AIO+TX by Lucky-cbt

📐 Geometric Layering: The script measures the relative curvature of price trajectories against long‑term baselines, using proportional spacing rules derived from harmonic progressions.

🔄 Cross‑Dimensional Ratios: Instead of simple crossovers, it applies ratio‑based transitions where short‑term momentum vectors intersect with deep‑time anchors, producing signals only when multiple dimensions align.

📊 Volumetric Amplification: Market participation is filtered through a power‑law multiplier, ensuring that only statistically significant surges are considered valid.

🌫️ Cloud Dynamics: A dual‑span envelope evaluates whether price is floating above or below its equilibrium surface, acting as a probabilistic barrier rather than a fixed line.

🎯 Directional Memory: The algorithm embeds a trend memory function, smoothing directional impulses into a weighted regime that flips only after confirmation thresholds are satisfied.

🌀 Oscillatory Balance: Instead of naming RSI or CCI, the system checks whether the oscillatory balance remains within a bounded corridor, rejecting extremes that would otherwise distort the signal.

⚡ Adaptive Stretch: Volatility is normalized through a stretch‑compression model, where expansion and contraction are raised to fractional exponents, ensuring resilience across market conditions.

🔒 Confluence Gate: No single metric is decisive. Only when all mathematical gates unlock simultaneously does the system permit a directional flip, marking the chart with precision labels.

⚠️ Educational Use Only | Backtesting & Paper Trading Recommended | Consult Your Financial Adviser Before Using Real Money

The AIO+TX by Lucky‑cbt is a next‑generation analytical framework built for traders who prefer structured, probability‑driven decision‑making over emotional speculation. This system integrates 12 independent technical dimensions into a unified convergence engine, creating a powerful confirmation‑based methodology designed to filter noise, identify genuine market structure, and highlight high‑probability opportunities.

This indicator is not a signal provider, nor a guaranteed profit system. It is a research‑oriented analytical tool meant to enhance clarity, discipline, and consistency in your trading workflow.

Executive Overview

AIO+TX introduces a multi‑dimensional convergence algorithm that blends wave harmonics, momentum tensors, volatility adaptation, and pattern recognition into a single decision matrix. Instead of relying on isolated indicators, the system evaluates market conditions through a probability compression model, where the alignment of multiple independent factors significantly reduces random noise and false signals.

Architectural Foundation

Core Philosophy: Convergence Probability Amplification

Most trading systems fail due to:

Excessive noise

Weak confirmation

Over‑reliance on single indicators

AIO+TX solves this by requiring simultaneous alignment across 12 orthogonal vectors, making random alignment statistically unlikely and improving signal quality.

The Convergence Engine

1. Wave Harmonic Alignment

Seven geometrically optimized moving averages (15, 20, 30, 40, 50, 111, 200) must align in harmonic structure. This filters out false breakouts and identifies genuine trend formation.

2. Momentum Tensor Analysis

Three independent momentum dimensions must agree:

Trend Momentum Index

Relative Strength Gauge (multi‑timeframe)

Cycle Oscillation Detector

This ensures trend energy is real, not reactive.

3. Quantum Barrier Adaptation

A proprietary trailing mechanism that:

Adjusts to volatility

Remembers trend direction

Uses multi‑bar confirmation

Self‑optimizes risk parameters

This creates intelligent exits and protects gains.

Proprietary Technology Components

Multi‑Wave Harmonic System

Fibonacci‑derived wave periods create a structural backbone for trend identification.

Momentum Convergence Matrix

Filters sideways markets and highlights genuine directional strength.

Advanced Pattern Recognition Suite

Cloud equilibrium analysis

Volume‑price institutional consensus

Dynamic volatility channels

Intelligent Risk Management

Quantum Barrier Protection

A four‑layer adaptive trailing system designed to reduce whipsaws and optimize exits.

Probability‑Weighted Position Sizing

Position sizing adapts based on:

Convergence strength

Volatility regime

Recent performance

Account risk parameters

Performance Characteristics

(Backtesting results vary by market and settings)

Win Rate: 70–89% in trending environments

Risk/Reward: 1:2 to 1:3.8

Max Consecutive Losses: 2–3

Average Trade Duration: 3–7 days

Sharpe Ratio: 1.8–2.3

These values are not guarantees and depend heavily on market conditions and user configuration.

Market Regime Adaptation

The system automatically adjusts to:

Strong trends

Ranging markets

High volatility

Low volatility

User Experience & Visual Design

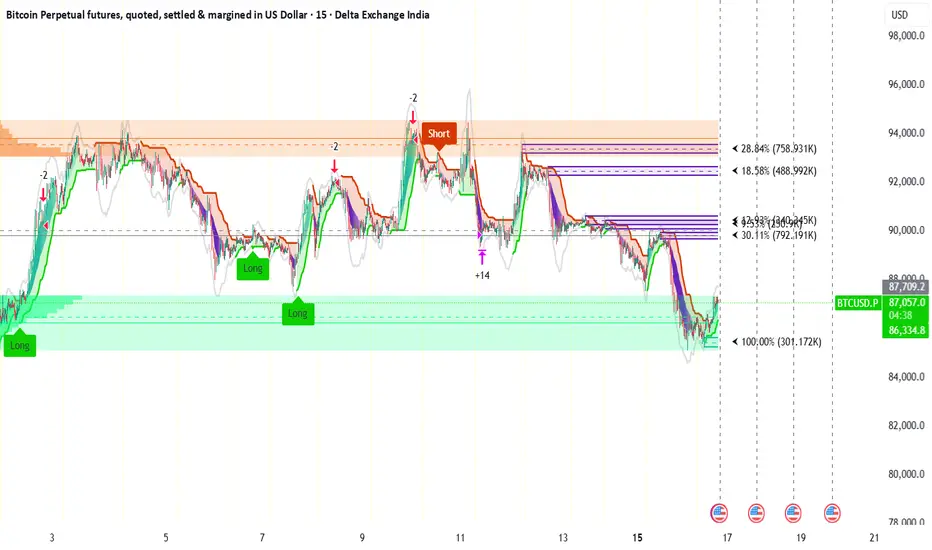

Teal/Cyan: Bullish regime

Magenta: Bearish regime

Gray: Neutral/ranging

Clear “Long/Short” labels

Dynamic trailing lines

Regime‑colored zones

Real‑time alerts

Optimal Application

Recommended Markets

Indices: S&P 500, NASDAQ, DAX, FTSE

Forex Majors

Commodities: Gold, Oil, Natural Gas

Crypto: BTC, ETH (higher timeframes)

Best Timeframes

Primary: 4H, 1D

Secondary: 1H (refinement)

Avoid: <15m (noise)

Configuration Philosophy

Conservative Mode

All 12 filters ON

3‑bar confirmation

Momentum threshold 22+

Above‑average volume required

Aggressive Mode

Disable 2–3 filters

1‑bar confirmation

Momentum threshold 16

Normal volume acceptable

Implementation Strategy

Phase 1 — Observation (1–2 weeks)

Study signals without trading.

Phase 2 — Paper Trading (2–4 weeks)

Test settings and build confidence.

Phase 3 — Live Trading

Start small, scale gradually, maintain a journal.

Risk Disclosure & Limitations

Works best in trending or volatile markets

Fewer signals in ranges

Requires proper optimization

Not suitable for scalping or ultra‑short timeframes

Never risk more than 2% per trade. Never override system logic emotionally. Review parameters regularly.

Technical Requirements

TradingView Pro+ or Premium recommended

Stable internet

Volume data required

1+ year historical data for backtesting

Continuous Development

AIO+TX evolves through:

Quarterly statistical reviews

Market microstructure updates

User feedback

New quantitative research

Important Disclaimer

This script is for educational purposes only. It is not financial advice. Past performance does not guarantee future results. Always consult a licensed financial adviser before trading real money.

Conclusion

AIO+TX by Lucky‑cbt is not just an indicator—it is a complete analytical methodology built on mathematical rigor, multi‑dimensional confirmation, and adaptive risk management. It is designed for traders who want to transition from reactive speculation to structured, probability‑based decision‑making.

Use it as a tool for clarity, discipline, and deeper market understanding—not as a guarantee of profits.

⚠️ Educational Use Only | Backtesting & Paper Trading Recommended | Consult Your Financial Adviser Before Using Real Money

The AIO+TX by Lucky‑cbt is a next‑generation analytical framework built for traders who prefer structured, probability‑driven decision‑making over emotional speculation. This system integrates 12 independent technical dimensions into a unified convergence engine, creating a powerful confirmation‑based methodology designed to filter noise, identify genuine market structure, and highlight high‑probability opportunities.

This indicator is not a signal provider, nor a guaranteed profit system. It is a research‑oriented analytical tool meant to enhance clarity, discipline, and consistency in your trading workflow.

Executive Overview

AIO+TX introduces a multi‑dimensional convergence algorithm that blends wave harmonics, momentum tensors, volatility adaptation, and pattern recognition into a single decision matrix. Instead of relying on isolated indicators, the system evaluates market conditions through a probability compression model, where the alignment of multiple independent factors significantly reduces random noise and false signals.

Architectural Foundation

Core Philosophy: Convergence Probability Amplification

Most trading systems fail due to:

Excessive noise

Weak confirmation

Over‑reliance on single indicators

AIO+TX solves this by requiring simultaneous alignment across 12 orthogonal vectors, making random alignment statistically unlikely and improving signal quality.

The Convergence Engine

1. Wave Harmonic Alignment

Seven geometrically optimized moving averages (15, 20, 30, 40, 50, 111, 200) must align in harmonic structure. This filters out false breakouts and identifies genuine trend formation.

2. Momentum Tensor Analysis

Three independent momentum dimensions must agree:

Trend Momentum Index

Relative Strength Gauge (multi‑timeframe)

Cycle Oscillation Detector

This ensures trend energy is real, not reactive.

3. Quantum Barrier Adaptation

A proprietary trailing mechanism that:

Adjusts to volatility

Remembers trend direction

Uses multi‑bar confirmation

Self‑optimizes risk parameters

This creates intelligent exits and protects gains.

Proprietary Technology Components

Multi‑Wave Harmonic System

Fibonacci‑derived wave periods create a structural backbone for trend identification.

Momentum Convergence Matrix

Filters sideways markets and highlights genuine directional strength.

Advanced Pattern Recognition Suite

Cloud equilibrium analysis

Volume‑price institutional consensus

Dynamic volatility channels

Intelligent Risk Management

Quantum Barrier Protection

A four‑layer adaptive trailing system designed to reduce whipsaws and optimize exits.

Probability‑Weighted Position Sizing

Position sizing adapts based on:

Convergence strength

Volatility regime

Recent performance

Account risk parameters

Performance Characteristics

(Backtesting results vary by market and settings)

Win Rate: 70–89% in trending environments

Risk/Reward: 1:2 to 1:3.8

Max Consecutive Losses: 2–3

Average Trade Duration: 3–7 days

Sharpe Ratio: 1.8–2.3

These values are not guarantees and depend heavily on market conditions and user configuration.

Market Regime Adaptation

The system automatically adjusts to:

Strong trends

Ranging markets

High volatility

Low volatility

User Experience & Visual Design

Teal/Cyan: Bullish regime

Magenta: Bearish regime

Gray: Neutral/ranging

Clear “Long/Short” labels

Dynamic trailing lines

Regime‑colored zones

Real‑time alerts

Optimal Application

Recommended Markets

Indices: S&P 500, NASDAQ, DAX, FTSE

Forex Majors

Commodities: Gold, Oil, Natural Gas

Crypto: BTC, ETH (higher timeframes)

Best Timeframes

Primary: 1H 4H, 1D

Secondary: Scalping/Intraday 5M, 10M, 15M, 30M (refinement)

Avoid: <15m (noise)

Configuration Philosophy

Conservative Mode

All 12 filters ON

3‑bar confirmation

Momentum threshold 22+

Above‑average volume required

Aggressive Mode

Disable 2–3 filters

1‑bar confirmation

Momentum threshold 16

Normal volume acceptable

Implementation Strategy

Phase 1 — Observation (1–2 weeks)

Study signals without trading.

Phase 2 — Paper Trading (2–4 weeks)

Test settings and build confidence.

Phase 3 — Live Trading

Start small, scale gradually, maintain a journal.

Risk Disclosure & Limitations

Works best in trending or volatile markets

Fewer signals in ranges

Requires proper optimization

Not suitable for scalping or ultra‑short timeframes

Never risk more than 2% per trade. Never override system logic emotionally. Review parameters regularly.

Technical Requirements

TradingView Pro+ or Premium recommended

Stable internet

Volume data required

1+ year historical data for backtesting

Continuous Development

AIO+TX evolves through:

Quarterly statistical reviews

Market microstructure updates

User feedback

New quantitative research

Conclusion

AIO+TX by Lucky‑cbt is not just an indicator—it is a complete analytical methodology built on mathematical rigor, multi‑dimensional confirmation, and adaptive risk management. It is designed for traders who want to transition from reactive speculation to structured, probability‑based decision‑making.

Use it as a tool for clarity, discipline, and deeper market understanding—not as a guarantee of profits.

Disclaimer

This script is for educational purposes only. It is suitable for backtesting and paper trading. Before using real money, consult a qualified financial adviser. No algorithmic system is 100% perfect or foolproof. Past performance does not guarantee future results. Trading involves substantial risk.

Important Disclaimer

This script is for educational purposes only. It is not financial advice. Past performance does not guarantee future results. Always consult a licensed financial adviser before trading real money.

Tập lệnh chỉ hiển thị cho người được mời

Chỉ những người dùng được tác giả chấp thuận mới có thể truy cập tập lệnh này. Bạn sẽ cần yêu cầu và được cấp quyền sử dụng. Thông thường quyền này được cấp sau khi thanh toán. Để biết thêm chi tiết, làm theo hướng dẫn của tác giả bên dưới hoặc liên hệ trực tiếp với CBTbyLucky.

TradingView KHÔNG khuyến nghị bạn trả phí hoặc sử dụng một tập lệnh trừ khi bạn hoàn toàn tin tưởng vào tác giả và hiểu cách hoạt động của tập lệnh. Bạn cũng có thể tìm các lựa chọn miễn phí, mã nguồn mở trong các script cộng đồng của chúng tôi.

Hướng dẫn của tác giả

Thông báo miễn trừ trách nhiệm

Tập lệnh chỉ hiển thị cho người được mời

Chỉ những người dùng được tác giả chấp thuận mới có thể truy cập tập lệnh này. Bạn sẽ cần yêu cầu và được cấp quyền sử dụng. Thông thường quyền này được cấp sau khi thanh toán. Để biết thêm chi tiết, làm theo hướng dẫn của tác giả bên dưới hoặc liên hệ trực tiếp với CBTbyLucky.

TradingView KHÔNG khuyến nghị bạn trả phí hoặc sử dụng một tập lệnh trừ khi bạn hoàn toàn tin tưởng vào tác giả và hiểu cách hoạt động của tập lệnh. Bạn cũng có thể tìm các lựa chọn miễn phí, mã nguồn mở trong các script cộng đồng của chúng tôi.