Gold Trading Scenario – Friday Outlook

Hello traders,

Fridays are often challenging for forex traders. As the week closes, bankers wrap up their positions, creating unpredictable market moves. This is especially tricky for those who rely on timing-based strategies, so it’s important to watch the smaller fluctuations closely today.

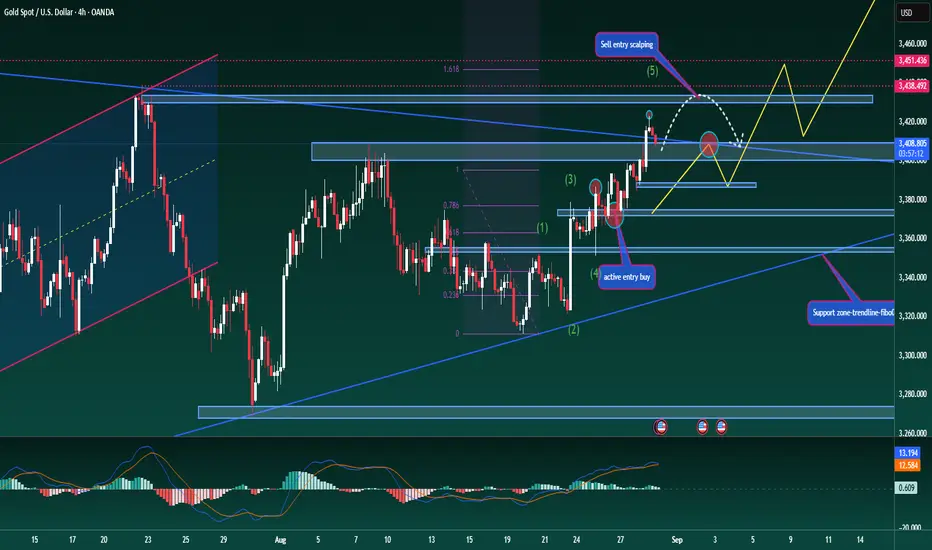

Looking at the current gold structure, the uptrend remains intact. Buying pressure is strong enough to push towards the next projected levels. Technical indicators continue to support a bullish view, with MACD showing steady momentum as both volume and moving averages remain positive.

From an Elliott Wave perspective, gold is moving in **wave 5**, which is typically an extended wave. This allows us to maintain a bullish outlook unless price breaks below **3386** and confirms with at least one candle close on the M15 timeframe or higher. In that case, the scenario would be invalidated. Until then, buying around this level with a stop-loss just below the key support zone (about 1 dollar lower) remains the preferred approach.

Selling opportunities are not yet ideal, but for those looking at short setups, the **3450 zone** should be monitored as a major resistance. In the shorter term, **3430** can act as a reaction level for temporary sells.

Fridays also tend to bring more news-driven traps, so be extra cautious. It’s a day that can really test less experienced traders.

This is my view for today’s session – use it as reference, and trade with discipline.

---

Hello traders,

Fridays are often challenging for forex traders. As the week closes, bankers wrap up their positions, creating unpredictable market moves. This is especially tricky for those who rely on timing-based strategies, so it’s important to watch the smaller fluctuations closely today.

Looking at the current gold structure, the uptrend remains intact. Buying pressure is strong enough to push towards the next projected levels. Technical indicators continue to support a bullish view, with MACD showing steady momentum as both volume and moving averages remain positive.

From an Elliott Wave perspective, gold is moving in **wave 5**, which is typically an extended wave. This allows us to maintain a bullish outlook unless price breaks below **3386** and confirms with at least one candle close on the M15 timeframe or higher. In that case, the scenario would be invalidated. Until then, buying around this level with a stop-loss just below the key support zone (about 1 dollar lower) remains the preferred approach.

Selling opportunities are not yet ideal, but for those looking at short setups, the **3450 zone** should be monitored as a major resistance. In the shorter term, **3430** can act as a reaction level for temporary sells.

Fridays also tend to bring more news-driven traps, so be extra cautious. It’s a day that can really test less experienced traders.

This is my view for today’s session – use it as reference, and trade with discipline.

---

🔥 BrianLionCapital – Where Top Traders Unite

✅ Accurate signals & exclusive analysis: 10–15 signals daily with continuous market insights

⏳ Every minute you hesitate is a winning opportunity slipping away!

t.me/+jqCSSdKGm7YyMGZl

✅ Accurate signals & exclusive analysis: 10–15 signals daily with continuous market insights

⏳ Every minute you hesitate is a winning opportunity slipping away!

t.me/+jqCSSdKGm7YyMGZl

Bài đăng liên quan

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.

🔥 BrianLionCapital – Where Top Traders Unite

✅ Accurate signals & exclusive analysis: 10–15 signals daily with continuous market insights

⏳ Every minute you hesitate is a winning opportunity slipping away!

t.me/+jqCSSdKGm7YyMGZl

✅ Accurate signals & exclusive analysis: 10–15 signals daily with continuous market insights

⏳ Every minute you hesitate is a winning opportunity slipping away!

t.me/+jqCSSdKGm7YyMGZl

Bài đăng liên quan

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.