Sigma Reversal Print [FxScripts]

The Sigma Reversal Print is a powerful tool designed for traders who like to trade reversal strategies plus trend traders looking to enter on strong pullbacks. It integrates advanced price action with volume analysis, highlighting areas where a trend reversal or pullback may be in progress, providing insights into where markets may be exhausted or about to surge.

Key Features and Functionality

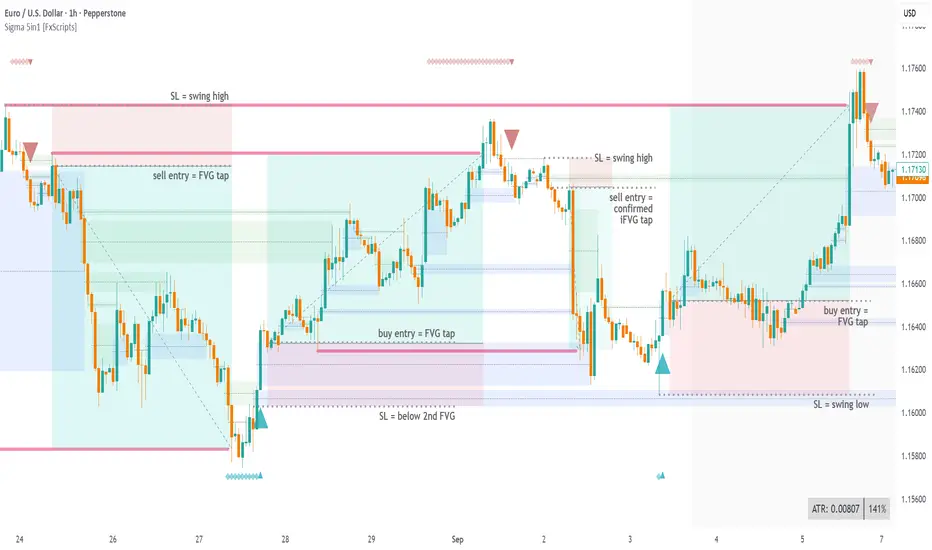

Reversal Trading: Tailored primarily for reversal traders, the Sigma Reversal Print highlights zones where the market is likely to change direction. While this approach offers significant potential, it inherently carries a degree of risk due to the precision required in predicting market turning points. The Sigma Reversal Print uses advanced methodology to forecast such reversals with a high degree of accuracy.

Signal Generation Based on Reversal and Pullback Zones: The Reversal Print generates signals when price enters specific conditions, representing exhaustion followed by a change in order flow. These conditions allow the indicator to filter out low-probability signals and focus on those with higher potential for a trend change.

Settings

Sensitivity Control: The sensitivity setting allows traders to adjust the strength of the pattern required for a signal to be generated. The scale ranges from 2-10 with higher sensitivity demanding more confirmation, leading to fewer, generally more reliable, signals however backtesting is highly recommended. Adjusting the sensitivity enables traders to balance early entries with signal accuracy, accommodating both aggressive and more conservative strategies.

Customizable Length: The length setting allows users to fine-tune the calculation period, adjusting the indicator’s responsiveness to overall market conditions. Adjusting length allows the Reversal Print to adapt to the user’s trading style and timeframe of choice. Similar to the sensitivity control, the scale ranges from 2-10 with a higher length demanding more confirmation. This can lead to fewer, often more reliable, signals however, once again, backtesting is highly recommended.

Advanced Filters

Opening Gap Filter: Turning this on allows the system to avoid painting false signals that can be triggered by the daily or weekly opening gap at market open. This setting is toggled on by default.

Price Filter: This filter applies an additional weighted price action algorithm to the signal being painted thus further filtering out weaker signals. Warning dots will still paint however the larger break arrow will no longer paint if the filter is triggered. This setting is toggled on by default.

Volume Filter: This filters out low volume entries which have a lower probability of turning into successful trades. Variable from 1-10 with 1 being the most lenient and 10 the most stringent. Warning dots will still paint however the larger break arrow will no longer paint if the filter is triggered. This setting is toggled on by default.

Alerts

Configure alerts and receive notifications when the first warning dot in a sequence appears (the series of dots seen on the chart) and again when a breakpoint is triggered (the larger arrow on the chart). This feature is particularly beneficial for traders who like to monitor multiple instruments or prefer not to stare at a screen all day.

Performance and Optimization

Backtesting Results: The Reversal Print has undergone extensive backtesting across various instruments, timeframes and market conditions, demonstrating strong performance in identifying reversal points, particularly during volatile or overextended price movements. User backtesting is strongly encouraged as it allows traders to optimize settings for their preferred instruments and timeframes.

Optimization for Diverse Markets: The Reversal Print can be used on crypto, forex, indices, commodities or stocks. The Reversal Print's algorithmic foundation ensures consistent performance across a variety of instruments. Key settings such as Sensitivity and Length will require adjustment based on the volatility and characteristics of each market.

Educational Resources and Support

Users of the Sigma Reversal Print benefit from comprehensive educational resources and full access to FxScripts Support. This ensures traders can maximize the potential of the Reversal Print and other tools in the Sigma Indicator Suite by learning best practices and gaining insights from an experienced team of traders.

Summary

The Reversal Print is a powerful and adaptable tool for reversal and pullback traders, combining statistical analysis and price action to identify high-probability turning points. Its advanced customization options, flexible controls and integration with the Sigma Indicator Suite offer significant advantages over standard indicators. By pinpointing precise entry points, the Reversal Print enables traders to make informed trading decisions with confidence.

Overview: The Sweep Detector helps users locate higher timeframe liquidity. This helps pinpoint the best zones to look for a reversal as these levels are often swept before a reversal takes place. This can lead to stronger signals when used in conjunction with the Sigma Reversal Print plus the rest of the Sigma Indicator Suite.

Recommendation: It’s best to target liquidity 3-4 timeframes higher than the one on your chart e.g. if you trade the 5m chart then it’s best to look for liquidity on the 4h or Daily. If you trade the 1h then look for liquidity on the Daily, Weekly or Monthly.

Settings: Users can add up to three different timeframes to their charts. Each of these can be turned on/off plus the linewidth, style and color can be configured independently for all timeframes. Users can also set the historic line count i.e. the total number of lines painted on the chart, in order to ease the amount of processing power used by the indicator. In general, fewer historic lines are required for higher timeframes.

New Feature: Liquidity Candle Counter

Overview: The Liquidity Candle Counter places a subtle background highlight on the chart across a designated number of candles. It’s used to ensure the recommended minimum number of candles between price and the origination point of the liquidity found by the Sweep Detector has been met.

Theory: Reversals that originate from historic liquidity have a much higher chance of success. Therefore waiting for price to sweep liquidity from points created as far into the past as possible can lead to stronger reversals.

Settings: 60 candles minimum are recommended between these two points, although users can adjust this plus the color of the background highlight to suit their personal preference.

Overview: Fair Value Gaps or FVGs, as they’re more commonly known, are a core feature of ICT trading. They also play an integral part of the Sigma Trading System as they demarcate entry levels ahead of time allowing you to place a limit order and step away from your charts should you wish to. This feature paints bullish and bearish FVGs and their midlines on the chart.

Background: A Fair Value Gap represents a price imbalance between three consecutive candles. A bullish FVG is formed when the high of the first candle doesn’t overlap with the low of the third candle (vice versa for a bearish FVG) and hence creates a price void. Such gaps frequently act as zones where price may later return, to partially or fully mitigate (fill). Midlines of FVGs often demonstrate additional price sensitivity levels, especially on higher timeframes.

Settings

- Bullish FVG on/off: enables or disables plotting of bullish FVGs

- Bearish FVG on/off: enables or disables plotting of bearish FVGs

- Midline on/off: shows or hides FVG midlines

- Standard color and line formatting options apply to all drawn elements

Once set, each of these settings also applies to alerts:

- Lookback period: sets the number of days of historical FVGs to plot (max 50 days for performance purposes)

- Use midline as opposed to full fill: selects whether to stop continuous painting of FVG at midline touch vs full fill (default on)

- Delete filled boxes and lines: deletes fully filled or threshold-crossed FVGs from the chart (default off)

- Use candle instead of body wicks: choose whether candle bodies or wicks are used for FVG mitigation (default is wicks)

Alerts

- Unconfirmed bullish/bearish FVG created: triggered when a gap exists however the third candle in the FVG sequence is yet to close

- Confirmed bullish/bearish FVG created: triggered when the third candle in the FVG sequence has closed forming a confirmed Fair Value Gap

- Price entered latest bullish/bearish FVG: triggered when price crosses the upper boundary of a bullish FVG from above or the lower boundary of a bearish FVG from below

- Price crossed threshold of latest bullish/bearish FVG: triggered when price crosses the designated threshold (midline or full fill) of an FVG as per the settings detailed above N.B. full fill is required to alert a confirmed iFVG, alternatively it's possible to set a level alert if midline is used

Adds a table to the corner of the chart showing the daily ATR value and the % of the ATR that price has moved so far today. As a general rule, market reversals are more likely to occur when this value is approaching or greater than 100%. Users can set the value at which the table background changes color when the current daily range exceeds the daily ATR, an accompanying alert may also be sent.

Additional Updates

Updated Reversal Print Settings: the Sensitivity and Length settings have been modified to detect breaks with greater accuracy.

Updated Reversal Print Filters: settings have been modified to allow for a broader range of values for the trend filter. Filtered markers now remain on the chart and are configurable to distinguish from unfiltered markers.

FVG + iFVG Alerts: updated alert rules.

Tập lệnh chỉ hiển thị cho người được mời

Chỉ những người dùng được tác giả chấp thuận mới có thể truy cập tập lệnh này. Bạn sẽ cần yêu cầu và được cấp quyền sử dụng. Thông thường quyền này được cấp sau khi thanh toán. Để biết thêm chi tiết, làm theo hướng dẫn của tác giả bên dưới hoặc liên hệ trực tiếp với FxScripts.

TradingView KHÔNG khuyến nghị bạn trả phí hoặc sử dụng một tập lệnh trừ khi bạn hoàn toàn tin tưởng vào tác giả và hiểu cách hoạt động của tập lệnh. Bạn cũng có thể tìm các lựa chọn miễn phí, mã nguồn mở trong các script cộng đồng của chúng tôi.

Hướng dẫn của tác giả

Thông báo miễn trừ trách nhiệm

Tập lệnh chỉ hiển thị cho người được mời

Chỉ những người dùng được tác giả chấp thuận mới có thể truy cập tập lệnh này. Bạn sẽ cần yêu cầu và được cấp quyền sử dụng. Thông thường quyền này được cấp sau khi thanh toán. Để biết thêm chi tiết, làm theo hướng dẫn của tác giả bên dưới hoặc liên hệ trực tiếp với FxScripts.

TradingView KHÔNG khuyến nghị bạn trả phí hoặc sử dụng một tập lệnh trừ khi bạn hoàn toàn tin tưởng vào tác giả và hiểu cách hoạt động của tập lệnh. Bạn cũng có thể tìm các lựa chọn miễn phí, mã nguồn mở trong các script cộng đồng của chúng tôi.