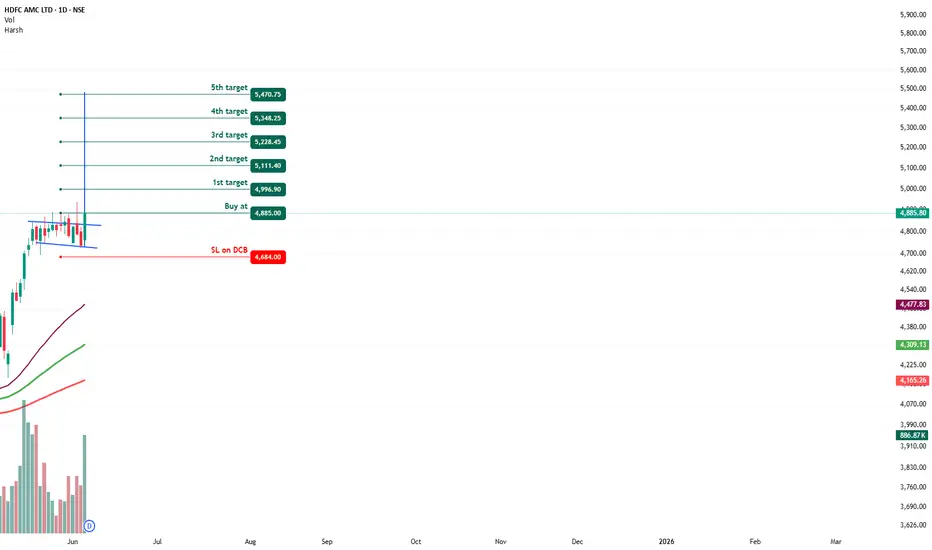

Trade Setup

📌 Stock: HDFC AMC ( HDFCAMC )

HDFCAMC )

📌 Trend: Strong Bullish Momentum

📌 Risk-Reward Ratio: 1:3 (Favorable)

🎯 Entry Zone: ₹485.00 (Breakout Confirmation)

🛑 Stop Loss: ₹4684.00 (Daily Closing Basis) (~6.1% Risk)

🎯 Target Levels:

₹4996.90

₹5111.40

₹5228.45

₹5348.45

₹5470.75(Final Target)

Technical Rationale

✅ Bullish Flag & Pole Breakout - Classic trend continuation pattern confirming uptrend

✅ Strong Momentum - Daily, Weekly & Monthly RSI >60 (Bullish zone)

✅ Volume Confirmation - Breakout volume 887K vs previous day's 431K (Nearly 2x surge)

✅ Multi-Timeframe Alignment - Daily and weekly charts showing strength

Key Observations

• The breakout comes with significantly higher volume, validating strength

• Well-defined pattern with clear neckline breakout

• Conservative stop loss at recent swing low

Trade Management Strategy

• Consider partial profit booking at each target level

• Move stop loss to breakeven after Target 1 is achieved

• Trail stop loss to protect profits as price progresses

Disclaimer ⚠️

This analysis is strictly for educational purposes and should not be construed as financial advice. Trading in equities involves substantial risk of capital loss. Past performance is not indicative of future results. Always conduct your own research, consider your risk appetite, and consult a financial advisor before making any investment decisions. The author assumes no responsibility for any trading outcomes based on this information.

What do you think? Are you watching HDFCAMC for this breakout opportunity? Share your views in the comments!

HDFCAMC for this breakout opportunity? Share your views in the comments!

📌 Stock: HDFC AMC (

📌 Trend: Strong Bullish Momentum

📌 Risk-Reward Ratio: 1:3 (Favorable)

🎯 Entry Zone: ₹485.00 (Breakout Confirmation)

🛑 Stop Loss: ₹4684.00 (Daily Closing Basis) (~6.1% Risk)

🎯 Target Levels:

₹4996.90

₹5111.40

₹5228.45

₹5348.45

₹5470.75(Final Target)

Technical Rationale

✅ Bullish Flag & Pole Breakout - Classic trend continuation pattern confirming uptrend

✅ Strong Momentum - Daily, Weekly & Monthly RSI >60 (Bullish zone)

✅ Volume Confirmation - Breakout volume 887K vs previous day's 431K (Nearly 2x surge)

✅ Multi-Timeframe Alignment - Daily and weekly charts showing strength

Key Observations

• The breakout comes with significantly higher volume, validating strength

• Well-defined pattern with clear neckline breakout

• Conservative stop loss at recent swing low

Trade Management Strategy

• Consider partial profit booking at each target level

• Move stop loss to breakeven after Target 1 is achieved

• Trail stop loss to protect profits as price progresses

Disclaimer ⚠️

This analysis is strictly for educational purposes and should not be construed as financial advice. Trading in equities involves substantial risk of capital loss. Past performance is not indicative of future results. Always conduct your own research, consider your risk appetite, and consult a financial advisor before making any investment decisions. The author assumes no responsibility for any trading outcomes based on this information.

What do you think? Are you watching

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.