PINE LIBRARY

Cập nhật lib_divergence

Library "lib_divergence"

offers a commonly usable function to detect divergences. This will take the default RSI or other symbols / indicators / oscillators as source data.

divergence(osc, pivot_left_bars, pivot_right_bars, div_min_range, div_max_range, ref_low, ref_high, min_divergence_offset_fraction, min_divergence_offset_dev_len, min_divergence_offset_atr_mul)

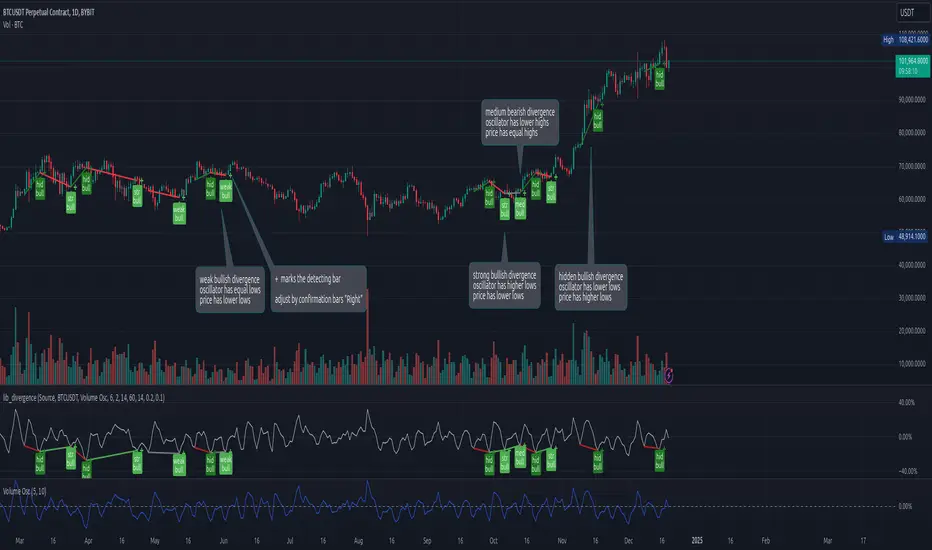

Detects Divergences between Price and Oscillator action. For bullish divergences, look at trend lines between lows. For bearish divergences, look at trend lines between highs. (strong) oscillator trending, price opposing it | (medium) oscillator trending, price trend flat | (weak) price opposite trending, oscillator trend flat | (hidden) price trending, oscillator opposing it. Pivot detection is only properly done in oscillator data, reference price data is only compared at the oscillator pivot (speed optimization)

Parameters:

osc (float): (series float) oscillator data (can be anything, even another instrument price)

pivot_left_bars (simple int): (simple int) optional number of bars left of a confirmed pivot point, confirming it is the highest/lowest in the range before and up to the pivot (default: 5)

pivot_right_bars (simple int): (simple int) optional number of bars right of a confirmed pivot point, confirming it is the highest/lowest in the range from and after the pivot (default: 5)

div_min_range (simple int): (simple int) optional minimum distance to the pivot point creating a divergence (default: 5)

div_max_range (simple int): (simple int) optional maximum amount of bars in a divergence (default: 50)

ref_low (float): (series float) optional reference range to compare the oscillator pivot points to. (default: low)

ref_high (float): (series float) optional reference range to compare the oscillator pivot points to. (default: high)

min_divergence_offset_fraction (simple float): (simple float) optional scaling factor for the offset zone (xDeviation) around the last oscillator H/L detecting following equal H/Ls (default: 0.01)

min_divergence_offset_dev_len (simple int): (simple int) optional lookback distance for the deviation detection for the offset zone around the last oscillator H/L detecting following equal H/Ls. Used as well for the ATR that does the equal H/L detection for the reference price. (default: 14)

min_divergence_offset_atr_mul (simple float): (simple float) optional scaling factor for the offset zone (xATR) around the last price H/L detecting following equal H/Ls (default: 1)

return A tuple of deviation flags. [strong_bull, strong_bear, medium_bull, medium_bear, weak_bull, weak_bear, hidden_bull, hidden_bear, pivot_h, pivot_l]

offers a commonly usable function to detect divergences. This will take the default RSI or other symbols / indicators / oscillators as source data.

divergence(osc, pivot_left_bars, pivot_right_bars, div_min_range, div_max_range, ref_low, ref_high, min_divergence_offset_fraction, min_divergence_offset_dev_len, min_divergence_offset_atr_mul)

Detects Divergences between Price and Oscillator action. For bullish divergences, look at trend lines between lows. For bearish divergences, look at trend lines between highs. (strong) oscillator trending, price opposing it | (medium) oscillator trending, price trend flat | (weak) price opposite trending, oscillator trend flat | (hidden) price trending, oscillator opposing it. Pivot detection is only properly done in oscillator data, reference price data is only compared at the oscillator pivot (speed optimization)

Parameters:

osc (float): (series float) oscillator data (can be anything, even another instrument price)

pivot_left_bars (simple int): (simple int) optional number of bars left of a confirmed pivot point, confirming it is the highest/lowest in the range before and up to the pivot (default: 5)

pivot_right_bars (simple int): (simple int) optional number of bars right of a confirmed pivot point, confirming it is the highest/lowest in the range from and after the pivot (default: 5)

div_min_range (simple int): (simple int) optional minimum distance to the pivot point creating a divergence (default: 5)

div_max_range (simple int): (simple int) optional maximum amount of bars in a divergence (default: 50)

ref_low (float): (series float) optional reference range to compare the oscillator pivot points to. (default: low)

ref_high (float): (series float) optional reference range to compare the oscillator pivot points to. (default: high)

min_divergence_offset_fraction (simple float): (simple float) optional scaling factor for the offset zone (xDeviation) around the last oscillator H/L detecting following equal H/Ls (default: 0.01)

min_divergence_offset_dev_len (simple int): (simple int) optional lookback distance for the deviation detection for the offset zone around the last oscillator H/L detecting following equal H/Ls. Used as well for the ATR that does the equal H/L detection for the reference price. (default: 14)

min_divergence_offset_atr_mul (simple float): (simple float) optional scaling factor for the offset zone (xATR) around the last price H/L detecting following equal H/Ls (default: 1)

return A tuple of deviation flags. [strong_bull, strong_bear, medium_bull, medium_bear, weak_bull, weak_bear, hidden_bull, hidden_bear, pivot_h, pivot_l]

Phát hành các Ghi chú

v2 improved performance, fixed bug in 'weak bear' detection, improved naming and comments for function parametersUpdated:

divergence(osc, pivot_confirmation_bars_left, pivot_confirmation_bars_right, pivot_min_x_distance, pivot_max_x_distance, ref_low, ref_high, pivot_min_y_distance_len, pivot_min_y_distance_dev_mult, pivot_min_y_distance_atr_mult)

Detects Divergences between Price and Oscillator action. For bullish divergences, look at trend lines between lows. For bearish divergences, look at trend lines between highs. (strong) oscillator trending, price opposing it | (medium) oscillator trending, price trend flat | (weak) price opposite trending, oscillator trend flat | (hidden) price trending, oscillator opposing it. Pivot detection is only properly done in oscillator data, reference price data is only compared at the oscillator pivot (speed optimization)

Parameters:

osc (float): (series float) oscillator data (can be anything, even another instrument price)

pivot_confirmation_bars_left (simple int): (simple int) optional number of bars left of a confirmed pivot point, confirming it is the highest/lowest in the range before and up to the pivot (default: 5)

pivot_confirmation_bars_right (simple int): (simple int) optional number of bars right of a confirmed pivot point, confirming it is the highest/lowest in the range from and after the pivot (default: 3)

pivot_min_x_distance (simple int): (simple int) optional minimum distance between pivot points considered for a divergence (should not be bigger than pivot_leftbars) (default: 5)

pivot_max_x_distance (simple int): (simple int) optional maximum distance between pivot points considered for a divergence (should not be bigger than pivot_leftbars) (default: 50)

ref_low (float): (series float) optional reference range to compare the oscillator pivot points to. (default: low)

ref_high (float): (series float) optional reference range to compare the oscillator pivot points to. (default: high)

pivot_min_y_distance_len (simple int): (simple int) optional lookback distance for the deviation detection for the offset zone around the last oscillator H/L when detecting following equal H/Ls. Used as well for the ATR that does the equal H/L detection for the reference price. (default: 14)

pivot_min_y_distance_dev_mult (simple float): (simple float) optional scaling factor for the offset zone (xDeviation) around the last oscillator H/L when detecting following equal H/Ls (default: 0.1)

pivot_min_y_distance_atr_mult (simple float): (simple float) optional scaling factor for the offset zone (xATR) around the last price H/L when detecting following equal H/Ls (default: 0.1)

return A tuple of deviation flags. [strong_bull, strong_bear, medium_bull, medium_bear, weak_bull, weak_bear, hidden_bull, hidden_bear, osc_pivot_h, osc_pivot_l]

Thư viện Pine

Theo đúng tinh thần TradingView, tác giả đã công bố mã Pine này như một thư viện mã nguồn mở để các lập trình viên Pine khác trong cộng đồng có thể tái sử dụng. Chúc mừng tác giả! Bạn có thể sử dụng thư viện này cho mục đích cá nhân hoặc trong các ấn phẩm mã nguồn mở khác, nhưng việc tái sử dụng mã này trong các ấn phẩm phải tuân theo Nội Quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Thư viện Pine

Theo đúng tinh thần TradingView, tác giả đã công bố mã Pine này như một thư viện mã nguồn mở để các lập trình viên Pine khác trong cộng đồng có thể tái sử dụng. Chúc mừng tác giả! Bạn có thể sử dụng thư viện này cho mục đích cá nhân hoặc trong các ấn phẩm mã nguồn mở khác, nhưng việc tái sử dụng mã này trong các ấn phẩm phải tuân theo Nội Quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.