OPEN-SOURCE SCRIPT

Cập nhật X Trade Plan [asset]

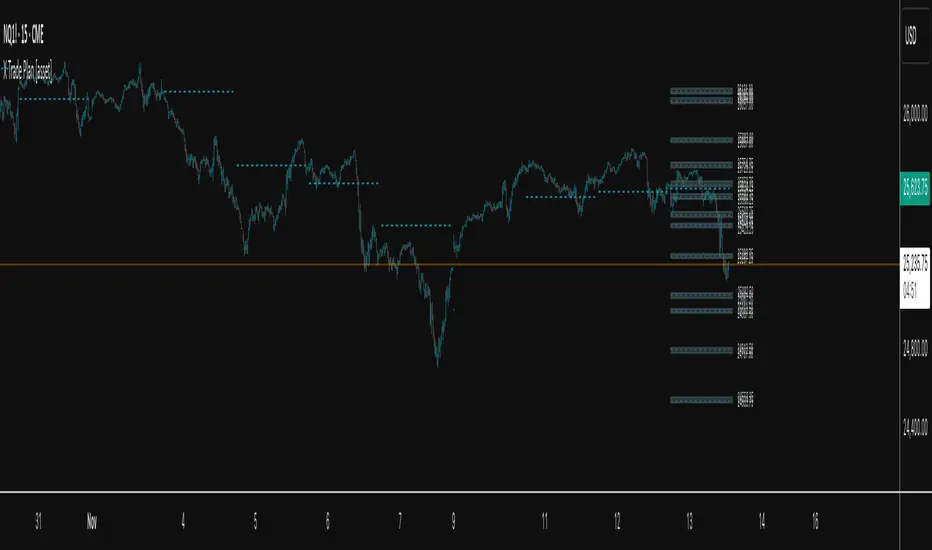

A precision-structured execution framework designed to identify, map, and visualize targeted areas of interest derived from prior end-of-day AVWAP levels. These areas represent historically important zones where order flow has previously rotated, absorbed, or redistributed—making them highly relevant for future intraday decision-making.

This tool is intended to work in direct combination with the X Tail that Wags indicator, which calculates and projects the previous session’s ending AVWAP forward into the next trading day. The projected end-of-day AVWAP levels serve as a backbone for this Trade Plan: each level is wrapped, extended, and visually organized into a standardized zone structure that the trader can interpret quickly and consistently.

Purpose and Core Concept

Markets consistently respond to prior session value. The end-of-day AVWAP reflects the final consensus price where volume and time-weighted participation reached equilibrium before the session closed. When carried forward, these levels often act as real-world:

Reversion points

Liquidity pockets

Control centers

Continuation or rejection pivots

Absorption shelves and distribution tops

By framing these AVWAP-derived levels into controlled ranges—each with a slight configurable margin—the indicator transforms abstract numbers into objective, visually actionable trading zones.

How This Indicator Works

The user inputs up to fifteen prior AVWAP levels that came from X Tail that Wags’ “Previous End-of-Day AVWAP” readouts. For each active level, X Trade Plan automatically:

Builds a structured zone around the AVWAP using a user-defined ± margin

Draws a filled box from the anchor bar forward a customizable distance

Adds optional top/bottom price labels for precision

Optionally draws a mid-line representing the core of the zone

Displays custom text labels for classification, notes, or tiering

Refreshes anchor points at user-selected higher-timeframe boundaries (e.g., Daily) so zones “reset cleanly” at each new session

Everything is designed to ensure consistent, non-overlapping, visually efficient zones that maintain chart clarity even when multiple levels are active.

Intended Use in a Trade Plan

This indicator is not a signal generator.

It is a structural mapping tool designed for traders who build a daily plan around:

1. Prior Value → Future Reaction

Price commonly retests, respects, or rejects previous session AVWAP levels. These zones act as tactical reference points to evaluate:

Whether price is accepting value

Rejecting value

Targeting inefficiencies

Passing through low-resistance channels

2. Defining Areas of Interest (AOIs)

Each zone identifies where:

Positioning from previous sessions may still exist

Liquidity may sit

Algorithmic systems often pivot

High-volume traders previously accumulated or distributed

3. Enhancing Bias and Scenario Planning

When used with X Tail that Wags, traders can combine:

Current session AVWAP direction

Prior session ending AVWAP levels

The constructed Trade Plan zones

to produce:

Meaningful upside/downside targets

Control-center ranges

Lean / location for entries

Expected reaction points

This synergy turns raw historical AVWAP data into actionable structure.

Why These Levels Matter

End-of-day AVWAP levels are powerful because they encapsulate:

The final “fair value” of the prior session

Where the most volume-weighted agreement occurred

Where institutional inventory was likely set or hedged

The price many algos and funds benchmark against

When the next session opens, these prior value levels serve as magnets and decision boundaries, helping traders anticipate:

High-probability pullback zones

Reversals off previous value

Break-and-go continuation levels

Failure points where trapped participants are forced to exit

Summary

X Trade Plan

𝑎

𝑠

𝑠

𝑒

𝑡

asset transforms prior AVWAP levels—sourced from X Tail that Wags—into a structured visual map of the market’s most relevant historical value areas. These zones are used to shape a deliberate, rules-based Trade Plan that identifies where the market is likely to react, pause, rotate, or accelerate during the current session.

When paired with X Tail that Wags, this indicator provides a powerful, integrated workflow for traders who rely on value-based context, precise levels, and scenario-driven preparation.

This tool is intended to work in direct combination with the X Tail that Wags indicator, which calculates and projects the previous session’s ending AVWAP forward into the next trading day. The projected end-of-day AVWAP levels serve as a backbone for this Trade Plan: each level is wrapped, extended, and visually organized into a standardized zone structure that the trader can interpret quickly and consistently.

Purpose and Core Concept

Markets consistently respond to prior session value. The end-of-day AVWAP reflects the final consensus price where volume and time-weighted participation reached equilibrium before the session closed. When carried forward, these levels often act as real-world:

Reversion points

Liquidity pockets

Control centers

Continuation or rejection pivots

Absorption shelves and distribution tops

By framing these AVWAP-derived levels into controlled ranges—each with a slight configurable margin—the indicator transforms abstract numbers into objective, visually actionable trading zones.

How This Indicator Works

The user inputs up to fifteen prior AVWAP levels that came from X Tail that Wags’ “Previous End-of-Day AVWAP” readouts. For each active level, X Trade Plan automatically:

Builds a structured zone around the AVWAP using a user-defined ± margin

Draws a filled box from the anchor bar forward a customizable distance

Adds optional top/bottom price labels for precision

Optionally draws a mid-line representing the core of the zone

Displays custom text labels for classification, notes, or tiering

Refreshes anchor points at user-selected higher-timeframe boundaries (e.g., Daily) so zones “reset cleanly” at each new session

Everything is designed to ensure consistent, non-overlapping, visually efficient zones that maintain chart clarity even when multiple levels are active.

Intended Use in a Trade Plan

This indicator is not a signal generator.

It is a structural mapping tool designed for traders who build a daily plan around:

1. Prior Value → Future Reaction

Price commonly retests, respects, or rejects previous session AVWAP levels. These zones act as tactical reference points to evaluate:

Whether price is accepting value

Rejecting value

Targeting inefficiencies

Passing through low-resistance channels

2. Defining Areas of Interest (AOIs)

Each zone identifies where:

Positioning from previous sessions may still exist

Liquidity may sit

Algorithmic systems often pivot

High-volume traders previously accumulated or distributed

3. Enhancing Bias and Scenario Planning

When used with X Tail that Wags, traders can combine:

Current session AVWAP direction

Prior session ending AVWAP levels

The constructed Trade Plan zones

to produce:

Meaningful upside/downside targets

Control-center ranges

Lean / location for entries

Expected reaction points

This synergy turns raw historical AVWAP data into actionable structure.

Why These Levels Matter

End-of-day AVWAP levels are powerful because they encapsulate:

The final “fair value” of the prior session

Where the most volume-weighted agreement occurred

Where institutional inventory was likely set or hedged

The price many algos and funds benchmark against

When the next session opens, these prior value levels serve as magnets and decision boundaries, helping traders anticipate:

High-probability pullback zones

Reversals off previous value

Break-and-go continuation levels

Failure points where trapped participants are forced to exit

Summary

X Trade Plan

𝑎

𝑠

𝑠

𝑒

𝑡

asset transforms prior AVWAP levels—sourced from X Tail that Wags—into a structured visual map of the market’s most relevant historical value areas. These zones are used to shape a deliberate, rules-based Trade Plan that identifies where the market is likely to react, pause, rotate, or accelerate during the current session.

When paired with X Tail that Wags, this indicator provides a powerful, integrated workflow for traders who rely on value-based context, precise levels, and scenario-driven preparation.

Phát hành các Ghi chú

updated to include the historical daily VWAPS to make it easier to create levels in one indicatorPhát hành các Ghi chú

added toggle to show check with the actual daily avwap Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.