OPEN-SOURCE SCRIPT

Open Interest liquidation map [Ox_kali]

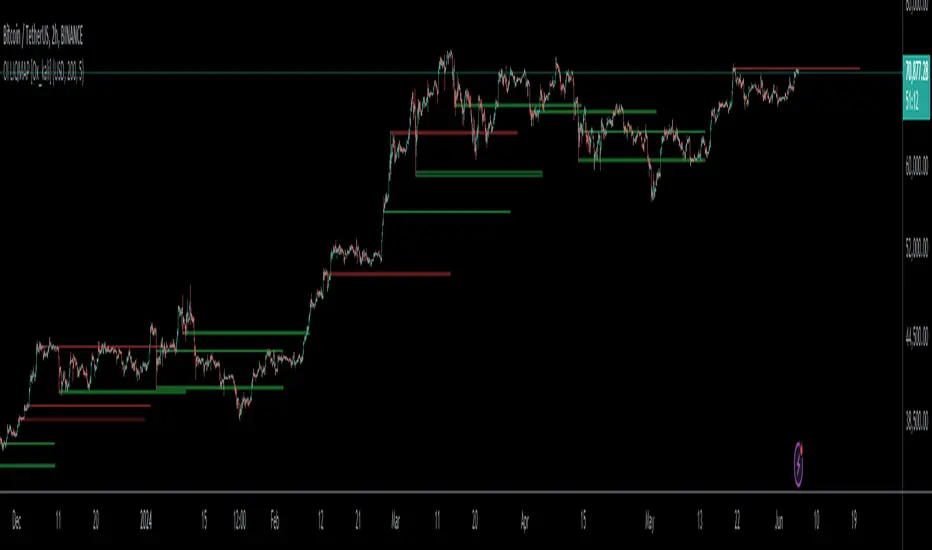

This script is inspired by LeviathanCapital work on aggregating Open Interest, as presented in the Open Interest Suite Aggregated script. This script aims to provide a liquidation map of Open Interest by identifying significant anomalies across multiple trading platforms. By integrating data from Binance, BitMEX, and Kraken, this script tries to offer a comprehensive and detailed view of Open Interest movements and attempts to define zones of interest.

Key Points

1. Multiple Data Sources: The script retrieves Open Interest data from several trading platforms, including Binance (USDT, USD, BUSD), BitMEX (USD, USDT), and Kraken (USD).

2. Anomaly Detection: Utilizes a simple moving average (SMA) to calculate the average size of Open Interest candles and identify anomalies based on a user-specified size factor.

3. Background Coloring: Offers an option to color the background of the charts based on detected anomalies, allowing for clear visualization of significant movements.

4. Dynamic Support and Resistance Zones: Defines and dynamically updates support and resistance zones based on Open Interest anomalies.

5. Alerts: Configures alerts to notify the user when an Open Interest anomaly is detected.

Trading Utility

This script can be useful for monitoring significant changes in Open Interest and potential liquidation zones across multiple platforms. The main trading applications include:

1. Identifying Liquidation Points: By detecting Open Interest anomalies, it is possible to identify potential liquidation points where significant price movements might occur.

2. Multi-Platform Analysis: By aggregating Open Interest data from multiple platforms, a more comprehensive market overview is obtained.

3. Detecting Support and Resistance Zones: Dynamic support and resistance zones help identify key price levels where trend reversals might occur.

4. Customized Alerts: Anomaly alerts allow for automated responses to market changes.

Conclusion

The “Open Interest liquidation map [Ox_kali]” script is an experimental tool for analyzing Open Interest across multiple trading platforms. Inspired by Leviathan’s work, this script attempts to identify liquidation and interest zones. This is an experimental version, and I welcome any comments and feedback for improvement.

Please note that the Open Interest liquidation map [Ox_kali] is not a guarantee of future market performance and should be used in conjunction with proper risk management. Always ensure that you have a thorough understanding of the indicator’s methodology and its limitations before making any investment decisions. Additionally, past performance is not indicative of future results.

Key Points

1. Multiple Data Sources: The script retrieves Open Interest data from several trading platforms, including Binance (USDT, USD, BUSD), BitMEX (USD, USDT), and Kraken (USD).

2. Anomaly Detection: Utilizes a simple moving average (SMA) to calculate the average size of Open Interest candles and identify anomalies based on a user-specified size factor.

3. Background Coloring: Offers an option to color the background of the charts based on detected anomalies, allowing for clear visualization of significant movements.

4. Dynamic Support and Resistance Zones: Defines and dynamically updates support and resistance zones based on Open Interest anomalies.

5. Alerts: Configures alerts to notify the user when an Open Interest anomaly is detected.

Trading Utility

This script can be useful for monitoring significant changes in Open Interest and potential liquidation zones across multiple platforms. The main trading applications include:

1. Identifying Liquidation Points: By detecting Open Interest anomalies, it is possible to identify potential liquidation points where significant price movements might occur.

2. Multi-Platform Analysis: By aggregating Open Interest data from multiple platforms, a more comprehensive market overview is obtained.

3. Detecting Support and Resistance Zones: Dynamic support and resistance zones help identify key price levels where trend reversals might occur.

4. Customized Alerts: Anomaly alerts allow for automated responses to market changes.

Conclusion

The “Open Interest liquidation map [Ox_kali]” script is an experimental tool for analyzing Open Interest across multiple trading platforms. Inspired by Leviathan’s work, this script attempts to identify liquidation and interest zones. This is an experimental version, and I welcome any comments and feedback for improvement.

Please note that the Open Interest liquidation map [Ox_kali] is not a guarantee of future market performance and should be used in conjunction with proper risk management. Always ensure that you have a thorough understanding of the indicator’s methodology and its limitations before making any investment decisions. Additionally, past performance is not indicative of future results.

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.