This Trading Giant Who Called Bitcoin's 2025 Peak Just Made Another Bold 420% Price Prediction

Bitcoin price (BTC) continues its historic rally, setting a fresh all-time high at $126,200 on Monday before pulling back slightly to trade around $124,500 on Tuesday, October 7, 2025. The cryptocurrency has surged nearly $20,000 in just two weeks, yet Matthew Sigel from VanEck, who accurately predicted Bitcoin's 2025 peak, now suggests the digital asset could reach an "equivalent value" of $644,000 by the next halving in 2028.

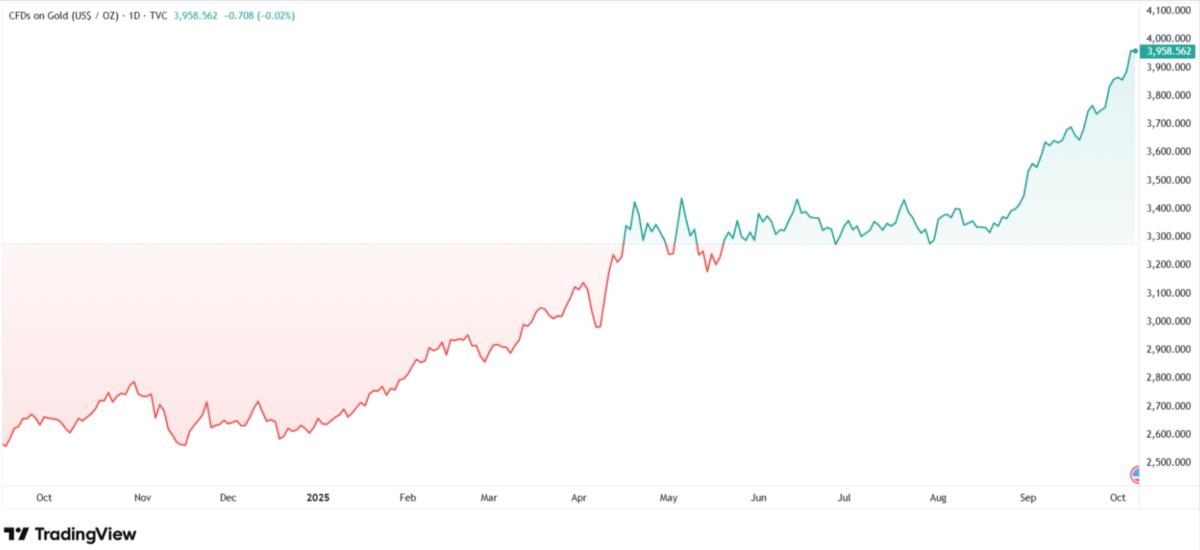

This bold prediction comes as gold prices hit record highs near $4,000 per ounce, creating a new benchmark for Bitcoin's potential market capitalization if it captures half of gold's store-of-value demand.

In this article, I am checking the current Bitcoin price today, analyzing the BTC/USDT technical chart and reviewing the most up to date BTC price forecasts.

Bitcoin Price Today Stays Under New All-Time High

Bitcoin's price action on Monday, October 6, 2025, saw the cryptocurrency break through previous resistance levels to establish a new all-time high at $126,200. This marked the fifth consecutive session of gains for the world's largest cryptocurrency by market capitalization.

As of today morning (Tuesday), Bitcoin trades at approximately $124,000, representing a modest 0.7% pullback from the peak. The cryptocurrency has demonstrated remarkable strength throughout October, gaining over 10% month-to-date and continuing the historical "Uptober" pattern of strong Q4 performance.

Bitcoin price today. Source: Tradingview.com

Year-over-year gains remain spectacular, with Bitcoin appreciating 100% from $62,000 twelve months ago. This doubling in value reflects the profound transformation in institutional adoption and regulatory clarity that has characterized 2025's market cycle.

“As was widely expected in Q4, a new all-time-high (ATH) was set for BTC, buoyed by the prospect of US stimulus, seeing prices rally 10% the past 9 days," Paul Howard, the Director at Wincent, commented for FinanceMagnates.com.

VanEck's $644K Bitcoin Price Prediction Explained

Matthew Sigel, head of digital assets research at VanEck, unveiled his latest Bitcoin forecast on Monday, tying it directly to gold's historic rally. His thesis centers on a generational shift in store-of-value preferences among younger investors, particularly in emerging markets.

"We've been saying Bitcoin should reach half of gold's market cap after the next halving," Sigel explained in his X post. "Roughly half of gold's value reflects its use as a store of value rather than industrial or jewelry demand, and surveys show younger consumers in emerging markets increasingly prefer Bitcoin for that role".

matthew sigel, recovering CFA@matthew_sigelTháng 10 07, 2025We’ve been saying Bitcoin should reach half of gold’s market cap after the next halving. Roughly half of gold’s value reflects its use as a store of value rather than industrial or jewelry demand, and surveys show younger consumers in emerging markets increasingly prefer Bitcoin…

At today's record gold price of approximately $3,960 per ounce, this implies an equivalent value of $644,000 per BTC by the 2028 halving. This represents a potential gain of 420% from current price levels, making it one of the most bullish institutional forecasts in the cryptocurrency space.

Gold price today. Source: Tradingview.com

VanEck's Track Record on Bitcoin Predictions

VanEck has demonstrated remarkable accuracy in forecasting Bitcoin's price movements throughout 2025. The firm correctly predicted that Bitcoin would establish new all-time highs during the year and has consistently maintained its $180,000 year-end target even as the market experienced volatility.

In their Mid-August 2025 Bitcoin ChainCheck report, VanEck analysts stated: "As autumn approaches, several intertwined risks and opportunities emerge. Still, we stick with our $180K BTC price target by year-end". This prediction remains in play as Bitcoin trades at $124,000, requiring only a 45% increase to reach the target with nearly three months remaining in 2025.

Bitcoin Price Technical Analysis

My Technical Analysis: Caution Despite Bullish Setup

Bitcoin's price has been rising for the fifth consecutive session, with Monday establishing a new all-time high at $126,200. Although the cryptocurrency is correcting by 0.7% on Tuesday, it still maintains very high levels at $123,800.

Based on my technical analysis, the previous peaks from July and August continue to play the role of significant resistance, which is difficult to break through and enter a full-fledged phase of price discovery in previously unexplored areas of the chart.

While I personally believe that Bitcoin will continue to rise in the medium and long term, after the recent strengthening of nearly $20,000 over the course of 2 weeks, I would not rule out some profit-taking from current levels. Such a scenario could close the price, for example, around the $112,000 level, which is the historical ATH from May of this year.

My technical analysis of the Bitcoin chart. Source: Tradingview.com

Wincent's Howard agree with my view, stating: "With trading volume falling sharply again and a number of large unlocks happening this week, we can expect a pullback next rather than a much quoted 'parabolic' ascension."

Key Technical Levels for Bitcoin

Current technical analysis reveals several critical price zones that traders are monitoring closely:

Support Levels:

- $123,000(immediate support, 24-hour low)

- $118,000 (previousconsolidation zone from late September)

- $112,000 (psychological roundnumber and May 2025 peak)

Resistance Levels:

- $126,200 (current all-time highestablished October 6)

- $130,000 (projected breakouttarget based on bull flag pattern)

- $135,000(Q3 2025 analyst target zone)

The recent price action has pushed Bitcoin's 30-day volatility to just 3.06%, one of the lowest readings in years, suggesting that institutional participation has matured the market significantly.

Bull Flag Pattern Signals Potential Breakout

Bitcoin appears to be forming a classic bull flag continuation pattern on the daily chart, similar to the setup observed in my previous analysis from June 2025.

The flagpole was established during the surge from $100,000 to $126,200, while the current consolidation would form the flag component if prices stabilize in the $120,000-$125,000 range. A confirmed breakout above $128,000 could propel Bitcoin toward the $135,000-$140,000 zone by late Q4 2025.

On-balance volume (OBV) indicators continue showing accumulation despite sideways price action, mirroring the pattern seen before Bitcoin's previous rally from $76,000 to $112,000 earlier in 2025. This hidden institutional buying suggests that smart money remains bullish on Bitcoin's medium-term prospects.

Why Bitcoin Is Surging?

Gold Rally Supports Bitcoin's Bullish Case

Gold's surge to nearly $4,000 per ounce has created a compelling framework for understanding Bitcoin's potential upside. The precious metal has gained 50% year-to-date, outperforming Bitcoin's gains during the same period as investors sought safe-haven assets amid economic uncertainty.

However, the demographic divide in store-of-value preferences reveals Bitcoin's structural advantage. Younger investors in emerging markets increasingly view Bitcoin as their preferred wealth preservation vehicle, while older generations remain anchored to gold.

Key Drivers Behind Bitcoin’s 2025–2026 Momentum

- Generational Wealth TransferFavors Bitcoin– As baby boomers pass trillions to younger, tech-savvy heirs, a largershare of inherited wealth is expected to move into Bitcoin instead ofgold.

- Massive Upside Compared to Gold – With gold’s $10 trillionstore-of-value market and Bitcoin’s $2.4 trillion cap, even partialsubstitution could push Bitcoin toward VanEck’s $644,000 target by 2028.

- Institutional AdoptionAccelerates –Nearly 60% of institutional investors now hold at least 10% of theirportfolios in digital assets, showing a clear shift from speculative tostrategic allocation.

- Strong Spot Bitcoin ETF Inflows – ETFs like BlackRock’siShares Bitcoin Trust continue attracting significant capital, addingbillions in inflows and providing crucial price stability.

- Corporate Treasuries EmbraceBitcoin –Firms now hold around $135 billion in Bitcoin, led by younger techcompanies using it as a treasury reserve asset.

- Regulatory Clarity BoostsConfidence –The SEC’s softer stance and passage of the GENIUS Act have created aclearer, more predictable environment for institutional investors.

- Potential for State and FederalBitcoin Reserves– VanEck expects the U.S. could treat Bitcoin as a strategic asset,strengthening its institutional legitimacy.

- Macro Tailwinds Support Growth – Rate cut expectations,dollar weakness, and inflation fears are driving renewed demand forBitcoin as a hedge and liquidity beneficiary.

- Federal Reserve Rate CutsExpected –Markets anticipate rate reductions in late 2025, lowering the cost ofholding Bitcoin and increasing capital inflows.

- Inflation and Dollar DebasementConcerns –High government debt and declining fiat value make Bitcoin’s fixed 21million supply increasingly attractive as a long-term store of value.

Bitcoin Price Predictions for Late 2025 and Beyond

Multiple scenarios exist for Bitcoin's price trajectory through the remainder of 2025 and into subsequent years, depending on the interplay of technical, fundamental, and macroeconomic factors.

Short-Term Outlook: $180K by Year-End 2025

VanEck maintains its prediction that Bitcoin will reach approximately $180,000 by the end of 2025, requiring a 45% increase from current levels. This target assumes continued ETF inflows, institutional adoption, and favorable macroeconomic conditions through Q4 2025.

For the target to be achieved, Bitcoin would need to break through the current resistance zone at $126,000-$128,000 and establish $135,000-$140,000 as a consolidation range by November. The historical pattern of Q4 strength ("Uptober" and year-end rallies) supports this bullish scenario.

"At Wincent we have seen a pickup in OTC volumes lately where counterparties can take these positions onto book rather than dumping in the market. If that continues then we can expect less volatility and further price ascension in the coming weeks and surely at least one more ATH reached before the end of the year for BTC," Howard explained for FinanceMagnates.com

Medium-Term: $200K-$300K by 2026

Following the typical post-halving cycle pattern, Bitcoin could establish new all-time highs in the $200,000-$300,000 range during 2026, approximately 12-18 months after the April 2024 halving event. VanEck's analysis suggests this timeline aligns with historical precedent from previous cycles.

The firm noted in September 2025 that Bitcoin's traditional four-year cycle remains relevant, though institutional participation may dampen extreme volatility compared to previous bull markets. A more measured appreciation would reflect the asset's maturation while still delivering substantial returns.

Long-Term: $644K by 2028 Halving

VanEck's most recent prediction targets $644,000 per Bitcoin by the next halving event scheduled for 2028. This forecast assumes Bitcoin captures approximately 50% of gold's store-of-value market capitalization as generational wealth transfer accelerates and younger investors increasingly prefer digital assets.

Even more bullish long-term scenarios exist. VanEck's 2050 analysis suggests Bitcoin could reach $2.9 million if adopted for 10% of global trade settlement and 5% of domestic transactions, with central banks holding approximately 2% of reserves in the cryptocurrency.

It is also worth noting the forecast from Mike Novogratz, who also accurately predicted Bitcoin’s rally in 2025. According to him, the cryptocurrency could ultimately reach a level of $1 million.

Bitcoin Price Predictions Table

TimeHorizon | PredictedPrice Range | KeyDrivers |

Short-Term(Q4 2025) | $180,000 | - Continued ETF inflows- Institutional adoption- Supportive macro conditions (rate cuts, liquidity)- Seasonal Q4 strength ("Uptober" rally) |

Medium-Term(2026) | $200,000 –$300,000 | - Post-halving cycle momentum- Historical 12–18 month lag after halving- Reduced volatility due to institutional presence |

Long-Term(2028 Halving) | $644,000 | - Capturing 50% of gold’sstore-of-value market- Accelerating generational wealth transfer- Broader institutional and sovereign adoption |

VeryLong-Term (2050 Scenario) | $2.9million | - Use in 10% of global tradesettlement- 5% of domestic transactions in BTC- 2% of central bank reserves held in Bitcoin |

You may also like my other articles with Bitcoin and crypto price predictions:

Comparative Analysis: Bitcoin vs. Gold Performance

The relationship between Bitcoin and gold has evolved significantly in 2025, with both assets reaching record highs but gold temporarily outperforming the cryptocurrency on a percentage basis.

Year-to-Date Performance (2025):

- Gold:+50% (from $2,640 to $3,960)

- Bitcoin:+100% (from $62,000 to $124,000)

Bitcoin is giving investors way higher ROI than gold. Source: Tradingview.com

Despite Bitcoin's superior annual performance, gold skeptic Peter Schiff noted that Bitcoin remains approximately 15% below its record high when priced in gold terms. Bitcoin would need to reach about $148,000 to match its record high in gold-adjusted terms, according to Schiff's calculation.

However, Bitcoin advocate Joe Consorti from custodian Theya countered that Bitcoin's "fair value floor has been lifted to $1.34 million" with gold's rise, suggesting the cryptocurrency remains dramatically undervalued relative to its potential.

Key Risks and Bearish Scenarios

Despite overwhelmingly bullish technical and fundamental indicators, several risks could derail Bitcoin's ascent toward VanEck's ambitious targets.

Profit-Taking After Rapid Gains

As noted in my technical analysis, Bitcoin's $20,000 surge in just two weeks creates conditions for significant profit-taking. A correction to the $112,000-$115,000 range (May 2025 all-time high) would represent healthy consolidation rather than trend reversal, but could trigger cascading stop-losses if support fails.

Short-term bearish scenarios include breakdown below $120,000, which could extend losses toward $110,000 or even test the $100,000 psychological support zone if ETF flows reverse or macroeconomic data surprises negatively.

Regulatory and Geopolitical Risks

Upcoming trade war deadlines, including EU retaliatory tariffs on July 14 and expiration of China tariff pauses on August 12, could drive episodic volatility in risk assets including Bitcoin. These geopolitical developments remain unpredictable wildcards that could temporarily disrupt bullish momentum.

Additionally, regulatory shifts, while currently favorable, could reverse if political winds change or if major security breaches undermine confidence in cryptocurrency infrastructure.

Bitcoin News FAQ

What is the biggest problem with Bitcoin?

Bitcoin's biggest problem is scalability and transaction costs. Processing transactions takes approximately 10 minutes with median fees around $20, making it cumbersome for everyday use. Additionally, price volatility undermines its viability as a medium of exchange, and security vulnerabilities persist, with over $2.17 billion stolen from cryptocurrency services in H1 2025 alone.

What is the biggest risk to Bitcoin?

The biggest risks include regulatory uncertainty, quantum computing threats to cryptographic security, and custodial failures that could undermine institutional trust. Security breaches remain significant, with 2025 on track to exceed $4 billion in stolen funds. Additionally, mining centralization and potential government crackdowns pose long-term threats to Bitcoin's decentralized nature.

What if I invested $1,000 in Bitcoin 5 years ago?

A $1,000 investment in Bitcoin five years ago (October 2020, when BTC traded around $11,000) would be worth approximately $11,318 today at current prices of $124,500. This represents a 1,032% return, demonstrating Bitcoin's exceptional performance despite volatility over the past half-decade.

Who controls Bitcoin?

Nobody controls Bitcoin. It operates as a decentralized network maintained by thousands of nodes worldwide. The protocol is governed by consensus among miners, developers, and users, with no central authority able to unilaterally change the rules. The "social layer" of Bitcoin users ultimately determines protocol changes through community consensus, as demonstrated during the 2017 block size debate.