OPEN-SOURCE SCRIPT

Cập nhật DOW Theory Price Action Multi-Time Frame

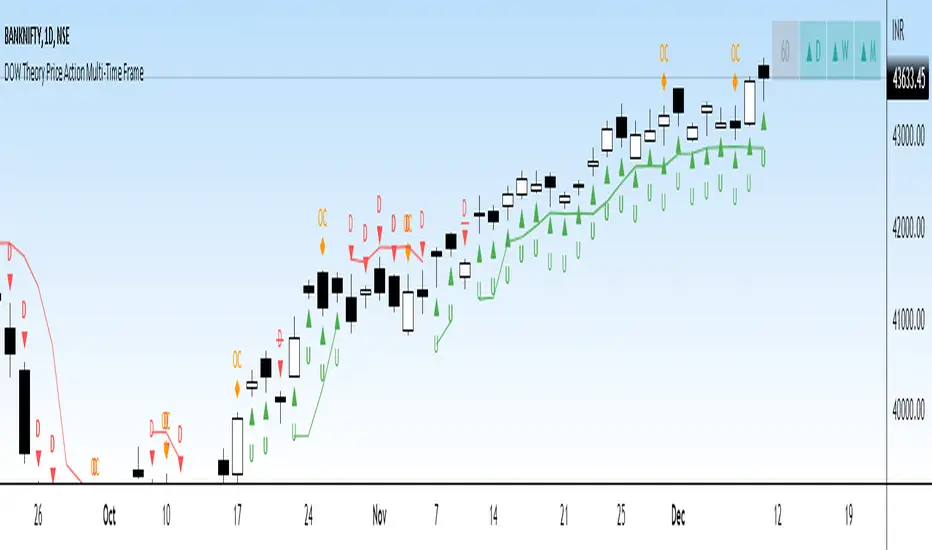

This indicator gives a visual representation of Dow Theory Price action based trend analysis and provides trader a table with 4 different timeframe to align with the trend.

It will help traders identify if it is an ongoing Impulse Wave or a Corrective Wave.

3 rules for Bullish Price Action setup (Uptrend or continuation of existing UpTrend): Denoted by 'U' below the candlestic

HH - Higher High

HL - Higher Low

CAH - Close above prior High

3 rules for Bearish Price Action setup (Downtrend or continuation of existing DownTrend): Denoted by 'D' below the candlestic

LH - Lower High

HL - LowerLow

CAH - Close below prior Low

Exception - Outside Candle: Denoted by 'OC' above the candlestic

Outside reversal is a two-day price pattern that shows when a candle or bar on a candlestick or bar chart falls “outside” of the previous day's candle or bar.

The table posistion can be set be user from the input settings as per his screen setting / resolution.

The trailing line can is also customizable from inputs, recomended value is 3-4.

Ideation Credits: Mr. Vineet Jain

It will help traders identify if it is an ongoing Impulse Wave or a Corrective Wave.

3 rules for Bullish Price Action setup (Uptrend or continuation of existing UpTrend): Denoted by 'U' below the candlestic

HH - Higher High

HL - Higher Low

CAH - Close above prior High

3 rules for Bearish Price Action setup (Downtrend or continuation of existing DownTrend): Denoted by 'D' below the candlestic

LH - Lower High

HL - LowerLow

CAH - Close below prior Low

Exception - Outside Candle: Denoted by 'OC' above the candlestic

Outside reversal is a two-day price pattern that shows when a candle or bar on a candlestick or bar chart falls “outside” of the previous day's candle or bar.

The table posistion can be set be user from the input settings as per his screen setting / resolution.

The trailing line can is also customizable from inputs, recomended value is 3-4.

Ideation Credits: Mr. Vineet Jain

Phát hành các Ghi chú

Fixed the code where it the trend was an existing trend was changing without a valid DOW Theory Price action condition becoming true.Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.