When news, insider positioning, and the weekly chart all align, I pay close attention and so should you.

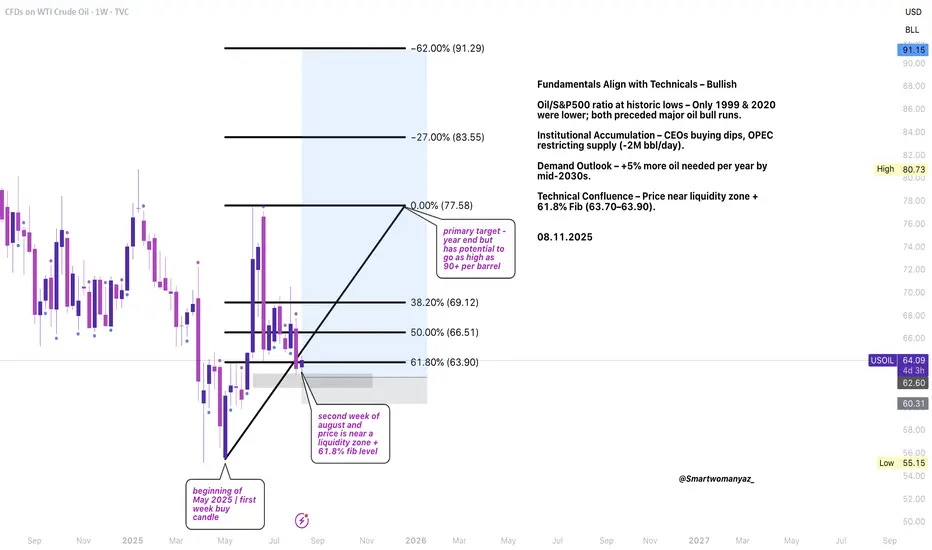

Crude oil has built a strong bullish structure on the weekly timeframe, breaking above key resistance levels and holding higher lows. The recent OPEC+ decision to maintain a -2MM bbl/d production cut, combined with CEOs and major oil traders buying aggressively at every dip, provides strong fundamental confirmation of this trend.

In the U.S., gas prices are already trending upward which is another clear signal that the market is pricing in tighter supply and stronger demand.

From a technical perspective, price has cleared the 50% Fibonacci retracement and is now targeting the $77.50 zone in the short term. The medium-term projection sits near $90, with potential for higher if supply constraints persist. Pullbacks into support zones could present attractive re-entry opportunities for swing and position traders.

Bias: Bullish

Targets: $77.50 (short-term)

Chart: Weekly timeframe

If you agree with this outlook, drop your thoughts below or share this idea with others.

Crude oil has built a strong bullish structure on the weekly timeframe, breaking above key resistance levels and holding higher lows. The recent OPEC+ decision to maintain a -2MM bbl/d production cut, combined with CEOs and major oil traders buying aggressively at every dip, provides strong fundamental confirmation of this trend.

In the U.S., gas prices are already trending upward which is another clear signal that the market is pricing in tighter supply and stronger demand.

From a technical perspective, price has cleared the 50% Fibonacci retracement and is now targeting the $77.50 zone in the short term. The medium-term projection sits near $90, with potential for higher if supply constraints persist. Pullbacks into support zones could present attractive re-entry opportunities for swing and position traders.

Bias: Bullish

Targets: $77.50 (short-term)

Chart: Weekly timeframe

If you agree with this outlook, drop your thoughts below or share this idea with others.

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.