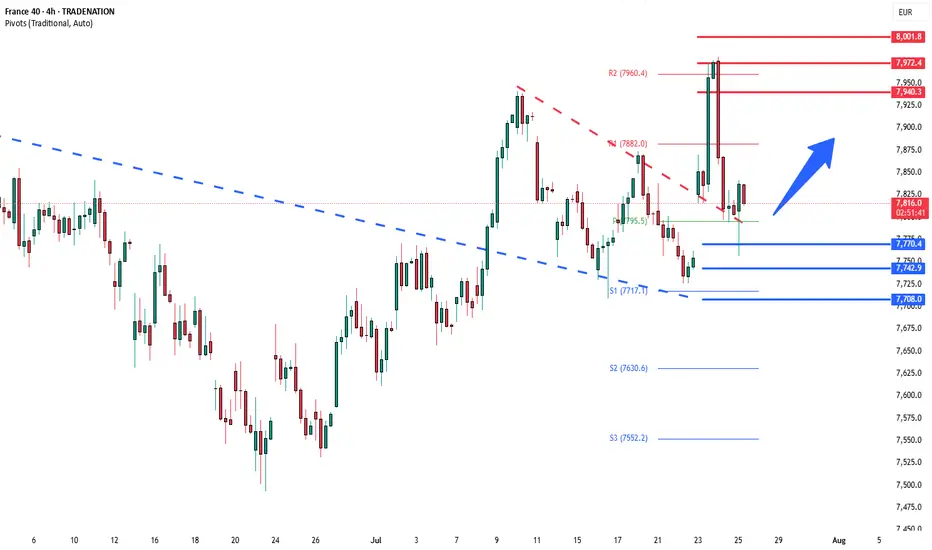

The CAC 40 index continues to display a bullish bias, underpinned by a well-established rising trend. Recent intraday price action indicates a breakout from consolidation, suggesting renewed upward momentum.

Key Technical Levels:

Support:

7770 – This level marks the prior consolidation zone and now serves as critical support.

7740 – Secondary support, guarding against deeper downside.

7700 – Key psychological and technical level; a breach would suggest trend weakness.

Resistance:

7940 – Immediate upside target from the breakout pattern.

7970 – Minor resistance within an extended bullish leg.

8000 – Major psychological resistance and potential profit-taking zone.

Trading Scenarios:

Bullish Scenario:

A corrective pullback toward the 7770 level, followed by a bullish reversal, would confirm support and potentially set the stage for an advance toward 7940, with scope to extend to 7970 and 8000 in the medium term.

Bearish Scenario:

A daily close below 7770 would invalidate the bullish breakout and suggest a short-term trend reversal. This would open the door to a retracement toward 7740, with extended downside risk to 7700.

Conclusion:

The CAC 40 remains technically bullish as long as price holds above the 7770 support level. Traders should watch for confirmation of support on pullbacks to position for a continuation higher. A decisive break below 7770, however, would shift sentiment to neutral-to-bearish, triggering a deeper correction.

Key Technical Levels:

Support:

7770 – This level marks the prior consolidation zone and now serves as critical support.

7740 – Secondary support, guarding against deeper downside.

7700 – Key psychological and technical level; a breach would suggest trend weakness.

Resistance:

7940 – Immediate upside target from the breakout pattern.

7970 – Minor resistance within an extended bullish leg.

8000 – Major psychological resistance and potential profit-taking zone.

Trading Scenarios:

Bullish Scenario:

A corrective pullback toward the 7770 level, followed by a bullish reversal, would confirm support and potentially set the stage for an advance toward 7940, with scope to extend to 7970 and 8000 in the medium term.

Bearish Scenario:

A daily close below 7770 would invalidate the bullish breakout and suggest a short-term trend reversal. This would open the door to a retracement toward 7740, with extended downside risk to 7700.

Conclusion:

The CAC 40 remains technically bullish as long as price holds above the 7770 support level. Traders should watch for confirmation of support on pullbacks to position for a continuation higher. A decisive break below 7770, however, would shift sentiment to neutral-to-bearish, triggering a deeper correction.

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.