OPEN-SOURCE SCRIPT

Triple HMA Bands (1.2 / 1.4 / 1.6)

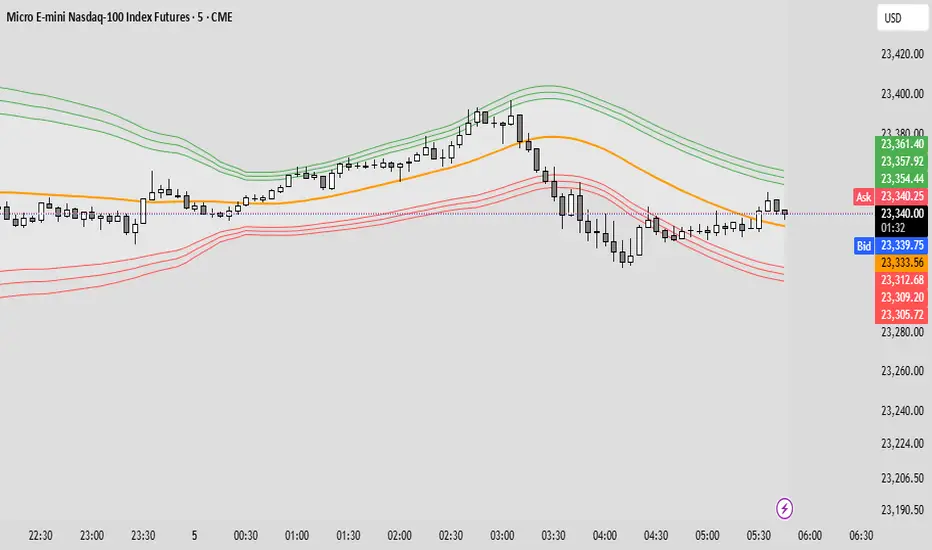

📈 Triple HMA Bands — Custom Volatility & Trend Indicator

Description:

The Triple HMA Bands indicator combines the Hull Moving Average (HMA) with volatility-based envelopes, similar to Bollinger Bands, to visualize trend direction and market extremes.

The HMA (length 90) serves as the central trend line, offering a smooth and responsive view of market direction.

Surrounding the HMA are three dynamic bands calculated using standard deviations of price:

Inner Band (1.2σ) — normal volatility range.

Middle Band (1.4σ) — elevated volatility zone.

Outer Band (1.6σ) — statistically extreme price movement.

The shaded zones between the bands help visualize volatility expansion and contraction, making it easier to identify:

Trend strength and stability

Potential reversal zones

Breakout or breakdown events

How to Use:

Price staying within the inner band may indicate a stable trend or consolidation.

Price reaching or exceeding the outer band suggests overbought/oversold conditions and potential reversal.

Widening bands = rising volatility; narrowing bands = low volatility, often before a breakout.

This indicator is ideal for trend traders, mean reversion strategies, or anyone wanting a volatility-sensitive trend filter.

Description:

The Triple HMA Bands indicator combines the Hull Moving Average (HMA) with volatility-based envelopes, similar to Bollinger Bands, to visualize trend direction and market extremes.

The HMA (length 90) serves as the central trend line, offering a smooth and responsive view of market direction.

Surrounding the HMA are three dynamic bands calculated using standard deviations of price:

Inner Band (1.2σ) — normal volatility range.

Middle Band (1.4σ) — elevated volatility zone.

Outer Band (1.6σ) — statistically extreme price movement.

The shaded zones between the bands help visualize volatility expansion and contraction, making it easier to identify:

Trend strength and stability

Potential reversal zones

Breakout or breakdown events

How to Use:

Price staying within the inner band may indicate a stable trend or consolidation.

Price reaching or exceeding the outer band suggests overbought/oversold conditions and potential reversal.

Widening bands = rising volatility; narrowing bands = low volatility, often before a breakout.

This indicator is ideal for trend traders, mean reversion strategies, or anyone wanting a volatility-sensitive trend filter.

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.