OPEN-SOURCE SCRIPT

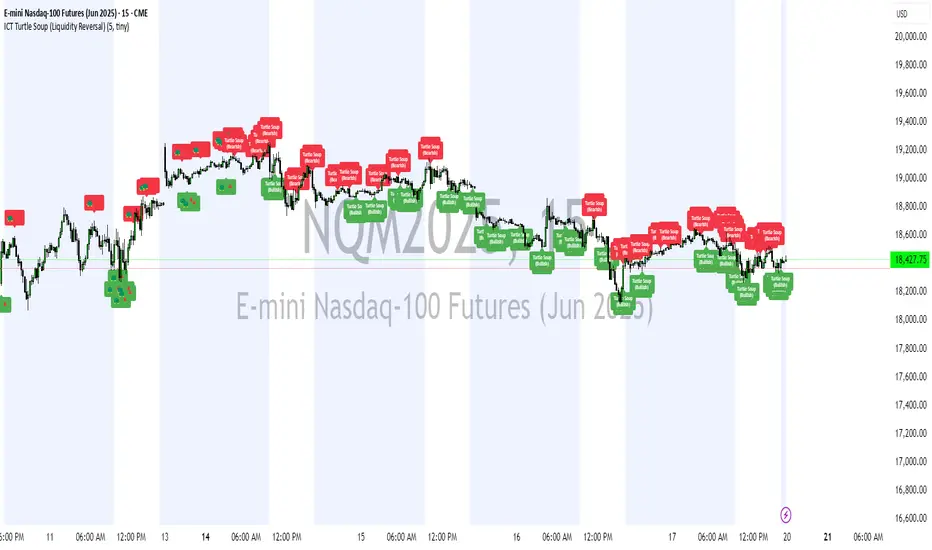

ICT Turtle Soup (Liquidity Reversal)

ICT Turtle Soup — Liquidity Reversal Detection

Classic Liquidity Trap Reversal Strategy for Smart Money Traders

This indicator implements the ICT Turtle Soup concept — a classic liquidity-based reversal pattern — which occurs when price runs above or below a recent swing level to grab liquidity, then sharply reverses. This pattern is commonly used in Smart Money Concepts (SMC) and Inner Circle Trader (ICT) strategies to anticipate false breakouts and high-probability reversals.

🔍 What This Script Does:

Identifies Swing Highs & Lows

Detects recent swing highs and lows using a customizable lookback period.

Tracks Liquidity Grabs

A bearish Turtle Soup setup is triggered when price breaks above a recent swing high but closes back below it.

A bullish Turtle Soup setup is triggered when price breaks below a recent swing low but closes back above it.

These conditions often signal liquidity traps, where price sweeps resting orders before reversing.

Plots Signals Directly on the Chart

Turtle Soup setups are marked with 🐢🔻 (bearish) and 🐢🔺 (bullish) labels.

Optional full-text labels can also be displayed for clarity and journaling.

Includes Alert Conditions

Alerts can be enabled to notify you of bullish or bearish Turtle Soup reversals in real-time.

⚙️ Customization Features:

Adjustable swing lookback period

Enable/disable Turtle Soup labels

Set label font size

Choose your preferred bullish/bearish signal colors

💡 How to Use:

Add this script to your chart (ideally on intraday timeframes such as 5m–15m).

Wait for a Turtle Soup signal near a key swing high/low or liquidity zone.

Combine with other confirmation tools (e.g., FVGs, Order Blocks, OTE) for stronger setups.

Use alerts to stay ahead of fast-moving reversals.

🧠 Why It Works:

Turtle Soup setups are rooted in liquidity theory — they exploit the market’s tendency to sweep obvious swing levels before reversing. These moves often trap retail traders and mark the beginning of Smart Money entries.

🔗 Best Used With:

Maximize the edge by combining this with other SMC tools:

✅ First FVG — Opening Range Fair Value Gap Detector

✅ ICT SMC Liquidity Grabs + OB + Fibonacci OTE Levels

✅ Liquidity Levels — Smart Swing Lows

Together, they create a complete ecosystem for identifying, confirming, and executing liquidity-driven trade setups with precision.

Classic Liquidity Trap Reversal Strategy for Smart Money Traders

This indicator implements the ICT Turtle Soup concept — a classic liquidity-based reversal pattern — which occurs when price runs above or below a recent swing level to grab liquidity, then sharply reverses. This pattern is commonly used in Smart Money Concepts (SMC) and Inner Circle Trader (ICT) strategies to anticipate false breakouts and high-probability reversals.

🔍 What This Script Does:

Identifies Swing Highs & Lows

Detects recent swing highs and lows using a customizable lookback period.

Tracks Liquidity Grabs

A bearish Turtle Soup setup is triggered when price breaks above a recent swing high but closes back below it.

A bullish Turtle Soup setup is triggered when price breaks below a recent swing low but closes back above it.

These conditions often signal liquidity traps, where price sweeps resting orders before reversing.

Plots Signals Directly on the Chart

Turtle Soup setups are marked with 🐢🔻 (bearish) and 🐢🔺 (bullish) labels.

Optional full-text labels can also be displayed for clarity and journaling.

Includes Alert Conditions

Alerts can be enabled to notify you of bullish or bearish Turtle Soup reversals in real-time.

⚙️ Customization Features:

Adjustable swing lookback period

Enable/disable Turtle Soup labels

Set label font size

Choose your preferred bullish/bearish signal colors

💡 How to Use:

Add this script to your chart (ideally on intraday timeframes such as 5m–15m).

Wait for a Turtle Soup signal near a key swing high/low or liquidity zone.

Combine with other confirmation tools (e.g., FVGs, Order Blocks, OTE) for stronger setups.

Use alerts to stay ahead of fast-moving reversals.

🧠 Why It Works:

Turtle Soup setups are rooted in liquidity theory — they exploit the market’s tendency to sweep obvious swing levels before reversing. These moves often trap retail traders and mark the beginning of Smart Money entries.

🔗 Best Used With:

Maximize the edge by combining this with other SMC tools:

✅ First FVG — Opening Range Fair Value Gap Detector

✅ ICT SMC Liquidity Grabs + OB + Fibonacci OTE Levels

✅ Liquidity Levels — Smart Swing Lows

Together, they create a complete ecosystem for identifying, confirming, and executing liquidity-driven trade setups with precision.

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.