OPEN-SOURCE SCRIPT

Cập nhật RSI For Loop

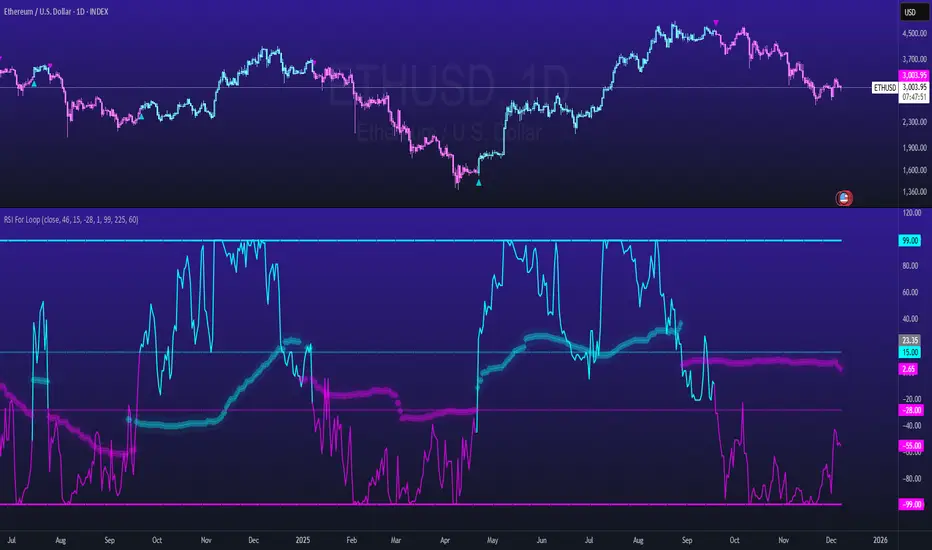

RSI For Loop – Enhanced RSI Dominance Oscillator

Original concept & innovation ©viResearch

Enhanced version with historical-comparison loop, median-based statistical strength bands, asymmetric thresholds, and visual upgrades

Core Concept (viResearch)

viResearch was the first to introduce the groundbreaking idea of replacing traditional fixed RSI levels with a loop-based scoring system that evaluates RSI behavior across a defined range, creating a dynamic, self-normalizing momentum score that dramatically reduces false signals in trending markets.

Key Enhancements in This Version

I kept the core brilliance of viResearch's loop concept but completely rewrote the scoring mechanism to make it even more powerful and adaptive:

1. Historical Dominance Comparison

The loop directly compares the current RSI value to the actual RSI values of the previous 1–99 bars (user-adjustable).

→ +1 for every past bar the current RSI beats

→ –1 for every past bar it loses to

This transforms the indicator into a true RSI Dominance / Percentile-Rank oscillator that instantly shows whether current momentum is stronger or weaker than nearly all recent history – perfectly adaptive to any market regime, volatility level, or asset.

2. Median + 3σ Statistical Strength Bands

Added a rolling median of the dominance score plus dynamic ±3σ bands calculated from the RSI score median standard deviation.

These bands identify genuinely extreme momentum phases (statistically rare events) that only occur during the strongest momentum or capitulation moves – giving high-conviction confirmation.

3. Visual & Practical Upgrades

- Clean bar/candle coloring

- On-chart triangle signals at trend changes

- Diamond stepline ±3σ bands

- Built-in alerts for both trend changes and extreme strength phases

- 9 professional color themes

How to Use It

Primary Trend Signals

- Green triangle + bullish bar color → New bullish momentum regime (score crosses above +15)

- Magenta triangle + bearish bar color → New bearish momentum regime (score crosses below –28)

These are some of the cleanest trend-change signals you will ever see – especially powerful on daily/weekly charts.

Extreme Strength Confirmation

Score breaks above the upper 3σ diamond line → Exceptional bullish strength/dominance (add to longs, strength behind the asset)

Score breaks below the lower 3σ diamond line → Exceptional bearish strength/dominance (capitulation or weakness)

These are rarer, very high-probability zones.

Zero-Line Context

Above zero = current RSI stronger than average recent history

Below zero = weaker than average recent history

Near zero = choppy/range-bound (stay out or mean-reversion trade)

Recommended Settings

RSI Length: 46

Loop range: 1 to 99 (~3–6 months on daily)

Long Threshold: +15

Short Threshold: –28

Median Length: 225

SD Length: 60

Works on all assets and timeframes. Absolutely deadly on daily/weekly for swing and position trading, and still excellent on 4H/30min for crypto/stocks.

This enhanced version honors viResearch's original genius while improving on it with true historical comparison and statistical extreme detection – delivering what is, in my opinion, one of the cleanest and most powerful momentum/trend indicators available on TradingView.

Backtests are based on past results and are not indicative of future performance.

Phát hành các Ghi chú

- name change of signal boolMã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.