Hello everyone,

If you’re struggling to combine Time (multi-timeframe analysis) and Structure (market framework) to build a solid foundation for predicting what’s likely to happen in the market, this post will reveal the secret many professionals use — with up to 80% win probability!

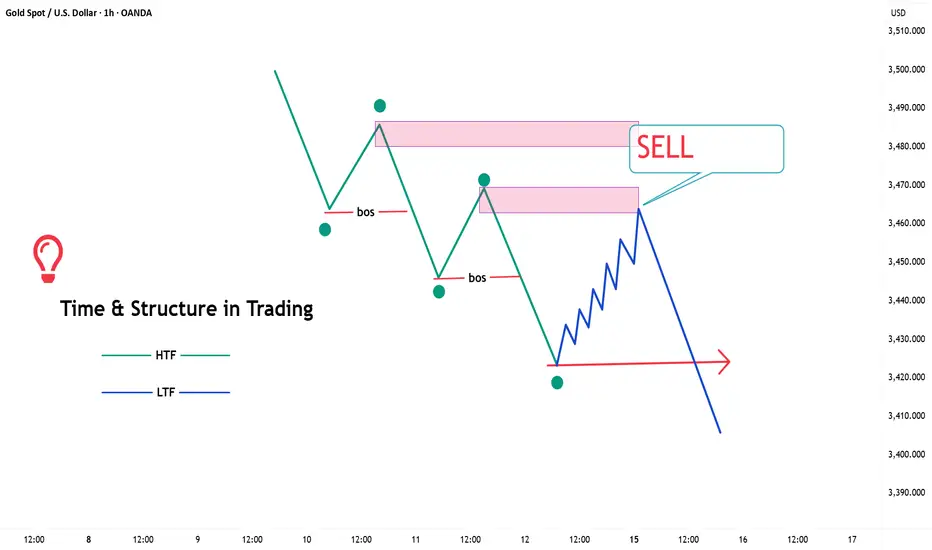

1. The Core Mindset – Time & Structure

Every timeframe speaks a different language:

- H4, D1 = the bigger picture (overall trend).

- M15, M5, M1 = the micro view (entry signals, internal flow).

The key is: never rely on one timeframe alone – always align them.

2. POI – Points of Interest

- Each timeframe has its own POI (Points of Interest).

- Example: When you find a POI on H4, don’t rush in.

Zoom into M15 or M5 to see what’s happening inside that zone.

3. Multi-Timeframe Alignment – The Smart Money Way

For example:

- H4: Price taps into a demand zone.

- M15: Structure shifts from bearish → bullish inside that demand zone.

This means H4 is preparing for a rally, and M15 confirms your BUY entry with higher precision.

When multiple timeframes align in the same direction, your probability skyrockets.

4. Why Always Respect the Bigger Picture?

- LTF (Lower Timeframe) = just noise or details.

- HTF (Higher Timeframe) = the real storyline.

If M15 shows a BUY but H4 is strongly bearish, you’re fighting the market.

But if M15 and H4 point the same way, you have a High Probability Setup.

5. Keys to High-Probability Trading

Identify the higher timeframe trend (H4, D1).

Mark strong POIs.

Drop to lower timeframes (M15, M5, M1) to watch for structure shifts.

Only trade when Time & Structure are aligned.

Always manage risk – place SL beyond OB/POI zones.

6. Final Takeaway

High-probability trades appear when multiple timeframes confirm the same direction.

Don’t trade on gut feeling — let Time + Structure guide you, just like Smart Money does.

If you’re struggling to combine Time (multi-timeframe analysis) and Structure (market framework) to build a solid foundation for predicting what’s likely to happen in the market, this post will reveal the secret many professionals use — with up to 80% win probability!

1. The Core Mindset – Time & Structure

Every timeframe speaks a different language:

- H4, D1 = the bigger picture (overall trend).

- M15, M5, M1 = the micro view (entry signals, internal flow).

The key is: never rely on one timeframe alone – always align them.

2. POI – Points of Interest

- Each timeframe has its own POI (Points of Interest).

- Example: When you find a POI on H4, don’t rush in.

Zoom into M15 or M5 to see what’s happening inside that zone.

3. Multi-Timeframe Alignment – The Smart Money Way

For example:

- H4: Price taps into a demand zone.

- M15: Structure shifts from bearish → bullish inside that demand zone.

This means H4 is preparing for a rally, and M15 confirms your BUY entry with higher precision.

When multiple timeframes align in the same direction, your probability skyrockets.

4. Why Always Respect the Bigger Picture?

- LTF (Lower Timeframe) = just noise or details.

- HTF (Higher Timeframe) = the real storyline.

If M15 shows a BUY but H4 is strongly bearish, you’re fighting the market.

But if M15 and H4 point the same way, you have a High Probability Setup.

5. Keys to High-Probability Trading

Identify the higher timeframe trend (H4, D1).

Mark strong POIs.

Drop to lower timeframes (M15, M5, M1) to watch for structure shifts.

Only trade when Time & Structure are aligned.

Always manage risk – place SL beyond OB/POI zones.

6. Final Takeaway

High-probability trades appear when multiple timeframes confirm the same direction.

Don’t trade on gut feeling — let Time + Structure guide you, just like Smart Money does.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.