction with price action.

1) An increase in volume during a price increase predicts even higher prices. Accordingly, an increase in volume during a price decline predicts even lower prices.

2) A huge volume, more than twice the normal volume, warns of a possible trend change.

3) A rising price with less volume than the previous peak predicts the end of the current growth. Accordingly, a falling price with a volume less than at the previous bottom predicts the end of the current decline.

Traders, if you like this idea or have your own opinion about it, write in the comments. I will be glad👩💻

💰FREE FOREX signals in Telegram: bit.ly/3F4mrMi

🚀FREE CRYPTO signals in Telegram: t.me/cryptolingrid

🌎WebSite: lingrid.org

🚀FREE CRYPTO signals in Telegram: t.me/cryptolingrid

🌎WebSite: lingrid.org

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.

💰FREE FOREX signals in Telegram: bit.ly/3F4mrMi

🚀FREE CRYPTO signals in Telegram: t.me/cryptolingrid

🌎WebSite: lingrid.org

🚀FREE CRYPTO signals in Telegram: t.me/cryptolingrid

🌎WebSite: lingrid.org

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.