OPEN-SOURCE SCRIPT

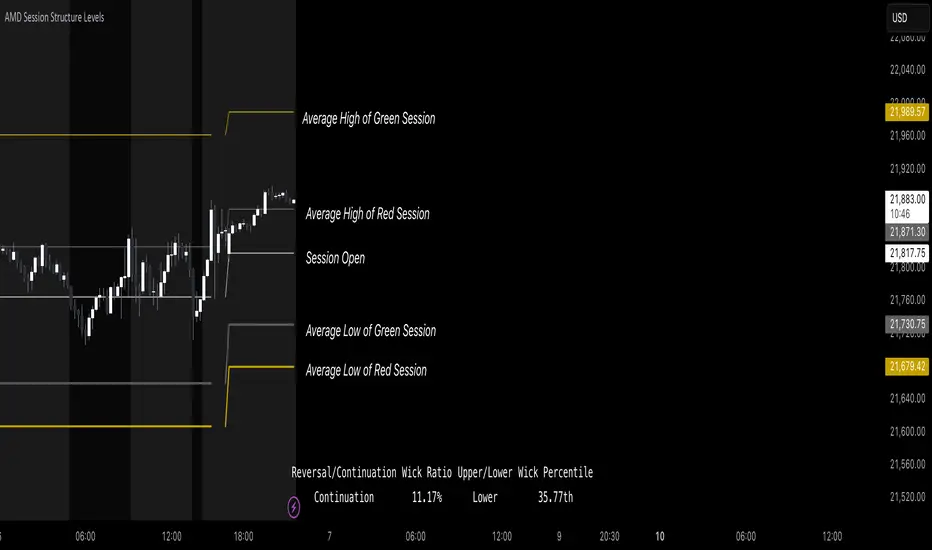

AMD Session Structure Levels

# Market Structure & Manipulation Probability Indicator

## Overview

This advanced indicator is designed for traders who want a systematic approach to analyzing market structure, identifying manipulation, and assessing probability-based trade setups. It incorporates four core components:

### 1. Session Price Action Analysis

- Tracks **OHLC (Open, High, Low, Close)** within defined sessions.

- Implements a **dual tracking system**:

- **Official session levels** (fixed from the session open to close).

- **Real-time max/min tracking** to differentiate between temporary spikes and real price acceptance.

### 2. Market Manipulation Detection

- Identifies **manipulative price action** using the relationship between the open and close:

- If **price closes below open** → assumes **upward manipulation**, followed by **downward distribution**.

- If **price closes above open** → assumes **downward manipulation**, followed by **upward distribution**.

- Normalized using **ATR**, ensuring adaptability across different volatility conditions.

### 3. Probability Engine

- Tracks **historical wick ratios** to assess trend vs. reversal conditions.

- Calculates **conditional probabilities** for price moves.

- Uses a **special threshold system (0.45 and 0.03)** for reversal signals.

- Provides **real-time probability updates** to enhance trade decision-making.

### 4. Market Condition Classification

- Classifies market conditions using a **wick-to-body ratio**:

```pine

wick_to_body_ratio = open > close ? upper_wick / (high - low) : lower_wick / (high - low)

```

- **Low ratio (<0.25)** → Likely a **trend day**.

- **High ratio (>0.25)** → Likely a **range day**.

---

## Why This Indicator Stands Out

### ✅ Smarter Level Detection

- Uses **ATR-based dynamic levels** instead of static support/resistance.

- Differentiates **manipulation from distribution** for better decision-making.

- Updates probabilities **in real-time**.

### ✅ Memory-Efficient Design

- Implements **circular buffers** to maintain efficiency:

```pine

var float[] manipUp = array.new_float(lookbackPeriod, 0.0)

var float[] manipDown = array.new_float(lookbackPeriod, 0.0)

```

- Ensures **constant memory usage**, even over extended trading sessions.

### ✅ Advanced Probability Calculation

- Utilizes **conditional probabilities** instead of simple averages.

- Incorporates **market context** through wick analysis.

- Provides **actionable signals** via a probability table.

---

## Trading Strategy Guide

### **Best Entry Setups**

✅ Wait for **price to approach manipulation levels**.

✅ Confirm using the **probability table**.

✅ Check the **wick ratio for context**.

✅ Enter when **conditional probability aligns**.

### **Smart Exit Management**

✅ Use **distribution levels** as **profit targets**.

✅ Scale out **when probabilities shift**.

✅ Monitor **wick percentiles** for confirmation.

### **Risk Management**

✅ Size positions based on **probability readings**.

✅ Place stops at **manipulation levels**.

✅ Adjust position size based on **trend vs. range classification**.

---

## Configuration Tips

### **Session Settings**

```pine

sessionTime = input.session("0830-1500", "Session Hours")

weekDays = input.string("23456", "Active Days")

```

- Match these to your **primary trading session**.

- Adjust for different **market opens** if needed.

### **Analysis Parameters**

```pine

lookbackPeriod = input.int(50, "Lookback Period")

low_threshold = input.float(0.25, "Trend/Range Threshold")

```

- **50 periods** is a good starting point but can be optimized per instrument.

- The **0.25 threshold** is ideal for most markets but may need adjustments.

---

## Market Structure Breakdown

### **Trend/Continuation Days**

- **Characteristics:**

✅ Small **opposing wicks** (minimal counter-pressure).

✅ Clean, **directional price movement**.

- **Bullish Trend Day Example:**

✅ Small **lower wicks** (minimal downward pressure).

✅ Strong **closes near the highs** → **Buyers in control**.

- **Bearish Trend Day Example:**

✅ Small **upper wicks** (minimal upward pressure).

✅ Strong **closes near the lows** → **Sellers in control**.

### **Reversal Days**

- **Characteristics:**

✅ **Large opposing wicks** → Failed momentum in the initial direction.

- **Bullish Reversal Example:**

✅ **Large upper wick early**.

✅ **Strong close from the lows** → **Sellers failed to maintain control**.

- **Bearish Reversal Example:**

✅ **Large lower wick early**.

✅ **Weak close from the highs** → **Buyers failed to maintain control**.

---

## Summary

This indicator systematically quantifies market structure by measuring **manipulation, distribution, and probability-driven trade setups**. Unlike traditional indicators, it adapts dynamically using **ATR, historical probabilities, and real-time tracking** to offer a structured, data-driven approach to trading.

🚀 **Use this tool to enhance your decision-making and gain an objective edge in the market!**

## Overview

This advanced indicator is designed for traders who want a systematic approach to analyzing market structure, identifying manipulation, and assessing probability-based trade setups. It incorporates four core components:

### 1. Session Price Action Analysis

- Tracks **OHLC (Open, High, Low, Close)** within defined sessions.

- Implements a **dual tracking system**:

- **Official session levels** (fixed from the session open to close).

- **Real-time max/min tracking** to differentiate between temporary spikes and real price acceptance.

### 2. Market Manipulation Detection

- Identifies **manipulative price action** using the relationship between the open and close:

- If **price closes below open** → assumes **upward manipulation**, followed by **downward distribution**.

- If **price closes above open** → assumes **downward manipulation**, followed by **upward distribution**.

- Normalized using **ATR**, ensuring adaptability across different volatility conditions.

### 3. Probability Engine

- Tracks **historical wick ratios** to assess trend vs. reversal conditions.

- Calculates **conditional probabilities** for price moves.

- Uses a **special threshold system (0.45 and 0.03)** for reversal signals.

- Provides **real-time probability updates** to enhance trade decision-making.

### 4. Market Condition Classification

- Classifies market conditions using a **wick-to-body ratio**:

```pine

wick_to_body_ratio = open > close ? upper_wick / (high - low) : lower_wick / (high - low)

```

- **Low ratio (<0.25)** → Likely a **trend day**.

- **High ratio (>0.25)** → Likely a **range day**.

---

## Why This Indicator Stands Out

### ✅ Smarter Level Detection

- Uses **ATR-based dynamic levels** instead of static support/resistance.

- Differentiates **manipulation from distribution** for better decision-making.

- Updates probabilities **in real-time**.

### ✅ Memory-Efficient Design

- Implements **circular buffers** to maintain efficiency:

```pine

var float[] manipUp = array.new_float(lookbackPeriod, 0.0)

var float[] manipDown = array.new_float(lookbackPeriod, 0.0)

```

- Ensures **constant memory usage**, even over extended trading sessions.

### ✅ Advanced Probability Calculation

- Utilizes **conditional probabilities** instead of simple averages.

- Incorporates **market context** through wick analysis.

- Provides **actionable signals** via a probability table.

---

## Trading Strategy Guide

### **Best Entry Setups**

✅ Wait for **price to approach manipulation levels**.

✅ Confirm using the **probability table**.

✅ Check the **wick ratio for context**.

✅ Enter when **conditional probability aligns**.

### **Smart Exit Management**

✅ Use **distribution levels** as **profit targets**.

✅ Scale out **when probabilities shift**.

✅ Monitor **wick percentiles** for confirmation.

### **Risk Management**

✅ Size positions based on **probability readings**.

✅ Place stops at **manipulation levels**.

✅ Adjust position size based on **trend vs. range classification**.

---

## Configuration Tips

### **Session Settings**

```pine

sessionTime = input.session("0830-1500", "Session Hours")

weekDays = input.string("23456", "Active Days")

```

- Match these to your **primary trading session**.

- Adjust for different **market opens** if needed.

### **Analysis Parameters**

```pine

lookbackPeriod = input.int(50, "Lookback Period")

low_threshold = input.float(0.25, "Trend/Range Threshold")

```

- **50 periods** is a good starting point but can be optimized per instrument.

- The **0.25 threshold** is ideal for most markets but may need adjustments.

---

## Market Structure Breakdown

### **Trend/Continuation Days**

- **Characteristics:**

✅ Small **opposing wicks** (minimal counter-pressure).

✅ Clean, **directional price movement**.

- **Bullish Trend Day Example:**

✅ Small **lower wicks** (minimal downward pressure).

✅ Strong **closes near the highs** → **Buyers in control**.

- **Bearish Trend Day Example:**

✅ Small **upper wicks** (minimal upward pressure).

✅ Strong **closes near the lows** → **Sellers in control**.

### **Reversal Days**

- **Characteristics:**

✅ **Large opposing wicks** → Failed momentum in the initial direction.

- **Bullish Reversal Example:**

✅ **Large upper wick early**.

✅ **Strong close from the lows** → **Sellers failed to maintain control**.

- **Bearish Reversal Example:**

✅ **Large lower wick early**.

✅ **Weak close from the highs** → **Buyers failed to maintain control**.

---

## Summary

This indicator systematically quantifies market structure by measuring **manipulation, distribution, and probability-driven trade setups**. Unlike traditional indicators, it adapts dynamically using **ATR, historical probabilities, and real-time tracking** to offer a structured, data-driven approach to trading.

🚀 **Use this tool to enhance your decision-making and gain an objective edge in the market!**

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.