⚖️  US100 Fundamental Impact today

US100 Fundamental Impact today

• The core driver is the US CPI (inflation) + Unemployment Claims at 3:30 pm.

• Expect increased volatility on NAS100 around that time:

• ✅ Lower CPI + weaker jobs → Bullish NAS100 (rate cut hopes).

• ❌ Higher CPI + strong jobs → Bearish NAS100 (higher for longer Fed).

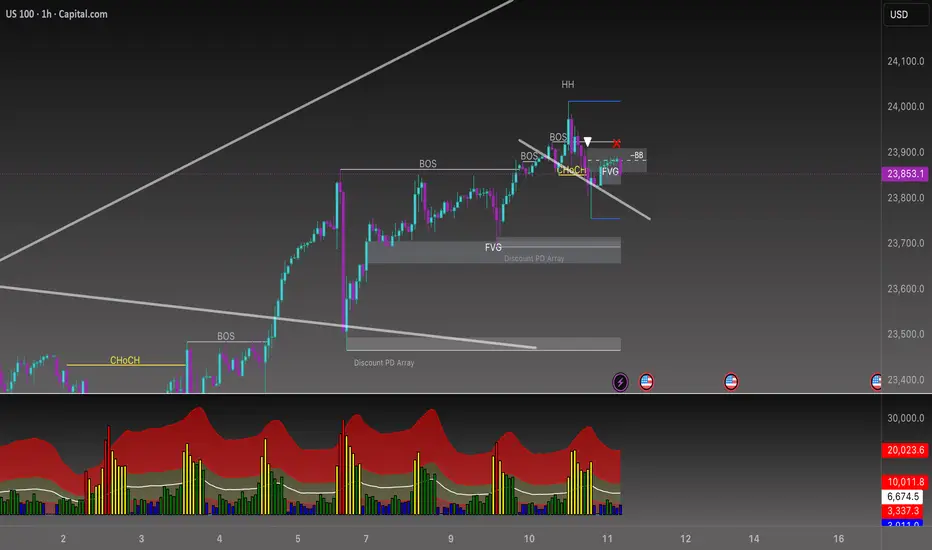

1. Bearish Continuation (Main Scenario)

• Rejection from the bearish FVG + BB zone → downside continuation.

• Targeting:

• 23,750 short-term liquidity sweep.

• Then 23,700–23,650 (discount FVG).

• Extended target: 23,540 (major discount PD array).

2. Deeper Retracement / Liquidity Sweep (Alternative Scenario)

• Price might push slightly above the bearish FVG / BB zone (~23,900–23,930) to sweep late shorts.

• Then reversal down, same targets as scenario 1.

3. Bullish Recovery (Less Likely for Now)

• If price reclaims above 23,950–24,000, structure shifts bullish again.

• Potential revisit of 24,100+ liquidity above the HH.

⸻

⚖️ Bias

• For now, bias is bearish unless 23,950–24,000 is broken with strength.

• Volume histogram also shows selling momentum increasing after the rejection.

• The core driver is the US CPI (inflation) + Unemployment Claims at 3:30 pm.

• Expect increased volatility on NAS100 around that time:

• ✅ Lower CPI + weaker jobs → Bullish NAS100 (rate cut hopes).

• ❌ Higher CPI + strong jobs → Bearish NAS100 (higher for longer Fed).

1. Bearish Continuation (Main Scenario)

• Rejection from the bearish FVG + BB zone → downside continuation.

• Targeting:

• 23,750 short-term liquidity sweep.

• Then 23,700–23,650 (discount FVG).

• Extended target: 23,540 (major discount PD array).

2. Deeper Retracement / Liquidity Sweep (Alternative Scenario)

• Price might push slightly above the bearish FVG / BB zone (~23,900–23,930) to sweep late shorts.

• Then reversal down, same targets as scenario 1.

3. Bullish Recovery (Less Likely for Now)

• If price reclaims above 23,950–24,000, structure shifts bullish again.

• Potential revisit of 24,100+ liquidity above the HH.

⸻

⚖️ Bias

• For now, bias is bearish unless 23,950–24,000 is broken with strength.

• Volume histogram also shows selling momentum increasing after the rejection.

Bài đăng liên quan

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Bài đăng liên quan

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.