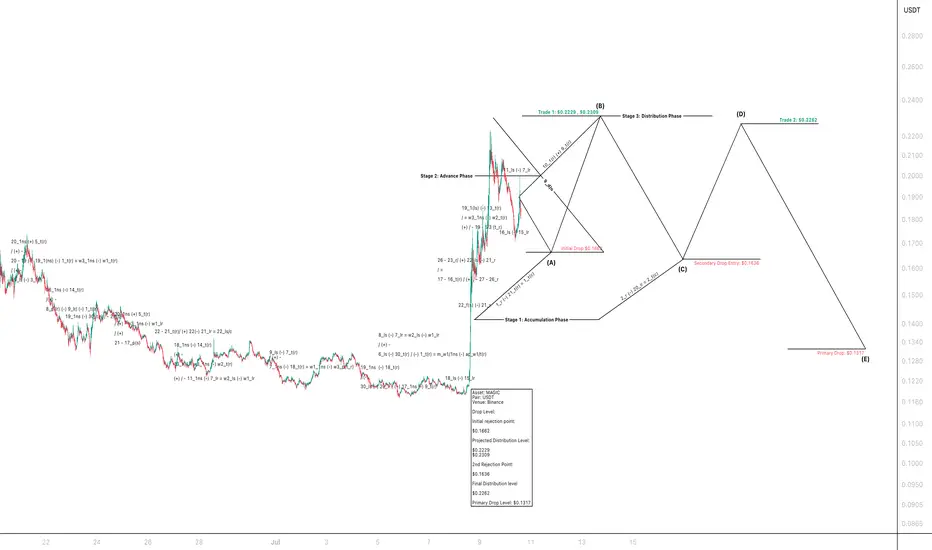

📊 MAGIC/USDT – Full Cycle Forecast | Accumulation to Distribution to Breakdown

This chart represents a full market cycle model for MAGIC/USDT, detailing each structural phase with projected entry, distribution, and drop levels.

🔍 Cycle Breakdown:

Stage 1: Accumulation Phase

Price consolidates in a base structure before launching into the advance.

Stage 2: Advance Phase

The asset moves aggressively upward, forming the foundation for distribution.

Initial rejection: $0.1662

Stage 3: Distribution Phase

Price is projected to reach:

Distribution Cluster 1: $0.2229 & $0.2309 (Trade 1 zone)

Second Rejection Point: $0.1636

Final Distribution Level: $0.2262 (Trade 2 zone)

Downside Projection:

Secondary Drop Entry: $0.1636

Primary Breakdown Target: $0.1317

🎯 Summary:

This publication outlines the expected structural behaviour of MAGIC/USDT through a complete market cycle. Trade zones and rejection levels are mathematically calculated to anticipate both bullish distribution zones and bearish re-entry opportunities. The forecast ends with a projected primary decline to $0.1317, following final distribution near $0.2262.

Disclaimer: The following forecast is derived from a proprietary, hand-crafted mathematical model developed independently over several years. It does not rely on traditional indicators, technical patterns, or third-party frameworks such as Elliott Wave Theory.

This model calculates price action based on distribution phases, economic timing cycles, and natural market imbalances.

#Crypto Forecast #MAGICUSDT #Market Structure #Cycle Analysis #Quant Model #Binance #Technical Outlook.

This chart represents a full market cycle model for MAGIC/USDT, detailing each structural phase with projected entry, distribution, and drop levels.

🔍 Cycle Breakdown:

Stage 1: Accumulation Phase

Price consolidates in a base structure before launching into the advance.

Stage 2: Advance Phase

The asset moves aggressively upward, forming the foundation for distribution.

Initial rejection: $0.1662

Stage 3: Distribution Phase

Price is projected to reach:

Distribution Cluster 1: $0.2229 & $0.2309 (Trade 1 zone)

Second Rejection Point: $0.1636

Final Distribution Level: $0.2262 (Trade 2 zone)

Downside Projection:

Secondary Drop Entry: $0.1636

Primary Breakdown Target: $0.1317

🎯 Summary:

This publication outlines the expected structural behaviour of MAGIC/USDT through a complete market cycle. Trade zones and rejection levels are mathematically calculated to anticipate both bullish distribution zones and bearish re-entry opportunities. The forecast ends with a projected primary decline to $0.1317, following final distribution near $0.2262.

Disclaimer: The following forecast is derived from a proprietary, hand-crafted mathematical model developed independently over several years. It does not rely on traditional indicators, technical patterns, or third-party frameworks such as Elliott Wave Theory.

This model calculates price action based on distribution phases, economic timing cycles, and natural market imbalances.

#Crypto Forecast #MAGICUSDT #Market Structure #Cycle Analysis #Quant Model #Binance #Technical Outlook.

Institutional Note:

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.

Institutional Note:

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.