🟡  XAUUSD XAUUSD Daily Plan – September 19, 2025

XAUUSD XAUUSD Daily Plan – September 19, 2025

1. Market Overview

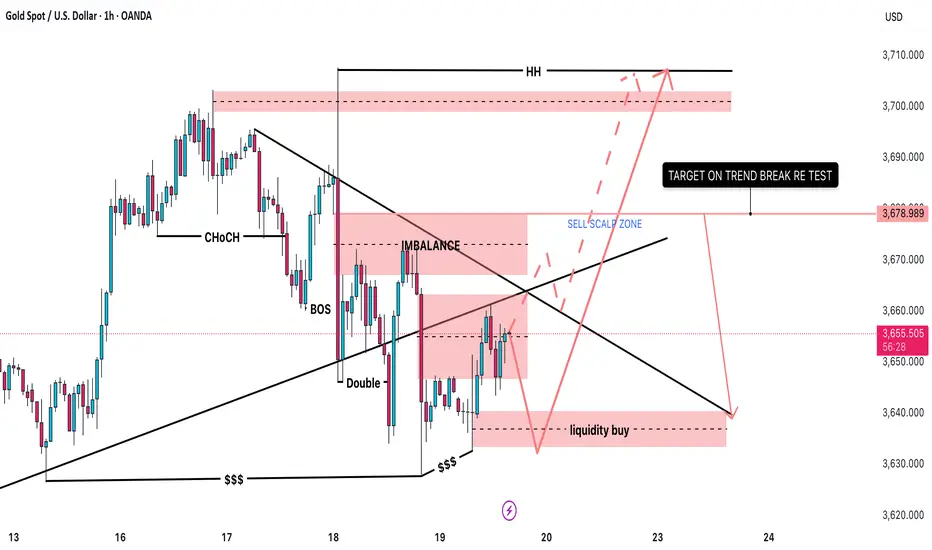

Price is consolidating around 3655 – 3660 after forming a short-term bearish structure.

On H1, several supply & demand zones are highlighted:

Liquidity Buy Zone around 3640 (potential demand).

Imbalance / Supply Zone around 3670 – 3680.

The overall higher-timeframe trend remains bullish, but in the short term, the market is retesting liquidity areas.

2. Key Levels & Zones

Liquidity Buy Zone: 3640 – 3645 → key support.

Sell Scalp Zone / Imbalance: 3670 – 3680 → short-term resistance.

Higher High Target (HH): 3700 – 3710 → strong higher-timeframe resistance.

Longer-term Support: 3620 – 3630.

3. Main Trading Scenarios

🟢 Long Setup (trend-aligned)

Wait for price to retest Liquidity Buy zone 3640 – 3645.

If reversal signals appear (pin bar, engulfing, etc.), consider opening Long.

Targets:

Short-term: 3678 (trendline break retest).

Mid-term: 3700 – 3710 (HH).

🔴 Short Setup (scalp only)

If price retraces into Sell Scalp Zone 3670 – 3680 and shows strong rejection → Short scalp opportunity.

Target: 3640 – 3645.

Note: Short trades are counter-trend, so manage quickly.

4. Trade Management Notes

Prioritize Longs from support zones since the higher-timeframe trend is still bullish.

Shorts should only be seen as short-term scalp opportunities near resistance.

Risk management: limit to 1–2% per trade, avoid holding against the main trend.

📌 Conclusion: XAUUSD is currently testing the descending trendline and resistance area. A successful breakout could target 3700+. Otherwise, the market is likely to revisit 3640 before launching the next bullish leg.

1. Market Overview

Price is consolidating around 3655 – 3660 after forming a short-term bearish structure.

On H1, several supply & demand zones are highlighted:

Liquidity Buy Zone around 3640 (potential demand).

Imbalance / Supply Zone around 3670 – 3680.

The overall higher-timeframe trend remains bullish, but in the short term, the market is retesting liquidity areas.

2. Key Levels & Zones

Liquidity Buy Zone: 3640 – 3645 → key support.

Sell Scalp Zone / Imbalance: 3670 – 3680 → short-term resistance.

Higher High Target (HH): 3700 – 3710 → strong higher-timeframe resistance.

Longer-term Support: 3620 – 3630.

3. Main Trading Scenarios

🟢 Long Setup (trend-aligned)

Wait for price to retest Liquidity Buy zone 3640 – 3645.

If reversal signals appear (pin bar, engulfing, etc.), consider opening Long.

Targets:

Short-term: 3678 (trendline break retest).

Mid-term: 3700 – 3710 (HH).

🔴 Short Setup (scalp only)

If price retraces into Sell Scalp Zone 3670 – 3680 and shows strong rejection → Short scalp opportunity.

Target: 3640 – 3645.

Note: Short trades are counter-trend, so manage quickly.

4. Trade Management Notes

Prioritize Longs from support zones since the higher-timeframe trend is still bullish.

Shorts should only be seen as short-term scalp opportunities near resistance.

Risk management: limit to 1–2% per trade, avoid holding against the main trend.

📌 Conclusion: XAUUSD is currently testing the descending trendline and resistance area. A successful breakout could target 3700+. Otherwise, the market is likely to revisit 3640 before launching the next bullish leg.

Real-Time Update + Signals: t.me/+EJlT6QpqU6Q3MGVl

💋 3 - 6 OneShotOneKill (Daily Trading Signals) Daily

💋 Real - Time Plan Update

💋10 - 15 Scalping Signals Daily

💋 Proceed Position and Plan

💋 3 - 6 OneShotOneKill (Daily Trading Signals) Daily

💋 Real - Time Plan Update

💋10 - 15 Scalping Signals Daily

💋 Proceed Position and Plan

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.

Real-Time Update + Signals: t.me/+EJlT6QpqU6Q3MGVl

💋 3 - 6 OneShotOneKill (Daily Trading Signals) Daily

💋 Real - Time Plan Update

💋10 - 15 Scalping Signals Daily

💋 Proceed Position and Plan

💋 3 - 6 OneShotOneKill (Daily Trading Signals) Daily

💋 Real - Time Plan Update

💋10 - 15 Scalping Signals Daily

💋 Proceed Position and Plan

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.