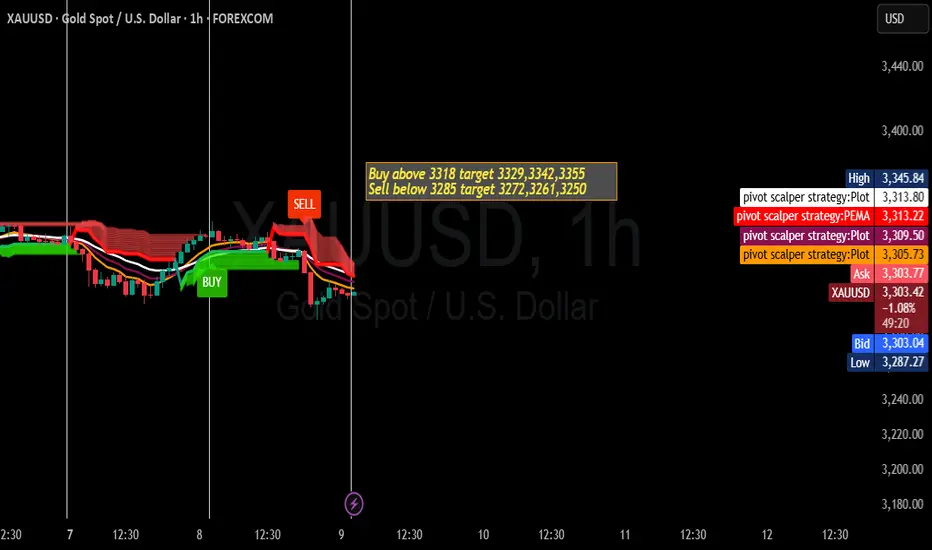

📈 GOLD INTRADAY TRADE SETUP

✨ High-Probability Levels Based on Price Action ✨

🟢 Buy Setup – Breakout Trade

Entry: Buy above the high of the 1-hour candle with a strong close above ₹3318

Targets:

🎯 T1: ₹3329

🎯 T2: ₹3342

🎯 T3: ₹3355

Stop Loss: Below ₹3308 (adjust based on risk appetite)

Reason: Bullish momentum expected above ₹3318 with confirmation from higher time frame close. Ideal for momentum traders looking to ride the trend.

🔴 Sell Setup – Breakdown Trade

Entry: Sell below the low of the 15-minute candle with a firm close below ₹3285

Targets:

🎯 T1: ₹3272

🎯 T2: ₹3261

🎯 T3: ₹3250

Stop Loss: Above ₹3295 (modify as per volatility)

Reason: Short-term weakness signaled by intraday structure. Ideal for scalpers and short-sellers during correction phases.

⚠️ Important Notes:

Wait for candle close confirmation at key levels.

Use proper risk management – position sizing, stop-loss, and trailing methods.

Combine with indicators like RSI, volume, or VWAP for added confidence.

📌 Disclaimer:

🔺 This analysis is for educational and informational purposes only.

📊 Trading involves substantial risk – always consult with your financial advisor before making decisions.

💡 Past performance is not indicative of future results. Trade wisely and stay disciplined!

✨ High-Probability Levels Based on Price Action ✨

🟢 Buy Setup – Breakout Trade

Entry: Buy above the high of the 1-hour candle with a strong close above ₹3318

Targets:

🎯 T1: ₹3329

🎯 T2: ₹3342

🎯 T3: ₹3355

Stop Loss: Below ₹3308 (adjust based on risk appetite)

Reason: Bullish momentum expected above ₹3318 with confirmation from higher time frame close. Ideal for momentum traders looking to ride the trend.

🔴 Sell Setup – Breakdown Trade

Entry: Sell below the low of the 15-minute candle with a firm close below ₹3285

Targets:

🎯 T1: ₹3272

🎯 T2: ₹3261

🎯 T3: ₹3250

Stop Loss: Above ₹3295 (modify as per volatility)

Reason: Short-term weakness signaled by intraday structure. Ideal for scalpers and short-sellers during correction phases.

⚠️ Important Notes:

Wait for candle close confirmation at key levels.

Use proper risk management – position sizing, stop-loss, and trailing methods.

Combine with indicators like RSI, volume, or VWAP for added confidence.

📌 Disclaimer:

🔺 This analysis is for educational and informational purposes only.

📊 Trading involves substantial risk – always consult with your financial advisor before making decisions.

💡 Past performance is not indicative of future results. Trade wisely and stay disciplined!

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.