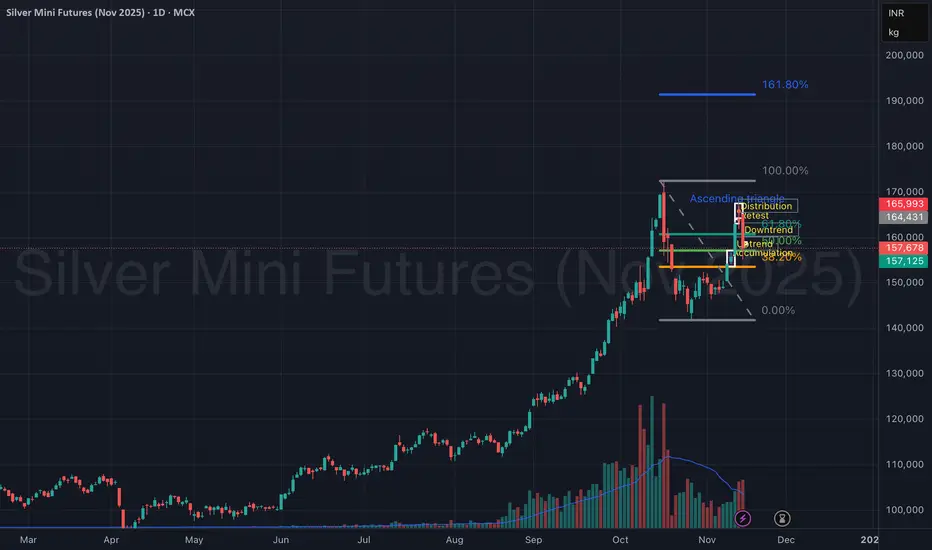

Silver Mini Futures on the 15-min chart clearly showcases a complete market cycle structure — transitioning from accumulation → uptrend → distribution → downtrend, providing an excellent study in price behavior and volume confirmation.

The move began with accumulation around ₹1,55,000, followed by a strong uptrend breakout, leading to a sharp rally. However, as price entered the ascending triangle near the ₹1,66,000 zone, momentum weakened, signaling distribution.

An exhaustion gap and a failed retest confirmed a reversal, leading to a steep downtrend, which remains active after a minor pullback.

📊 Phase Breakdown:

Accumulation Phase: ₹1,54,800 – ₹1,55,800

Sideways base formation with increasing volume at lows.

Uptrend Phase: Breakout above ₹1,56,000 triggered momentum.

Distribution Phase: Formed an ascending triangle with weak breakout follow-through.

Retest failure at ₹1,65,000 signaled exhaustion.

Downtrend Phase: Sharp decline with heavy volume, currently finding support near ₹1,57,000.

🎯 Key Technical Zones:

Resistance: ₹1,64,400 – ₹1,66,000 (supply zone)

Immediate Resistance (Retest Box): ₹1,58,200 – ₹1,58,800

Support Zone: ₹1,56,800 – ₹1,57,100

Major Support: ₹1,54,500

🧠 View:

Silver Mini Futures is currently in a downtrend continuation phase after a distribution top. A minor retest near ₹1,58,800 could invite short opportunities, while only a sustained move above ₹1,60,000 may signal trend reversal strength.

The move began with accumulation around ₹1,55,000, followed by a strong uptrend breakout, leading to a sharp rally. However, as price entered the ascending triangle near the ₹1,66,000 zone, momentum weakened, signaling distribution.

An exhaustion gap and a failed retest confirmed a reversal, leading to a steep downtrend, which remains active after a minor pullback.

📊 Phase Breakdown:

Accumulation Phase: ₹1,54,800 – ₹1,55,800

Sideways base formation with increasing volume at lows.

Uptrend Phase: Breakout above ₹1,56,000 triggered momentum.

Distribution Phase: Formed an ascending triangle with weak breakout follow-through.

Retest failure at ₹1,65,000 signaled exhaustion.

Downtrend Phase: Sharp decline with heavy volume, currently finding support near ₹1,57,000.

🎯 Key Technical Zones:

Resistance: ₹1,64,400 – ₹1,66,000 (supply zone)

Immediate Resistance (Retest Box): ₹1,58,200 – ₹1,58,800

Support Zone: ₹1,56,800 – ₹1,57,100

Major Support: ₹1,54,500

🧠 View:

Silver Mini Futures is currently in a downtrend continuation phase after a distribution top. A minor retest near ₹1,58,800 could invite short opportunities, while only a sustained move above ₹1,60,000 may signal trend reversal strength.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.