🧭 Overall Structure

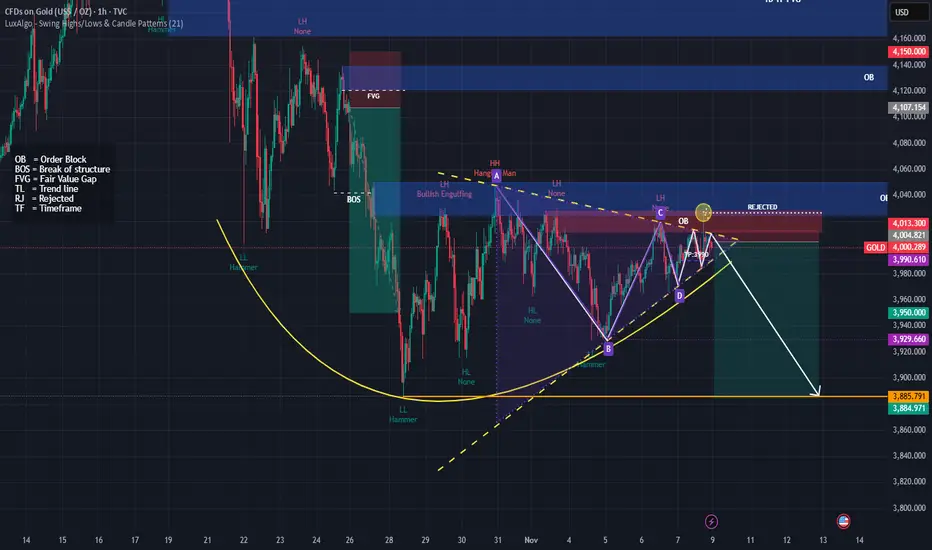

The chart shows a potential bearish setup.

I have drawn a descending pattern (A-B-C-D) with rejection from an Order Block (OB) around $4,013–$4,020.

The white arrow projects a downward move toward 3,885.

🔍 Key Technical Elements

1. Order Blocks (OB)

Upper OB (~4,150–4,120): Higher timeframe supply zone; strong resistance if price rallies.

Current OB (~4,013–4,040): Recently rejected here — price reacted and failed to make a new higher high → confirms seller pressure.

2. Break of Structure (BOS)

A previous BOS occurred to the downside, suggesting bearish momentum took control after a temporary bullish leg.

3. Trend Lines (Yellow Dashed)

The upper TL connects lower highs → consistent downtrend.

The lower TL (support) was recently tested and might break soon — signaling bearish continuation.

4. Pattern

A–B–C–D harmonic-like pattern completed near the order block, often signaling a sell opportunity when it aligns with rejection zones.

Price formed a lower high (LH) at point C and another at D → confirms trend weakness.

5. Candlestick Rejection

“Rejected” and “Hammer” labels near point D and OB zone show failed bullish attempts → adds confluence for short.

🎯 Bearish Targets

TP1: 3,950 (nearest support)

TP2: 3,930 (previous low)

TP3 (Major): 3,885 (strong historical support zone)

⚠️ Invalidation

If price closes above 4,040–4,060 (OB zone), bearish setup invalidates.

That would mean liquidity grab and possible push toward 4,100–4,150 OB.

🧩 Summary

Bias Entry Zone Confirmation Targets Invalidation

Bearish 4,010–4,020 OB zone Rejection + lower high 3,950 → 3,930 → 3,885 Close above 4,060

The chart shows a potential bearish setup.

I have drawn a descending pattern (A-B-C-D) with rejection from an Order Block (OB) around $4,013–$4,020.

The white arrow projects a downward move toward 3,885.

🔍 Key Technical Elements

1. Order Blocks (OB)

Upper OB (~4,150–4,120): Higher timeframe supply zone; strong resistance if price rallies.

Current OB (~4,013–4,040): Recently rejected here — price reacted and failed to make a new higher high → confirms seller pressure.

2. Break of Structure (BOS)

A previous BOS occurred to the downside, suggesting bearish momentum took control after a temporary bullish leg.

3. Trend Lines (Yellow Dashed)

The upper TL connects lower highs → consistent downtrend.

The lower TL (support) was recently tested and might break soon — signaling bearish continuation.

4. Pattern

A–B–C–D harmonic-like pattern completed near the order block, often signaling a sell opportunity when it aligns with rejection zones.

Price formed a lower high (LH) at point C and another at D → confirms trend weakness.

5. Candlestick Rejection

“Rejected” and “Hammer” labels near point D and OB zone show failed bullish attempts → adds confluence for short.

🎯 Bearish Targets

TP1: 3,950 (nearest support)

TP2: 3,930 (previous low)

TP3 (Major): 3,885 (strong historical support zone)

⚠️ Invalidation

If price closes above 4,040–4,060 (OB zone), bearish setup invalidates.

That would mean liquidity grab and possible push toward 4,100–4,150 OB.

🧩 Summary

Bias Entry Zone Confirmation Targets Invalidation

Bearish 4,010–4,020 OB zone Rejection + lower high 3,950 → 3,930 → 3,885 Close above 4,060

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.