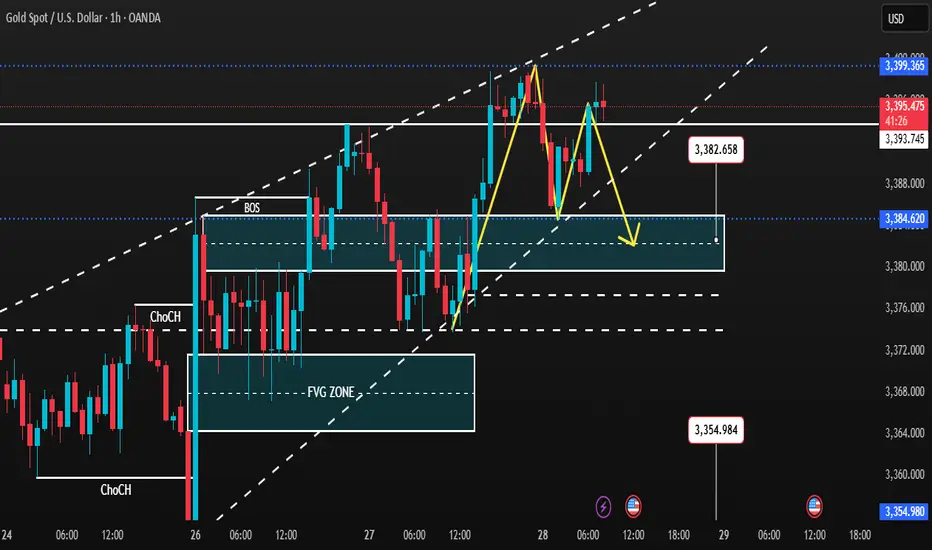

Gold SMC Daily Plan – 28/08

Market Context (SMC view):

Gold is trading near 3395–3396 after a sharp bullish rally. Early bearish divergence is visible on H4, hinting at a short-term top.

Key resistance is at 3400 – a clean breakout above may trigger liquidity sweep towards 342x–343x, retesting the old ATH.

On the downside, if 3370 support breaks, price may correct deeper into 335x BUY zone for a strong bullish setup.

Key Levels:

Resistance: 3396–3400 (Sell Zone), 342x–343x (Liquidity sweep area)

Support: 3370, 3354–3352 (Buy Zone), 3325 (SL for longs)

SMC Zones & Liquidity Pools:

BUY ZONE 1: 3354–3352 (below liquidity sweep under 3370)

SL: 3347

TP: 3365 → 3375 → 3385 → 3395 → 3400+

BUY ZONE 2: 3380–3382

SL: 3374

TP: 3390 → 3400 → 3415 → 3430 → 3450+

SELL ZONE: 3408–3410 (above recent high)

SL: 3416

TP: 3390 → 3380 → 3375 → 3360

Trading Plan & Scenarios:

Sell Setup (Primary Bias – Divergence Play):

Look for liquidity grab above 3396–3399 (into resistance).

Enter short with SL above 3403.

Partial profits at 3390–3380–3375; keep runner towards 3360 if support breaks.

Buy Setup (Counter Play – Break & Retest):

If price dips into 3354–3352 BUY zone, wait for bullish confirmation (choch/BOS on lower TF).

Enter long with SL below 3347.

Targets: 3365 → 3375 → 3385 → 3395 → 3400+

Confluences:

H4 bearish divergence signalling possible exhaustion at top.

Liquidity pools above 3396 and below 3370 remain untapped.

FVG and imbalance align with 335x buy zone.

Market Context (SMC view):

Gold is trading near 3395–3396 after a sharp bullish rally. Early bearish divergence is visible on H4, hinting at a short-term top.

Key resistance is at 3400 – a clean breakout above may trigger liquidity sweep towards 342x–343x, retesting the old ATH.

On the downside, if 3370 support breaks, price may correct deeper into 335x BUY zone for a strong bullish setup.

Key Levels:

Resistance: 3396–3400 (Sell Zone), 342x–343x (Liquidity sweep area)

Support: 3370, 3354–3352 (Buy Zone), 3325 (SL for longs)

SMC Zones & Liquidity Pools:

BUY ZONE 1: 3354–3352 (below liquidity sweep under 3370)

SL: 3347

TP: 3365 → 3375 → 3385 → 3395 → 3400+

BUY ZONE 2: 3380–3382

SL: 3374

TP: 3390 → 3400 → 3415 → 3430 → 3450+

SELL ZONE: 3408–3410 (above recent high)

SL: 3416

TP: 3390 → 3380 → 3375 → 3360

Trading Plan & Scenarios:

Sell Setup (Primary Bias – Divergence Play):

Look for liquidity grab above 3396–3399 (into resistance).

Enter short with SL above 3403.

Partial profits at 3390–3380–3375; keep runner towards 3360 if support breaks.

Buy Setup (Counter Play – Break & Retest):

If price dips into 3354–3352 BUY zone, wait for bullish confirmation (choch/BOS on lower TF).

Enter long with SL below 3347.

Targets: 3365 → 3375 → 3385 → 3395 → 3400+

Confluences:

H4 bearish divergence signalling possible exhaustion at top.

Liquidity pools above 3396 and below 3370 remain untapped.

FVG and imbalance align with 335x buy zone.

⚜️ Daily 4 - 6 Swing SIGNALS

⚜️ Daily 9 - 15 Scalping SIGNALS

⚜️ SMC - ICT | Document and Real Trade Logic

⚜️ Forex & Crypto & Gold | SIGNALS

Join Real - Time Signals Here: t.me/+pi-w7HQsxw03YWNl

⚜️ Daily 9 - 15 Scalping SIGNALS

⚜️ SMC - ICT | Document and Real Trade Logic

⚜️ Forex & Crypto & Gold | SIGNALS

Join Real - Time Signals Here: t.me/+pi-w7HQsxw03YWNl

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

⚜️ Daily 4 - 6 Swing SIGNALS

⚜️ Daily 9 - 15 Scalping SIGNALS

⚜️ SMC - ICT | Document and Real Trade Logic

⚜️ Forex & Crypto & Gold | SIGNALS

Join Real - Time Signals Here: t.me/+pi-w7HQsxw03YWNl

⚜️ Daily 9 - 15 Scalping SIGNALS

⚜️ SMC - ICT | Document and Real Trade Logic

⚜️ Forex & Crypto & Gold | SIGNALS

Join Real - Time Signals Here: t.me/+pi-w7HQsxw03YWNl

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.