OPEN-SOURCE SCRIPT

Bid/Ask Volume Tension with Rolling Avg

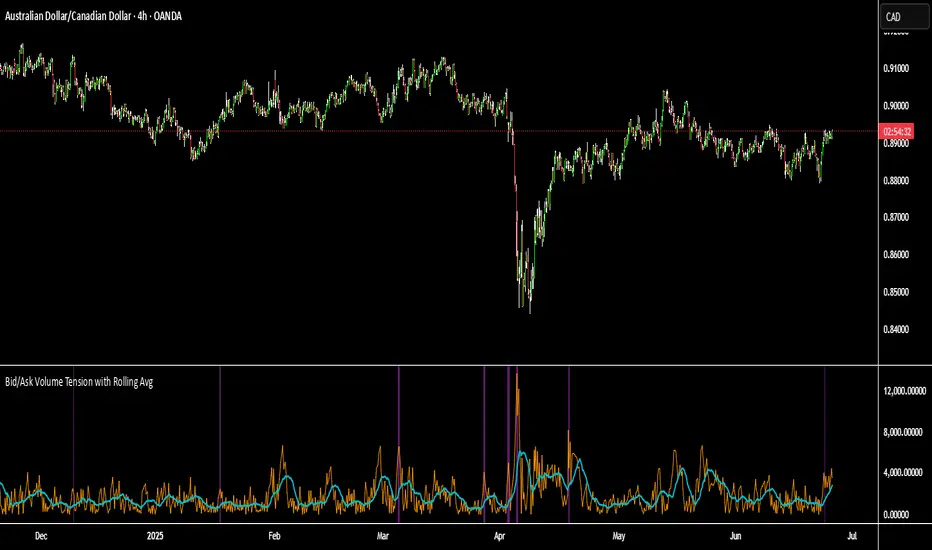

📊 Bid/Ask Volume Tension with Rolling Average

This indicator is designed to help traders identify pivotal moments of buildup, exhaustion, or imbalance in the market by calculating the tension between buy and sell volume.

🔍 How It Works:

Buy volume is approximated when the candle closes higher than or equal to its open.

Sell volume is approximated when the candle closes below its open.

Both are smoothed using an EMA (Exponential Moving Average) for noise reduction.

Tension is calculated as the absolute difference between smoothed buy and sell volume.

A rolling average of tension shows the baseline for normal behavior.

When instant tension rises significantly above the rolling average, it often signals:

A build-up before a large move

Aggressive order flow imbalances

Potential reversals or breakouts

🧠 How to Use:

Watch the orange line (instant tension) for spikes above the aqua line (rolling average).

Purple background highlights show when tension exceeds a customizable multiple of the average — a potential setup zone.

Use this indicator alongside:

Price action (candlestick structure)

Support/resistance

Liquidity zones or order blocks

⚙️ Settings:

Smoothing Length: Controls the responsiveness of buy/sell volume smoothing.

Rolling Avg Window: Defines the lookback period for the baseline tension.

Buildup Threshold: Triggers highlight zones when tension exceeds this multiple of the average.

🧪 Best For:

Spotting pre-breakout tension

Detecting volume-based divergences

Confirming order flow imbalances

This indicator is designed to help traders identify pivotal moments of buildup, exhaustion, or imbalance in the market by calculating the tension between buy and sell volume.

🔍 How It Works:

Buy volume is approximated when the candle closes higher than or equal to its open.

Sell volume is approximated when the candle closes below its open.

Both are smoothed using an EMA (Exponential Moving Average) for noise reduction.

Tension is calculated as the absolute difference between smoothed buy and sell volume.

A rolling average of tension shows the baseline for normal behavior.

When instant tension rises significantly above the rolling average, it often signals:

A build-up before a large move

Aggressive order flow imbalances

Potential reversals or breakouts

🧠 How to Use:

Watch the orange line (instant tension) for spikes above the aqua line (rolling average).

Purple background highlights show when tension exceeds a customizable multiple of the average — a potential setup zone.

Use this indicator alongside:

Price action (candlestick structure)

Support/resistance

Liquidity zones or order blocks

⚙️ Settings:

Smoothing Length: Controls the responsiveness of buy/sell volume smoothing.

Rolling Avg Window: Defines the lookback period for the baseline tension.

Buildup Threshold: Triggers highlight zones when tension exceeds this multiple of the average.

🧪 Best For:

Spotting pre-breakout tension

Detecting volume-based divergences

Confirming order flow imbalances

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.