OPEN-SOURCE SCRIPT

Annual Lump Sum: Yearly & Compounded

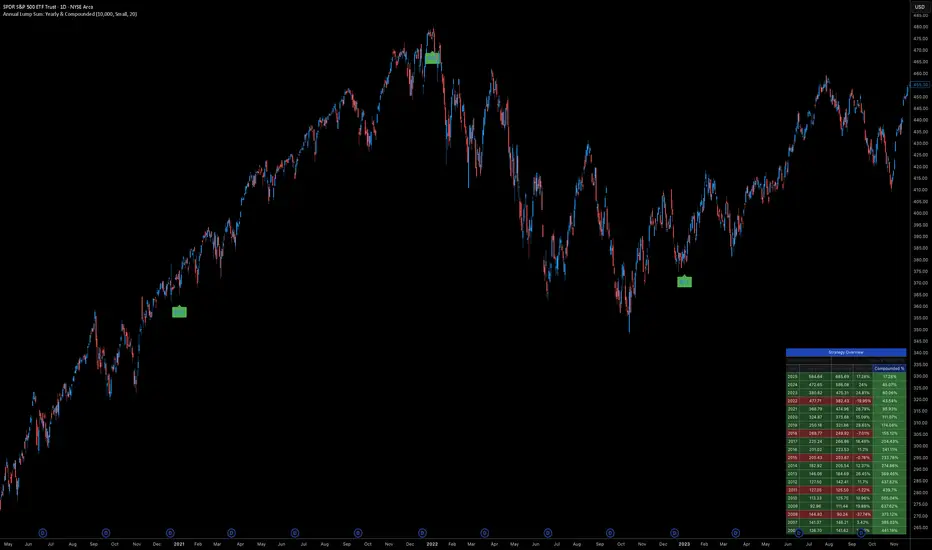

Annual Lump Sum Investment Analyzer (Yearly vs. Compounded)

Overview

This Pine Script indicator simulates a disciplined "Lump Sum" investing strategy. It calculates the performance of buying a fixed dollar amount (e.g., $10,000) on the very first trading day of every year and holding it indefinitely.

Unlike standard backtesters that only show a total percentage, this tool breaks down performance by "Vintage" (the year of purchase), allowing you to see which specific years contributed most to your wealth.

Key Features

Automated Execution: Automatically detects the first trading bar of every new year to simulate a buy.

Dual-Yield Analysis: The table provides two distinct ways to view returns:

Yearly %: How the market performed specifically during that calendar year (Jan 1 to Dec 31).

Compounded %: The total return of that specific year's investment from the moment it was bought until today.

Live Updates: For the current year, the "End Price" and "Yields" update in real-time with market movements.

Portfolio Summary: Displays your Total Invested Capital vs. Total Current Value at the top of the table.

Table Column Breakdown

The dashboard in the bottom-right corner displays the following:

Year: The vintage year of the investment.

Buy Price: The price of the asset on the first trading day of that year.

End Price: The price on the last trading day of that year (or the current price if the year is still active).

Yearly %: The isolated performance of that specific calendar year. (Green = The market ended the year higher than it started).

Compounded %: The "Diamond Hands" return. This shows how much that specific $10,000 tranche is up (or down) right now relative to the current price.

How to Use

Add the script to your chart.

Crucial: Set your chart timeframe to Daily (D). This ensures the script correctly identifies the first trading day of the year.

Open the Settings (Inputs) to adjust:

Annual Investment Amount: Default is $10,000.

Table Size: Adjust text size (Tiny, Small, Normal, Large).

Max Rows: Limit how many historical years are shown to keep the chart clean.

Use Case

This tool is perfect for investors who want to visualize the power of long-term holding. It allows you to see that even if a specific year had a bad "Yearly Yield" (e.g., buying in 2008), the "Compounded Yield" might still be massive today due to time in the market.

Overview

This Pine Script indicator simulates a disciplined "Lump Sum" investing strategy. It calculates the performance of buying a fixed dollar amount (e.g., $10,000) on the very first trading day of every year and holding it indefinitely.

Unlike standard backtesters that only show a total percentage, this tool breaks down performance by "Vintage" (the year of purchase), allowing you to see which specific years contributed most to your wealth.

Key Features

Automated Execution: Automatically detects the first trading bar of every new year to simulate a buy.

Dual-Yield Analysis: The table provides two distinct ways to view returns:

Yearly %: How the market performed specifically during that calendar year (Jan 1 to Dec 31).

Compounded %: The total return of that specific year's investment from the moment it was bought until today.

Live Updates: For the current year, the "End Price" and "Yields" update in real-time with market movements.

Portfolio Summary: Displays your Total Invested Capital vs. Total Current Value at the top of the table.

Table Column Breakdown

The dashboard in the bottom-right corner displays the following:

Year: The vintage year of the investment.

Buy Price: The price of the asset on the first trading day of that year.

End Price: The price on the last trading day of that year (or the current price if the year is still active).

Yearly %: The isolated performance of that specific calendar year. (Green = The market ended the year higher than it started).

Compounded %: The "Diamond Hands" return. This shows how much that specific $10,000 tranche is up (or down) right now relative to the current price.

How to Use

Add the script to your chart.

Crucial: Set your chart timeframe to Daily (D). This ensures the script correctly identifies the first trading day of the year.

Open the Settings (Inputs) to adjust:

Annual Investment Amount: Default is $10,000.

Table Size: Adjust text size (Tiny, Small, Normal, Large).

Max Rows: Limit how many historical years are shown to keep the chart clean.

Use Case

This tool is perfect for investors who want to visualize the power of long-term holding. It allows you to see that even if a specific year had a bad "Yearly Yield" (e.g., buying in 2008), the "Compounded Yield" might still be massive today due to time in the market.

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.