OPEN-SOURCE SCRIPT

Constance Brown Composite Index Enhanced

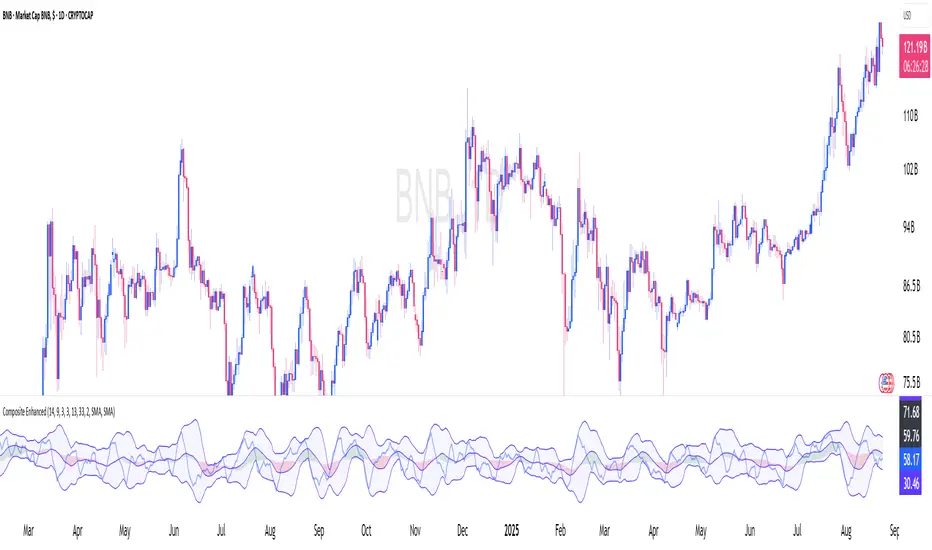

What This Indicator Does

Implements Constance Brown's copyrighted Composite Index formula (1996) from her Master's thesis - a breakthrough oscillator that solves the critical problem where RSI fails to show divergences in long-horizon trends, providing early warning signals for major market reversals.

The Problem It Solves

Traditional RSI frequently fails to display divergence signals in Global Equity Indexes and long-term charts, leaving asset managers without warning of major price reversals. Brown's research showed RSI failed to provide divergence signals 42 times across major markets - failures that would have been "extremely costly for asset managers."

Key Components

Composite Line: RSI Momentum (9-period) + Smoothed RSI Average - the core breakthrough formula

Fast/Slow Moving Averages: Trend direction confirmation (13/33 periods default)

Bollinger Bands: Volatility envelope around the composite signal

Enhanced Divergence Detection: Significantly improved trend reversal timing vs standard RSI

Research-Proven Performance

Based on Brown's extensive study across 6 major markets (1919-2015):

42 divergence signals triggered where RSI showed none

33 signals passed with meaningful reversals (78% success rate)

Only 5 failures - exceptional performance in monthly/2-month timeframes

Tested on: German DAX, French CAC 40, Shanghai Composite, Dow Jones, US/Japanese Government Bonds

New Customization Features

Moving Average Types: Choose SMA or EMA for fast/slow lines

Optional Fills: Toggle composite and Bollinger band fills on/off

All Periods Adjustable: RSI length, momentum, smoothing periods

Visual Styling: Customize colors and line widths in Style tab

Default Settings (Original Formula)

RSI Length: 14

RSI Momentum: 9 periods

RSI MA Length: 3

SMA Length: 3

Fast SMA: 13, Slow SMA: 33

Bollinger STD: 2.0

Applications

Long-term investing: Monthly/2-month charts for major trend changes

Elliott Wave analysis: Maximum displacement at 3rd-of-3rd waves, divergence at 5th waves

Multi-timeframe: Pairs well with MACD, works across all timeframes

Global markets: Proven effective on equities, bonds, currencies, commodities

Perfect for serious traders and asset managers seeking the proven mathematical edge that traditional RSI cannot provide.

Implements Constance Brown's copyrighted Composite Index formula (1996) from her Master's thesis - a breakthrough oscillator that solves the critical problem where RSI fails to show divergences in long-horizon trends, providing early warning signals for major market reversals.

The Problem It Solves

Traditional RSI frequently fails to display divergence signals in Global Equity Indexes and long-term charts, leaving asset managers without warning of major price reversals. Brown's research showed RSI failed to provide divergence signals 42 times across major markets - failures that would have been "extremely costly for asset managers."

Key Components

Composite Line: RSI Momentum (9-period) + Smoothed RSI Average - the core breakthrough formula

Fast/Slow Moving Averages: Trend direction confirmation (13/33 periods default)

Bollinger Bands: Volatility envelope around the composite signal

Enhanced Divergence Detection: Significantly improved trend reversal timing vs standard RSI

Research-Proven Performance

Based on Brown's extensive study across 6 major markets (1919-2015):

42 divergence signals triggered where RSI showed none

33 signals passed with meaningful reversals (78% success rate)

Only 5 failures - exceptional performance in monthly/2-month timeframes

Tested on: German DAX, French CAC 40, Shanghai Composite, Dow Jones, US/Japanese Government Bonds

New Customization Features

Moving Average Types: Choose SMA or EMA for fast/slow lines

Optional Fills: Toggle composite and Bollinger band fills on/off

All Periods Adjustable: RSI length, momentum, smoothing periods

Visual Styling: Customize colors and line widths in Style tab

Default Settings (Original Formula)

RSI Length: 14

RSI Momentum: 9 periods

RSI MA Length: 3

SMA Length: 3

Fast SMA: 13, Slow SMA: 33

Bollinger STD: 2.0

Applications

Long-term investing: Monthly/2-month charts for major trend changes

Elliott Wave analysis: Maximum displacement at 3rd-of-3rd waves, divergence at 5th waves

Multi-timeframe: Pairs well with MACD, works across all timeframes

Global markets: Proven effective on equities, bonds, currencies, commodities

Perfect for serious traders and asset managers seeking the proven mathematical edge that traditional RSI cannot provide.

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

🎯 Download my free guide! 10 Chart Patterns that Make Money

💰 Recent Winners: APPS +250%, NVDA +200%, SMCI +240%, HIMS +60%

👉 profitpunch.org

💰 Recent Winners: APPS +250%, NVDA +200%, SMCI +240%, HIMS +60%

👉 profitpunch.org

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

🎯 Download my free guide! 10 Chart Patterns that Make Money

💰 Recent Winners: APPS +250%, NVDA +200%, SMCI +240%, HIMS +60%

👉 profitpunch.org

💰 Recent Winners: APPS +250%, NVDA +200%, SMCI +240%, HIMS +60%

👉 profitpunch.org

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.