Hello Traders!

Gold (XAU/USD) is a perfect instrument for swing trading because of its clean technical reactions.

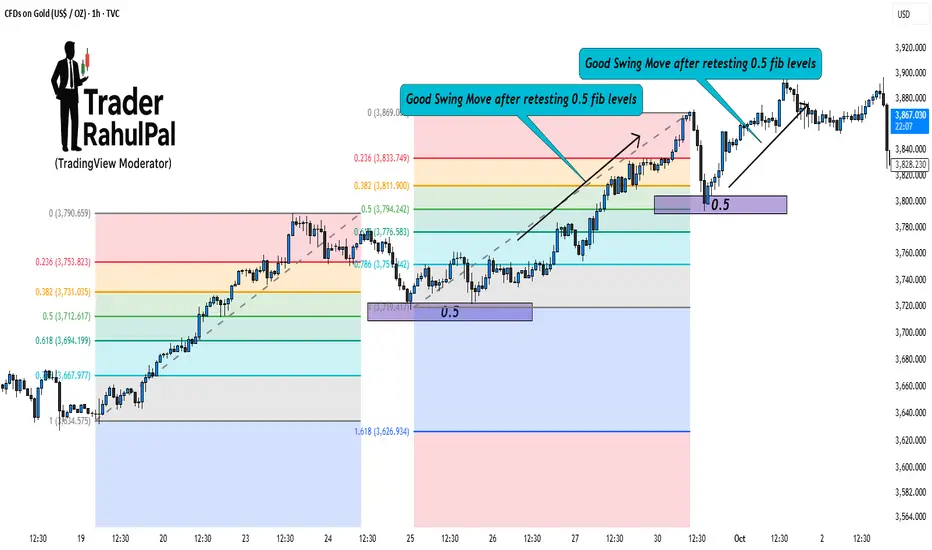

One of the most reliable tools to trade gold swings is the Fibonacci retracement.

When used correctly, it helps you catch pullbacks and ride the next wave in the trend. Let’s break it down step by step.

1. Identify the Swing Move

2. Draw Fibonacci Levels

3. Look for Confirmation

4. Entry & Risk Management

5. Why It Works Well on Gold

Rahul’s Tip:

Always combine Fibonacci with structure. If a Fib level aligns with a key support/resistance, that zone becomes even stronger.

Conclusion:

Swing trading gold with Fibonacci retracements is simple yet powerful.

By focusing on impulse moves, waiting for retracements, and confirming with price action, you can trade gold with more confidence and less guesswork.

If this post gave you a clear strategy, like it, share your thoughts in comments, and follow for more practical gold trading setups!

Gold (XAU/USD) is a perfect instrument for swing trading because of its clean technical reactions.

One of the most reliable tools to trade gold swings is the Fibonacci retracement.

When used correctly, it helps you catch pullbacks and ride the next wave in the trend. Let’s break it down step by step.

1. Identify the Swing Move

- First, find a strong impulse move on gold, either bullish or bearish.

- This becomes your “anchor move” for drawing Fibonacci levels.

- The idea is to wait for price to retrace part of this move before continuing in the main direction.

2. Draw Fibonacci Levels

- Take the swing low to swing high (for bullish) or swing high to swing low (for bearish).

- Mark key retracement levels: 38.2%, 50%, and 61.8%.

- These levels often act as strong support or resistance zones for gold.

3. Look for Confirmation

- Don’t trade blindly at a Fib level. Wait for confirmation like reversal candlesticks (pin bars, engulfing) or RSI divergence.

- Volume spikes near Fibonacci zones also confirm institutional buying/selling.

4. Entry & Risk Management

- Enter trades near 38.2%, 50%, or 61.8% retracements when confirmation appears.

- Place stop loss just beyond the next Fibonacci level.

- Set targets at previous swing highs/lows or Fibonacci extension levels like 127% and 161.8%.

5. Why It Works Well on Gold

- Gold respects technical levels strongly due to high liquidity.

- Institutions also use Fibonacci retracements to scale in and out of positions.

- This makes Fibonacci one of the most effective tools for swing traders in gold.

Rahul’s Tip:

Always combine Fibonacci with structure. If a Fib level aligns with a key support/resistance, that zone becomes even stronger.

Conclusion:

Swing trading gold with Fibonacci retracements is simple yet powerful.

By focusing on impulse moves, waiting for retracements, and confirming with price action, you can trade gold with more confidence and less guesswork.

If this post gave you a clear strategy, like it, share your thoughts in comments, and follow for more practical gold trading setups!

Premium Signals: 77% accuracy in Intraday & Positional trades for Stocks, Nifty, Bank Nifty, Gold, Silver & Crypto. Take demo & decide — most traders don’t leave after joining.

Free Demo: wa.me/919560602464

Free Telegram: spf.bio/c1lkb

Free Demo: wa.me/919560602464

Free Telegram: spf.bio/c1lkb

Bài đăng liên quan

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Premium Signals: 77% accuracy in Intraday & Positional trades for Stocks, Nifty, Bank Nifty, Gold, Silver & Crypto. Take demo & decide — most traders don’t leave after joining.

Free Demo: wa.me/919560602464

Free Telegram: spf.bio/c1lkb

Free Demo: wa.me/919560602464

Free Telegram: spf.bio/c1lkb

Bài đăng liên quan

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.