1. Why Multi-Timeframe Analysis Matters

Markets are fractal in nature—meaning price moves in repeating patterns across all timeframes. A trend visible on the 1-hour chart may simply be a pullback on the daily chart. A breakout on the 5-minute chart may be irrelevant when the weekly trend is sideways.

Relying only on one timeframe creates three common issues:

False breakouts: Lower timeframes give misleading breakouts during higher-timeframe consolidations.

Confusion about trend: The trend on a small timeframe often conflicts with the major trend.

Entries without context: Traders enter without understanding key support/resistance or institutional zones.

MTFA solves all these problems by combining macro and micro views to form decisions rooted in context.

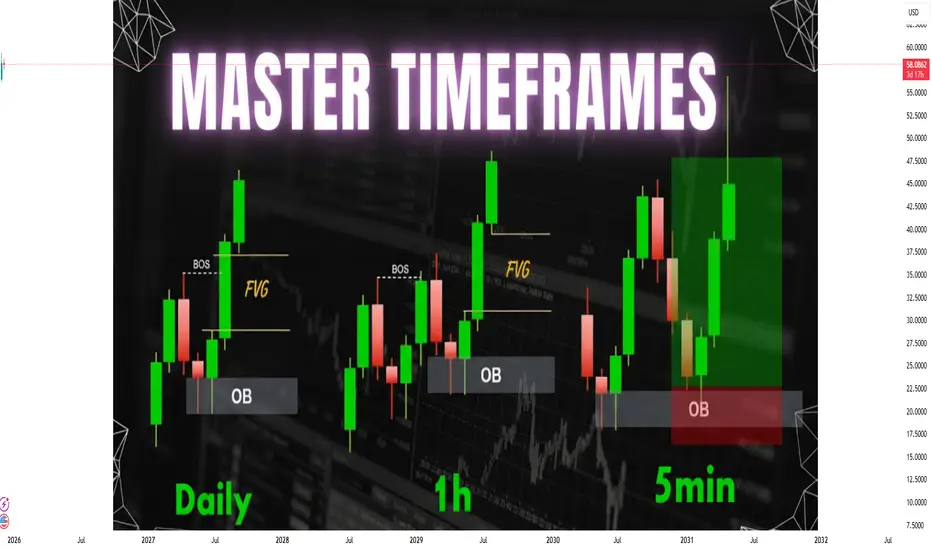

2. The Top-Down Approach (The Standard MTFA Process)

Most traders follow a 3-step method:

Step 1: Identify the Main Trend (Higher Timeframe – HTF)

Use Weekly, Daily, or 4H depending on your style.

Here you look for:

Overall trend direction (uptrend / downtrend / range)

Major support and resistance

Market structure (HH, HL, LH, LL)

Long-term supply and demand zones

HTF gives you the “big picture”—the dominant force of the market.

Step 2: Refine the Setup Zone (Middle Timeframe – MTF)

Use Daily-4H, 4H-1H, or 1H-15M depending on the trade.

This timeframe helps confirm:

Trend alignment

Pullbacks

Break of structure

Chart patterns (flags, triangles, channels)

Key levels where entries may occur

MTF filters out low-probability setups and identifies accurate zones.

Step 3: Execute With Precision (Lower Timeframe – LTF)

Use 1H, 15M, 5M, or 1M for exact entries.

This timeframe helps you:

Time entries

Catch liquidity grabs

Place tight stop-losses

Monitor candle patterns (pin bars, engulfing, doji)

Confirm momentum using volume/RSI/stochastic

This is where the actual trade triggers happen.

3. Choosing the Right Timeframes (Based on Trading Style)

Different trading styles require different combinations.

1. Scalpers

HTF: 1H

MTF: 15M

LTF: 1M–5M

Goal: Quick moves, tight SL, small targets.

2. Intraday Traders

HTF: Daily

MTF: 1H

LTF: 5M–15M

Goal: Catch day moves with strong accuracy.

3. Swing Traders

HTF: Weekly

MTF: Daily

LTF: 4H

Goal: Hold trades for days to weeks.

4. Position Traders

HTF: Monthly

MTF: Weekly

LTF: Daily

Goal: Capture major multi-month trends.

The key rule:

The larger timeframe decides trend direction; the smaller timeframe decides entry timing.

4. How MTFA Improves Trading Accuracy

1. Identifying True Trend Direction

A rise on the 15-minute chart may look bullish, but on the daily chart it may be a simple retracement in a strong downtrend. MTFA prevents trading against the dominant direction.

2. Avoiding Market Noise

Lower timeframes contain lots of fake moves (whipsaws). MTFA filters them out by relying on higher-timeframe structure.

3. Improved Entry and Exit

You can wait for precise structure breaks or candle confirmations on smaller timeframes while holding the higher-timeframe bias.

4. Better Risk Management

Since entries become more accurate, stop-loss distance reduces while keeping the same reward potential, thus improving risk-to-reward ratio (RRR).

5. Practical MTFA Example (Bullish Scenario)

Let’s say you are analyzing a stock or index.

Weekly Chart

Showing a clear uptrend (higher highs and higher lows).

Price currently retracing toward a major support zone.

Bias: Long (buy).

Daily Chart

Shows a bullish reversal pattern—like a double bottom or bullish engulfing candle.

Market structure shifts from lower lows to higher lows.

Bias strengthened: Prepare for long entries.

1-Hour Chart

Shows break of a short-term downward trendline.

A pullback retests a demand zone.

Entry triggers form: pin bar, engulfing, volume spike.

Execution: Enter long with confidence.

Here:

HTF gave direction.

MTF confirmed reversal.

LTF gave precision timing.

6. Understanding Conflicts Between Timeframes

Sometimes timeframes disagree:

Daily is bullish, but 1H is bearish.

4H shows consolidation, but 15M shows breakouts.

This is normal.

Rule:

The higher timeframe always overrides the lower timeframe.

If the HTF is bullish and LTF is bearish, the bearish move is likely a retracement—not a reversal.

Only when HTF breaks its structure should you consider changing bias.

7. Tools and Indicators Used in MTFA

MTFA does not depend on indicators, but indicators can support analysis.

Useful Tools

Price Action & Candlestick Patterns

Market Structure (HH, HL, LH, LL)

Support & Resistance Levels

Trendlines & Channels

Supply and Demand Zones

Helpful Indicators

Moving Averages (20/50/200) – for trend confirmation

RSI or Stochastic – for momentum and overbought/oversold

Volume – confirms strength of breakouts

MACD – for trend shifts

Key rule:

Indicators can support, but higher timeframe structure must lead the analysis.

8. Common MTFA Mistakes to Avoid

1. Overusing Too Many Timeframes

Using more than 3–4 creates confusion.

Stick to a simple framework: HTF + MTF + LTF.

2. Taking Trades Against the Higher-Timeframe Trend

This results in low-probability trades.

3. Forcing Breakouts on Small Timeframes

A breakout on 5M may be meaningless if the daily timeframe is in a strong range.

4. Not Waiting for Alignment

All timeframes must agree before entering.

5. Ignoring Key Levels

Higher-timeframe S/R zones are where major institutions trade.

9. Benefits of Mastering MTFA

Increases trade accuracy

Reduces emotional trades

Provides clear market structure

Helps catch major moves

Improves reward-to-risk

Builds professional-level discipline

Works in any market (stocks, forex, crypto, commodities, indices)

10. Summary of Multi-Timeframe Analysis

MTFA combines higher, middle, and lower timeframe views.

Higher timeframe shows trend and major levels.

Lower timeframe shows entry and precision.

MTFA avoids noise, false breakouts, and misleading signals.

It enhances risk management and trade quality.

All successful traders use MTFA, from scalpers to swing traders.

Markets are fractal in nature—meaning price moves in repeating patterns across all timeframes. A trend visible on the 1-hour chart may simply be a pullback on the daily chart. A breakout on the 5-minute chart may be irrelevant when the weekly trend is sideways.

Relying only on one timeframe creates three common issues:

False breakouts: Lower timeframes give misleading breakouts during higher-timeframe consolidations.

Confusion about trend: The trend on a small timeframe often conflicts with the major trend.

Entries without context: Traders enter without understanding key support/resistance or institutional zones.

MTFA solves all these problems by combining macro and micro views to form decisions rooted in context.

2. The Top-Down Approach (The Standard MTFA Process)

Most traders follow a 3-step method:

Step 1: Identify the Main Trend (Higher Timeframe – HTF)

Use Weekly, Daily, or 4H depending on your style.

Here you look for:

Overall trend direction (uptrend / downtrend / range)

Major support and resistance

Market structure (HH, HL, LH, LL)

Long-term supply and demand zones

HTF gives you the “big picture”—the dominant force of the market.

Step 2: Refine the Setup Zone (Middle Timeframe – MTF)

Use Daily-4H, 4H-1H, or 1H-15M depending on the trade.

This timeframe helps confirm:

Trend alignment

Pullbacks

Break of structure

Chart patterns (flags, triangles, channels)

Key levels where entries may occur

MTF filters out low-probability setups and identifies accurate zones.

Step 3: Execute With Precision (Lower Timeframe – LTF)

Use 1H, 15M, 5M, or 1M for exact entries.

This timeframe helps you:

Time entries

Catch liquidity grabs

Place tight stop-losses

Monitor candle patterns (pin bars, engulfing, doji)

Confirm momentum using volume/RSI/stochastic

This is where the actual trade triggers happen.

3. Choosing the Right Timeframes (Based on Trading Style)

Different trading styles require different combinations.

1. Scalpers

HTF: 1H

MTF: 15M

LTF: 1M–5M

Goal: Quick moves, tight SL, small targets.

2. Intraday Traders

HTF: Daily

MTF: 1H

LTF: 5M–15M

Goal: Catch day moves with strong accuracy.

3. Swing Traders

HTF: Weekly

MTF: Daily

LTF: 4H

Goal: Hold trades for days to weeks.

4. Position Traders

HTF: Monthly

MTF: Weekly

LTF: Daily

Goal: Capture major multi-month trends.

The key rule:

The larger timeframe decides trend direction; the smaller timeframe decides entry timing.

4. How MTFA Improves Trading Accuracy

1. Identifying True Trend Direction

A rise on the 15-minute chart may look bullish, but on the daily chart it may be a simple retracement in a strong downtrend. MTFA prevents trading against the dominant direction.

2. Avoiding Market Noise

Lower timeframes contain lots of fake moves (whipsaws). MTFA filters them out by relying on higher-timeframe structure.

3. Improved Entry and Exit

You can wait for precise structure breaks or candle confirmations on smaller timeframes while holding the higher-timeframe bias.

4. Better Risk Management

Since entries become more accurate, stop-loss distance reduces while keeping the same reward potential, thus improving risk-to-reward ratio (RRR).

5. Practical MTFA Example (Bullish Scenario)

Let’s say you are analyzing a stock or index.

Weekly Chart

Showing a clear uptrend (higher highs and higher lows).

Price currently retracing toward a major support zone.

Bias: Long (buy).

Daily Chart

Shows a bullish reversal pattern—like a double bottom or bullish engulfing candle.

Market structure shifts from lower lows to higher lows.

Bias strengthened: Prepare for long entries.

1-Hour Chart

Shows break of a short-term downward trendline.

A pullback retests a demand zone.

Entry triggers form: pin bar, engulfing, volume spike.

Execution: Enter long with confidence.

Here:

HTF gave direction.

MTF confirmed reversal.

LTF gave precision timing.

6. Understanding Conflicts Between Timeframes

Sometimes timeframes disagree:

Daily is bullish, but 1H is bearish.

4H shows consolidation, but 15M shows breakouts.

This is normal.

Rule:

The higher timeframe always overrides the lower timeframe.

If the HTF is bullish and LTF is bearish, the bearish move is likely a retracement—not a reversal.

Only when HTF breaks its structure should you consider changing bias.

7. Tools and Indicators Used in MTFA

MTFA does not depend on indicators, but indicators can support analysis.

Useful Tools

Price Action & Candlestick Patterns

Market Structure (HH, HL, LH, LL)

Support & Resistance Levels

Trendlines & Channels

Supply and Demand Zones

Helpful Indicators

Moving Averages (20/50/200) – for trend confirmation

RSI or Stochastic – for momentum and overbought/oversold

Volume – confirms strength of breakouts

MACD – for trend shifts

Key rule:

Indicators can support, but higher timeframe structure must lead the analysis.

8. Common MTFA Mistakes to Avoid

1. Overusing Too Many Timeframes

Using more than 3–4 creates confusion.

Stick to a simple framework: HTF + MTF + LTF.

2. Taking Trades Against the Higher-Timeframe Trend

This results in low-probability trades.

3. Forcing Breakouts on Small Timeframes

A breakout on 5M may be meaningless if the daily timeframe is in a strong range.

4. Not Waiting for Alignment

All timeframes must agree before entering.

5. Ignoring Key Levels

Higher-timeframe S/R zones are where major institutions trade.

9. Benefits of Mastering MTFA

Increases trade accuracy

Reduces emotional trades

Provides clear market structure

Helps catch major moves

Improves reward-to-risk

Builds professional-level discipline

Works in any market (stocks, forex, crypto, commodities, indices)

10. Summary of Multi-Timeframe Analysis

MTFA combines higher, middle, and lower timeframe views.

Higher timeframe shows trend and major levels.

Lower timeframe shows entry and precision.

MTFA avoids noise, false breakouts, and misleading signals.

It enhances risk management and trade quality.

All successful traders use MTFA, from scalpers to swing traders.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

Bài đăng liên quan

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

Bài đăng liên quan

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.