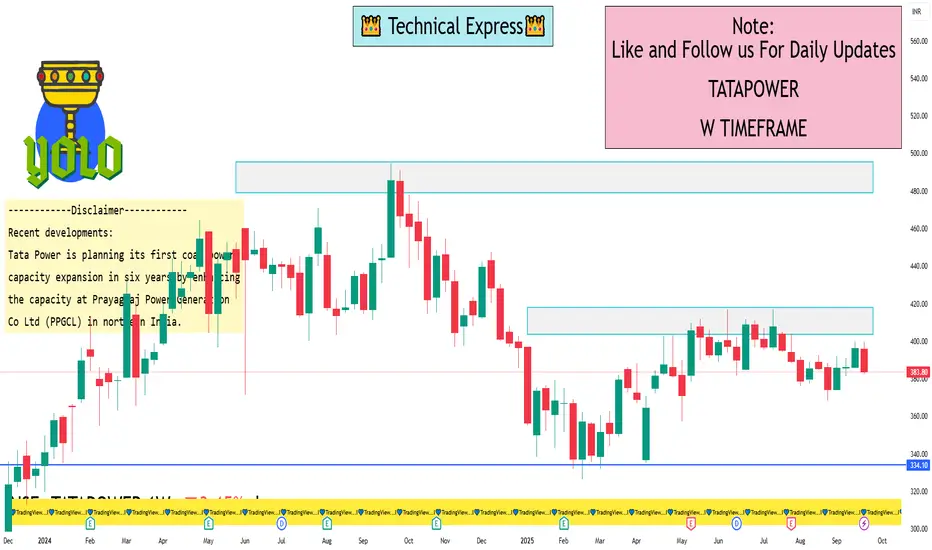

Key Technical Levels for the 1-Week Timeframe:

Immediate Support: ₹383.25 to ₹383.80

Next Support Level: ₹370.00

Immediate Resistance: ₹386.39

Next Resistance Level: ₹391.47

If the stock breaks below ₹383.25, it may test ₹370.00. Conversely, a rise above ₹391.47 could indicate a potential reversal.

Technical Indicators:

Relative Strength Index (RSI): Approximately 30.5, nearing oversold territory.

Moving Average Convergence Divergence (MACD): Currently at -2.66, indicating bearish momentum.

Moving Averages: The 5-day moving average is ₹384.54, suggesting short-term bearishness.

Fundamental insights:

Intrinsic Value: Estimated at ₹211.62, suggesting the stock is currently overvalued.

Profitability: The company reported a 6% year-on-year increase in Q1 net profit to ₹1,262 crore, driven by stronger revenues from renewable energy and transmission & distribution segments.

Recent developments:

Tata Power is planning its first coal power capacity expansion in six years by enhancing the capacity at Prayagraj Power Generation Co Ltd (PPGCL) in northern India.

Outlook:

The stock is currently in a downtrend, with technical indicators favoring a bearish scenario. Investors should monitor support levels closely and consider waiting for a confirmed reversal before making any investment decisions.

Immediate Support: ₹383.25 to ₹383.80

Next Support Level: ₹370.00

Immediate Resistance: ₹386.39

Next Resistance Level: ₹391.47

If the stock breaks below ₹383.25, it may test ₹370.00. Conversely, a rise above ₹391.47 could indicate a potential reversal.

Technical Indicators:

Relative Strength Index (RSI): Approximately 30.5, nearing oversold territory.

Moving Average Convergence Divergence (MACD): Currently at -2.66, indicating bearish momentum.

Moving Averages: The 5-day moving average is ₹384.54, suggesting short-term bearishness.

Fundamental insights:

Intrinsic Value: Estimated at ₹211.62, suggesting the stock is currently overvalued.

Profitability: The company reported a 6% year-on-year increase in Q1 net profit to ₹1,262 crore, driven by stronger revenues from renewable energy and transmission & distribution segments.

Recent developments:

Tata Power is planning its first coal power capacity expansion in six years by enhancing the capacity at Prayagraj Power Generation Co Ltd (PPGCL) in northern India.

Outlook:

The stock is currently in a downtrend, with technical indicators favoring a bearish scenario. Investors should monitor support levels closely and consider waiting for a confirmed reversal before making any investment decisions.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

Bài đăng liên quan

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

Bài đăng liên quan

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.