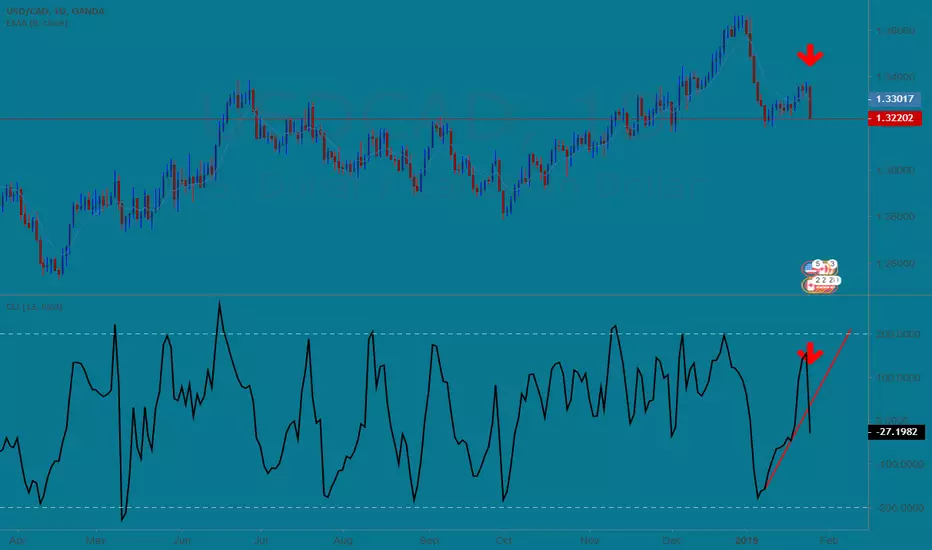

Short poss. 65p to 200ma or 200-600p if goes <1.316. The Daily CCI signal short is a trendline break on CCI with CCI also below +100. Reversal would be CCI trendline break in the other direction.

USDCAD Daily had an exceptionally large candle down y/d (Fri 1.25.19) from the 38.2% retrace up, to 50 sma, down toward the 200 sma. Fri close 1.32255. A move 65 pips down to 200sma probable, but not necessarily without bouncing first (making more profit available). 200sma now 1.3160. Because of possible bounce up before dropping to the 1.3160, I'd enter off a small timeframe.

Because USDCAD is in the 50/PP/200sma sandwich, expect swashbuckler moves both ways until price is below the 200sma and has retraced to retouch it. If that should unfold, a continuing drop could be a few hundred pips.

USDCAD Daily had an exceptionally large candle down y/d (Fri 1.25.19) from the 38.2% retrace up, to 50 sma, down toward the 200 sma. Fri close 1.32255. A move 65 pips down to 200sma probable, but not necessarily without bouncing first (making more profit available). 200sma now 1.3160. Because of possible bounce up before dropping to the 1.3160, I'd enter off a small timeframe.

Because USDCAD is in the 50/PP/200sma sandwich, expect swashbuckler moves both ways until price is below the 200sma and has retraced to retouch it. If that should unfold, a continuing drop could be a few hundred pips.

Ghi chú

1.28.19 SHORT @ 1.32758 SL 1.32808 can re-S above if stopped

Ghi chú

Dollar may rise now, so enty was too early. Exit +3.8 pip. will re-S laterGhi chú

S 1.32815.Ghi chú

Will add at 1.33Ghi chú

Taking profit 1.32557 +25.8p. Still expecting to short again from higher upGhi chú

Shorting retest of swing high M15 1.32791 v. tight stop. May be early, also it may not drop :). If price reaches swing high 1.32860 I'll short againGhi chú

Locking in b/e w some off by 1.3246Ghi chú

Price retraced 50% and retested that swing hi. Very small stop required to Short here in case pair drops. S 1.32803 w 5 pip stop 12:25:19. Will pull off one at +10p, trade will be a positive no matter what then.Ghi chú

rinse/repeatGhi chú

Short trade is still OK but is not yet in the clear from any big run below 200ma. However, taking another +20p here at 3:30am 1.32600 brings total to 3.8+25.8+33 +10+20 on single lot size = 90.6 pipA nearby support is PP 1.32535, with S1 just below. That would be a potential bounce point for a strong move higher. Leaving this Short unattended will require a larger stop than the 5p SL used to this point, but worst case would still leave 70 p profit if price again reached 1.32800. So it would be worth leaving the door open to a drop below 200sma at 1.32035 for a real ride.

Ghi chú

Another +35 pip collected,with price again approaching 200sma from the top. It now has a higher probability of dropping a few hundred pipsGhi chú

FOMC news speeded run to 161.8% 1.313. 161.8% fib is in itsself sometimes a signal for a move back up to at least 61.8%, which would be at 1.3225 On the other hand, CCI on both H4 and M15 is saying that the low is not in yet, even if some retracement up occurs now.

Ghi chú

Two additional potential hindrances to significant further move down are1) Price tagged Daily 200sma following the FOMC news

2) The 200sma is also a 113% extension of the downmove that paused at 1/9

Open, at 1.132. 113% can often be a place for trend change.

(3)) Listed above, where 161.8%'s often retrace, to 61.8% or more

we already have 196 pips, even if we don't see a lower w3 of W3. But....

One of the reasons I like CCI is that in situations like this where price and fibs cannot give clear answers, I have learned to trust CCI.

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.