OPEN-SOURCE SCRIPT

Day-Type Detector — Rejection / FNL / Outside / StopRun (Clean)

Day-Type Detector — Rejection / FNL / Outside / Stop-Run (Clean Version)

This indicator identifies four high-impact candlestick day-types commonly used in professional price-action and auction-market trading: Rejection Days, Failed New Low (FNL) Days, Outside Days, and Stop-Run Days. These patterns often precede major directional moves, reversals, and absorption events, making them particularly valuable for swing traders, positional traders, and short-term discretionary traders.

The script is designed to work across all timeframes and is built around volatility-adjusted measurements using Average Daily Range (ADR) for accuracy and consistency.

What This Indicator Detects

1. Rejection Day (Bullish & Bearish)

A Rejection Day is a wide-range bar that rejects a previous extreme.

The indicator identifies rejection based on:

Range > ADR × threshold

Long lower wick (for bullish) or long upper wick (for bearish)

Close located in the strong zone of the day’s range

These conditions highlight areas where aggressive counter-orderflow entered the market.

2. Failed New Low (FNL) / Failed New High

An FNL day traps traders who attempted breakout selling or buying.

The indicator checks for:

A break beyond the previous session’s low or high

Immediate rejection back inside

Midpoint recapture conditions

ADR-normalized range requirements

These days often trigger powerful directional reversals.

3. Outside Day (Bullish & Bearish)

An Outside Day is a statistically significant expansion day that breaks both the previous high and low.

The script validates:

High > previous high and low < previous low

Range > ADR threshold

Close beyond prior session extreme to complete the rejection sequence

Outside Days often represent stop runs, shakeouts, or trend accelerations.

4. Stop-Run Day (Bullish & Bearish)

Stop-Run Days are aggressive volatility expansions and tend to be the largest ranges within short windows.

This detector identifies them using:

Range > ADR × multiplier

Close located near the extreme of the day (top for bullish, bottom for bearish)

Strong body relative to total range

Break above/below previous session extreme

These patterns indicate capitulation or forced liquidation and are often followed by continuation or sharp counter-rotation.

Key Features

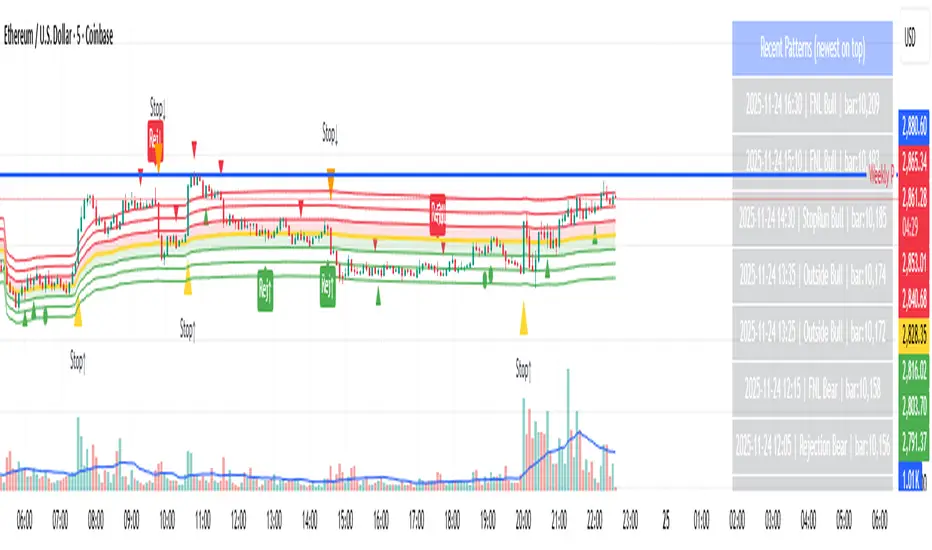

✔ Historical Pattern Marking

All qualifying bars are marked on the chart using plotshape() in global scope, ensuring full historical visibility.

✔ Event Logging & Table Display

A table (top-right of the chart) displays the most recent pattern detections, including:

Timestamp

Pattern type

Bar index

This allows users to monitor and study past pattern occurrences without scanning the chart manually.

✔ ADR-Adjusted Detection

Volatility uncertainty is removed by anchoring all thresholds to ADR.

This ensures consistency across:

Different symbols

Different timeframes

Different market regimes

✔ Alerts Included

Alerts are preconfigured for:

Rejection Day Bull / Bear

FNL Bull / Bear

Outside Day Bull / Bear

Stop-Run Bull / Bear

This allows the user to receive real-time notifications when major day-type structures develop.

How to Use

Add the indicator to any timeframe chart.

Enable or disable:

Historical markers

History table

ADR diagnostics

Watch for shape markers or use alerts for real-time signals.

Use the history table to review recent occurrences.

Combine these day-types with:

Market structure levels

High/low volume nodes (LVNs)

Support/resistance zones

Trend context

These day-types are most effective when they occur near meaningful structural levels because they show where strong order-flow entered the market.

Best Practices

Use higher timeframes (1H–1D) for swing entries.

Confirm signals with market structure or volume profile.

Treat these day-types as context, not standalone signals.

Observe follow-through behavior in the next 1–3 bars after detection.

Credits

This script is based on concepts commonly seen in auction-market theory and professional price-action frameworks, such as Rejection Days, Failed New Lows, Outside Days, and Stop-Run behaviors.

All calculations and logic have been rebuilt from scratch to ensure clean, reliable, and optimized Pine Script v6 execution.

This indicator identifies four high-impact candlestick day-types commonly used in professional price-action and auction-market trading: Rejection Days, Failed New Low (FNL) Days, Outside Days, and Stop-Run Days. These patterns often precede major directional moves, reversals, and absorption events, making them particularly valuable for swing traders, positional traders, and short-term discretionary traders.

The script is designed to work across all timeframes and is built around volatility-adjusted measurements using Average Daily Range (ADR) for accuracy and consistency.

What This Indicator Detects

1. Rejection Day (Bullish & Bearish)

A Rejection Day is a wide-range bar that rejects a previous extreme.

The indicator identifies rejection based on:

Range > ADR × threshold

Long lower wick (for bullish) or long upper wick (for bearish)

Close located in the strong zone of the day’s range

These conditions highlight areas where aggressive counter-orderflow entered the market.

2. Failed New Low (FNL) / Failed New High

An FNL day traps traders who attempted breakout selling or buying.

The indicator checks for:

A break beyond the previous session’s low or high

Immediate rejection back inside

Midpoint recapture conditions

ADR-normalized range requirements

These days often trigger powerful directional reversals.

3. Outside Day (Bullish & Bearish)

An Outside Day is a statistically significant expansion day that breaks both the previous high and low.

The script validates:

High > previous high and low < previous low

Range > ADR threshold

Close beyond prior session extreme to complete the rejection sequence

Outside Days often represent stop runs, shakeouts, or trend accelerations.

4. Stop-Run Day (Bullish & Bearish)

Stop-Run Days are aggressive volatility expansions and tend to be the largest ranges within short windows.

This detector identifies them using:

Range > ADR × multiplier

Close located near the extreme of the day (top for bullish, bottom for bearish)

Strong body relative to total range

Break above/below previous session extreme

These patterns indicate capitulation or forced liquidation and are often followed by continuation or sharp counter-rotation.

Key Features

✔ Historical Pattern Marking

All qualifying bars are marked on the chart using plotshape() in global scope, ensuring full historical visibility.

✔ Event Logging & Table Display

A table (top-right of the chart) displays the most recent pattern detections, including:

Timestamp

Pattern type

Bar index

This allows users to monitor and study past pattern occurrences without scanning the chart manually.

✔ ADR-Adjusted Detection

Volatility uncertainty is removed by anchoring all thresholds to ADR.

This ensures consistency across:

Different symbols

Different timeframes

Different market regimes

✔ Alerts Included

Alerts are preconfigured for:

Rejection Day Bull / Bear

FNL Bull / Bear

Outside Day Bull / Bear

Stop-Run Bull / Bear

This allows the user to receive real-time notifications when major day-type structures develop.

How to Use

Add the indicator to any timeframe chart.

Enable or disable:

Historical markers

History table

ADR diagnostics

Watch for shape markers or use alerts for real-time signals.

Use the history table to review recent occurrences.

Combine these day-types with:

Market structure levels

High/low volume nodes (LVNs)

Support/resistance zones

Trend context

These day-types are most effective when they occur near meaningful structural levels because they show where strong order-flow entered the market.

Best Practices

Use higher timeframes (1H–1D) for swing entries.

Confirm signals with market structure or volume profile.

Treat these day-types as context, not standalone signals.

Observe follow-through behavior in the next 1–3 bars after detection.

Credits

This script is based on concepts commonly seen in auction-market theory and professional price-action frameworks, such as Rejection Days, Failed New Lows, Outside Days, and Stop-Run behaviors.

All calculations and logic have been rebuilt from scratch to ensure clean, reliable, and optimized Pine Script v6 execution.

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.