🔥 GOLD WEEKLY SNAPSHOT — BY PROJECTSYNDICATE

🏆 Swing High / Swing low:

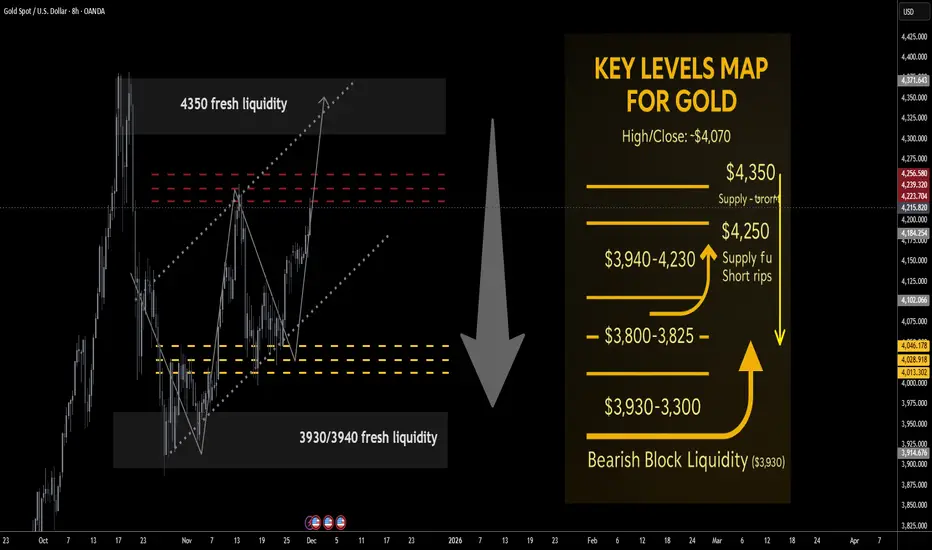

$4,350 → ~$3,930 — clean rejection from the $4,350 bear-liquidity pocket, weekly close back inside prior range and below $4.1k.

📈 Trend:

Structural uptrend still intact above ~$3,900, but near-term momentum has flipped distributive: rallies into $4,250–$4,350 look like supply, not fresh markup. Upside is seen as asymmetric to the downside from overhead resistance.

🛡 Supports:

• $4,060–$4,020: first demand / reaction band below the close.

• $4,000–$3,960: psychological shelf; first downside target on failed rallies.

• $3,940–$3,930: bullish block liquidity — key structural demand; loss of this area risks a deeper de-leveraging leg.

🚧 Resistances:

• $4,200–$4,230: immediate supply from the weekly close; first “sell-the-rip” area.

• $4,250–$4,280: primary bearish liquidity / core short zone.

• $4,300–$4,350: exhaustion band; $4,350 = recent swing high / bear block.

• Stretch: $4,380 prior spike; only expected on an overshoot / stop run.

🧭 Bias Next Week:

Fade strength rather than chase upside.

Base idea: short rips into $4,220–$4,320, scale adds toward $4,350, looking for reversal back into $4,060 → $4,000–$3,960.

• A weekly close above $4,380 would invalidate the short-the-rip bias and open room toward the higher Street targets.

________________________________________

🔝 Key Resistance Zones Short-Side Focus

• $4,200–$4,230: first supply from the weekly close; good area for initial probe shorts.

• $4,250–$4,280: primary bearish liquidity / main take-profit area for trapped late longs.

• $4,300–$4,350: extension / exhaustion band; includes the $4,350 swing high and core “blow-off” liquidity pocket.

• $4,380: prior spike high / stretched stop-run; only expect in a squeeze.

________________________________________

🛡 Support Zones Downside Objectives / Where Shorts Start Covering

• $4,060–$4,020: first reaction band below; scale out partial profits here.

• $4,000–$3,960: key psychological shelf; second profit zone and likely area of responsive dip-buyers.

• $3,940–$3,930: bullish block liquidity; final target for aggressive shorts, and the spot where higher-timeframe bulls are expected to defend. A sustained break below would be a regime change.

________________________________________

⚖️ Base Case Scenario

• Rallies into $4,220–$4,320 encounter selling as late longs de-risk and fresh shorts engage.

• Price fails to sustain above $4,300–$4,350, leaving a wick / rejection on the higher timeframes.

• From there, rotation lower toward $4,060, then $4,000–$3,960 as the primary downside objective.

• Only if the $3,960–$3,930 block cracks cleanly do we start talking about a deeper flush into $3,880–$3,850 as a secondary scenario.

________________________________________

🚀 Breakout / Invalidation Trigger

• Bearish framework invalidation:

o A strong daily/weekly acceptance > $4,380 would suggest bears are trapped and open the door toward $4,450+, in line with the newly raised Street forecasts.

o In that case, shift from short-the-rip to neutral / buy shallow pullbacks until a new top structure forms.

________________________________________

💡 Market Drivers to Watch This Week

• Fed communication and front-end real yields – any hawkish surprise or delay in cuts could extend the correction; dovish surprise risks another squeeze.

• USD index swings around data / politics – sharp dollar bounces favour your short bias from resistance.

• Central-bank headlines (reserve diversification, sanction risk) – supportive in the background but less impactful intraday; use them as context, not trade triggers.

• Geopolitical flare-ups – can create squeezes into your sell zones; be ready for fast spikes into $4,300–$4,350 rather than waiting for slow grinds.

________________________________________

🔓 Bull / Bear Trigger Lines

• Structural bull line:

• Above $3,930–$4,000: long-term bull structure intact; even if you’re tactically shorting rips, treat deep flushes into this band with respect — this is where bigger players are likely accumulating.

• Bear expansion line:

• Below $3,930: opens scope for a faster liquidation wave toward $3,880–$3,850; would indicate that the 2025 blow-off is transitioning toward a broader consolidation or mean-reversion phase.

________________________________________

🧭 Strategy

Use overhead resistance as a place to sell strength, not initiate fresh longs. Expect limited upside and a reversal from liquidity above the market.

1️⃣ Primary Short Setup – Fade the Rips

• Entry zones:

o First scale: $4,220–$4,250

o Add / build: $4,250–$4,280 (primary bear-liquidity block)

o Final add / exhaustion: $4,300–$4,350 (only if tape shows blow-off / stop-run behaviour).

• Stops / invalidation:

o Tactical: hard stop above $4,380.

o More conservative traders can run a soft line at $4,350 and hard stop just beyond $4,380.

• Targets:

o TP1: $4,060–$4,020

o TP2: $4,000–$3,960

o Stretch TP3 (runner): $3,940–$3,930 bullish block.

________________________________________

🌍 Macro Tailwinds

• • Policy / Real Yields

Markets are leaning into lower US real rates and more cuts through 2026, with talk of “fiscal dominance” and persistent deficits. This keeps the medium-term backdrop supportive for gold even after the parabolic run.

• • FX / USD Dynamics

A softer, more volatile dollar driven by rate-cut expectations and concerns over US fiscal sustainability continues to underpin gold on dips, even if short-term dollar squeezes can trigger sharp pullbacks.

• • Flows: Central Banks Still the Backbone

Central banks remain heavy net buyers, with H1 and Q3 data showing robust additions and EM reserve managers diversifying away from sanction-risk USD assets. Recent commentary links record highs to this central-bank bid plus tight physical markets.

• • Flows: ETF & Investor Participation

After several years of outflows, ETF demand has turned back to net inflows, adding to central-bank buying and reinforcing the idea of a higher structural floor in the ~$3.9k area even after corrections.

• • Geopolitics & Safe-Haven Premium

Gold’s 2025 surge is still anchored in elevated geopolitical risk (Russia–NATO tensions, US–China frictions, tariff headlines), plus anxiety about frozen reserves and sanctions. This keeps the safety bid sticky even when positioning looks crowded.

• ________________________________________

🏆 Swing High / Swing low:

$4,350 → ~$3,930 — clean rejection from the $4,350 bear-liquidity pocket, weekly close back inside prior range and below $4.1k.

📈 Trend:

Structural uptrend still intact above ~$3,900, but near-term momentum has flipped distributive: rallies into $4,250–$4,350 look like supply, not fresh markup. Upside is seen as asymmetric to the downside from overhead resistance.

🛡 Supports:

• $4,060–$4,020: first demand / reaction band below the close.

• $4,000–$3,960: psychological shelf; first downside target on failed rallies.

• $3,940–$3,930: bullish block liquidity — key structural demand; loss of this area risks a deeper de-leveraging leg.

🚧 Resistances:

• $4,200–$4,230: immediate supply from the weekly close; first “sell-the-rip” area.

• $4,250–$4,280: primary bearish liquidity / core short zone.

• $4,300–$4,350: exhaustion band; $4,350 = recent swing high / bear block.

• Stretch: $4,380 prior spike; only expected on an overshoot / stop run.

🧭 Bias Next Week:

Fade strength rather than chase upside.

Base idea: short rips into $4,220–$4,320, scale adds toward $4,350, looking for reversal back into $4,060 → $4,000–$3,960.

• A weekly close above $4,380 would invalidate the short-the-rip bias and open room toward the higher Street targets.

________________________________________

🔝 Key Resistance Zones Short-Side Focus

• $4,200–$4,230: first supply from the weekly close; good area for initial probe shorts.

• $4,250–$4,280: primary bearish liquidity / main take-profit area for trapped late longs.

• $4,300–$4,350: extension / exhaustion band; includes the $4,350 swing high and core “blow-off” liquidity pocket.

• $4,380: prior spike high / stretched stop-run; only expect in a squeeze.

________________________________________

🛡 Support Zones Downside Objectives / Where Shorts Start Covering

• $4,060–$4,020: first reaction band below; scale out partial profits here.

• $4,000–$3,960: key psychological shelf; second profit zone and likely area of responsive dip-buyers.

• $3,940–$3,930: bullish block liquidity; final target for aggressive shorts, and the spot where higher-timeframe bulls are expected to defend. A sustained break below would be a regime change.

________________________________________

⚖️ Base Case Scenario

• Rallies into $4,220–$4,320 encounter selling as late longs de-risk and fresh shorts engage.

• Price fails to sustain above $4,300–$4,350, leaving a wick / rejection on the higher timeframes.

• From there, rotation lower toward $4,060, then $4,000–$3,960 as the primary downside objective.

• Only if the $3,960–$3,930 block cracks cleanly do we start talking about a deeper flush into $3,880–$3,850 as a secondary scenario.

________________________________________

🚀 Breakout / Invalidation Trigger

• Bearish framework invalidation:

o A strong daily/weekly acceptance > $4,380 would suggest bears are trapped and open the door toward $4,450+, in line with the newly raised Street forecasts.

o In that case, shift from short-the-rip to neutral / buy shallow pullbacks until a new top structure forms.

________________________________________

💡 Market Drivers to Watch This Week

• Fed communication and front-end real yields – any hawkish surprise or delay in cuts could extend the correction; dovish surprise risks another squeeze.

• USD index swings around data / politics – sharp dollar bounces favour your short bias from resistance.

• Central-bank headlines (reserve diversification, sanction risk) – supportive in the background but less impactful intraday; use them as context, not trade triggers.

• Geopolitical flare-ups – can create squeezes into your sell zones; be ready for fast spikes into $4,300–$4,350 rather than waiting for slow grinds.

________________________________________

🔓 Bull / Bear Trigger Lines

• Structural bull line:

• Above $3,930–$4,000: long-term bull structure intact; even if you’re tactically shorting rips, treat deep flushes into this band with respect — this is where bigger players are likely accumulating.

• Bear expansion line:

• Below $3,930: opens scope for a faster liquidation wave toward $3,880–$3,850; would indicate that the 2025 blow-off is transitioning toward a broader consolidation or mean-reversion phase.

________________________________________

🧭 Strategy

Use overhead resistance as a place to sell strength, not initiate fresh longs. Expect limited upside and a reversal from liquidity above the market.

1️⃣ Primary Short Setup – Fade the Rips

• Entry zones:

o First scale: $4,220–$4,250

o Add / build: $4,250–$4,280 (primary bear-liquidity block)

o Final add / exhaustion: $4,300–$4,350 (only if tape shows blow-off / stop-run behaviour).

• Stops / invalidation:

o Tactical: hard stop above $4,380.

o More conservative traders can run a soft line at $4,350 and hard stop just beyond $4,380.

• Targets:

o TP1: $4,060–$4,020

o TP2: $4,000–$3,960

o Stretch TP3 (runner): $3,940–$3,930 bullish block.

________________________________________

🌍 Macro Tailwinds

• • Policy / Real Yields

Markets are leaning into lower US real rates and more cuts through 2026, with talk of “fiscal dominance” and persistent deficits. This keeps the medium-term backdrop supportive for gold even after the parabolic run.

• • FX / USD Dynamics

A softer, more volatile dollar driven by rate-cut expectations and concerns over US fiscal sustainability continues to underpin gold on dips, even if short-term dollar squeezes can trigger sharp pullbacks.

• • Flows: Central Banks Still the Backbone

Central banks remain heavy net buyers, with H1 and Q3 data showing robust additions and EM reserve managers diversifying away from sanction-risk USD assets. Recent commentary links record highs to this central-bank bid plus tight physical markets.

• • Flows: ETF & Investor Participation

After several years of outflows, ETF demand has turned back to net inflows, adding to central-bank buying and reinforcing the idea of a higher structural floor in the ~$3.9k area even after corrections.

• • Geopolitics & Safe-Haven Premium

Gold’s 2025 surge is still anchored in elevated geopolitical risk (Russia–NATO tensions, US–China frictions, tariff headlines), plus anxiety about frozen reserves and sanctions. This keeps the safety bid sticky even when positioning looks crowded.

• ________________________________________

Ghi chú

🎁Please hit the like button and🎁Leave a comment to support our team!

Ghi chú

let me know your thoughts on the above in the comments section 🔥🏧🚀Ghi chú

🏅 GOLD WEEKLY SUMMARY — SHORT THE RIPS🪙 Trend: Uptrend intact long-term, but near-term tape turning distributive.

🏔️ Key Sell Zone: $4,220–$4,320 — prime area to short rips into supply.

🐻 Bear Liquidity: $4,350 (fresh liquidity) → expect rejection / reversal.

📉 Stretch Stop-Run: $4,380 — only hit on squeeze; short bias still valid below here.

📊 Downside Targets: $4,060 → $4,000 → $3,960.

🛡️ Major Support: $3,930–$3,940 bullish block (HTF buyers defend).

⛔ Bear Expansion: Break below $3,930 = opens $3,880–$3,850.

💱 Macro: Lower real yields + softer USD = supportive but not enough to chase highs.

🏦 Flows: Strong central-bank buying keeps floor firm but upside crowded.

🎯 Strategy: Fade all strength into $4,220–$4,350; take profits down into $4,060–$3,960.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

Bài đăng liên quan

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

Bài đăng liên quan

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.