OPEN-SOURCE SCRIPT

Dominant Cycle Adaptive MACD

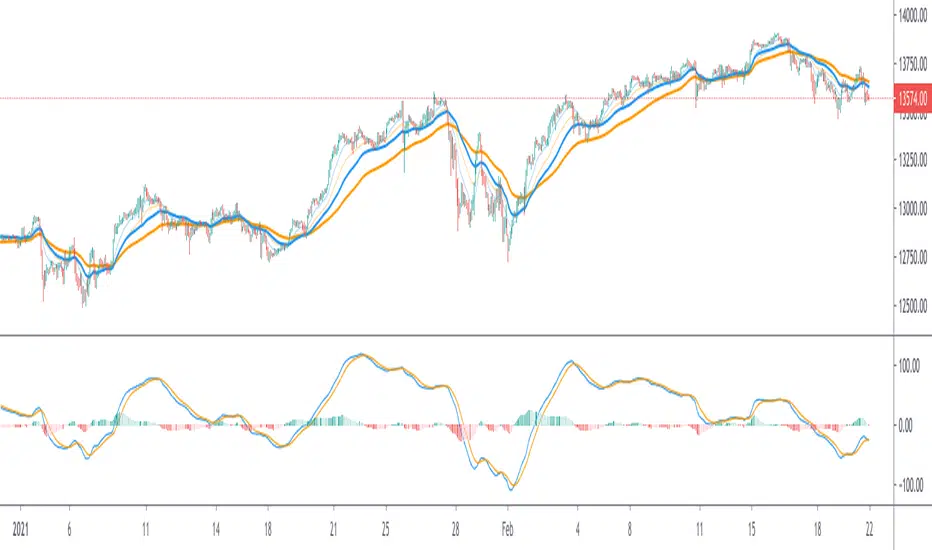

This Indicator is based on classic MACD but with an exceptional smoothing.

This smoothing eliminates the noise of the classic MACD as you see in the Chart

Adaptive MACD is compiled using with two adaptive moving averages, one adaptive to the dominant cycle and the other adaptive to twice the dominant cycle. As the basic behind the MACD is the difference of two moving averages we cannot find much difference between the conventional MACD (12, 26) and the adaptive MACD. However the adaptive MACD is less prone for less whipsaws and it catches the trends very well at the same time the catches the turning points in time. The Adaptive MACD is definite one notch better than the conventional MACD.

Dominant Cycle Period is calculated using Ehler's Method {Mentioned in the code}

This is how the Adaptiveness Impacts the Price Chart

1. (12, 26 EMA) VS Adaptive Dominant Cycle EMA

2. See how the Adaptive Lengths {both FastLength and SlowLength changes with time!}

Enjoy!

This smoothing eliminates the noise of the classic MACD as you see in the Chart

Adaptive MACD is compiled using with two adaptive moving averages, one adaptive to the dominant cycle and the other adaptive to twice the dominant cycle. As the basic behind the MACD is the difference of two moving averages we cannot find much difference between the conventional MACD (12, 26) and the adaptive MACD. However the adaptive MACD is less prone for less whipsaws and it catches the trends very well at the same time the catches the turning points in time. The Adaptive MACD is definite one notch better than the conventional MACD.

Dominant Cycle Period is calculated using Ehler's Method {Mentioned in the code}

This is how the Adaptiveness Impacts the Price Chart

1. (12, 26 EMA) VS Adaptive Dominant Cycle EMA

2. See how the Adaptive Lengths {both FastLength and SlowLength changes with time!}

Enjoy!

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Get Ocs Ai Trader, Your personal Ai Trade Assistant here

→ ocstrader.com

About me

AlgoTrading Certification, ( University of Oxford, Säid Business School )

PGP Research Analysis, ( NISM, SEBI )

Electronics Engineer

→ ocstrader.com

About me

AlgoTrading Certification, ( University of Oxford, Säid Business School )

PGP Research Analysis, ( NISM, SEBI )

Electronics Engineer

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Get Ocs Ai Trader, Your personal Ai Trade Assistant here

→ ocstrader.com

About me

AlgoTrading Certification, ( University of Oxford, Säid Business School )

PGP Research Analysis, ( NISM, SEBI )

Electronics Engineer

→ ocstrader.com

About me

AlgoTrading Certification, ( University of Oxford, Säid Business School )

PGP Research Analysis, ( NISM, SEBI )

Electronics Engineer

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.