OPEN-SOURCE SCRIPT

Cập nhật Linear Regression Forecast (ADX Adaptive)

Linear Regression Forecast (ADX Adaptive)

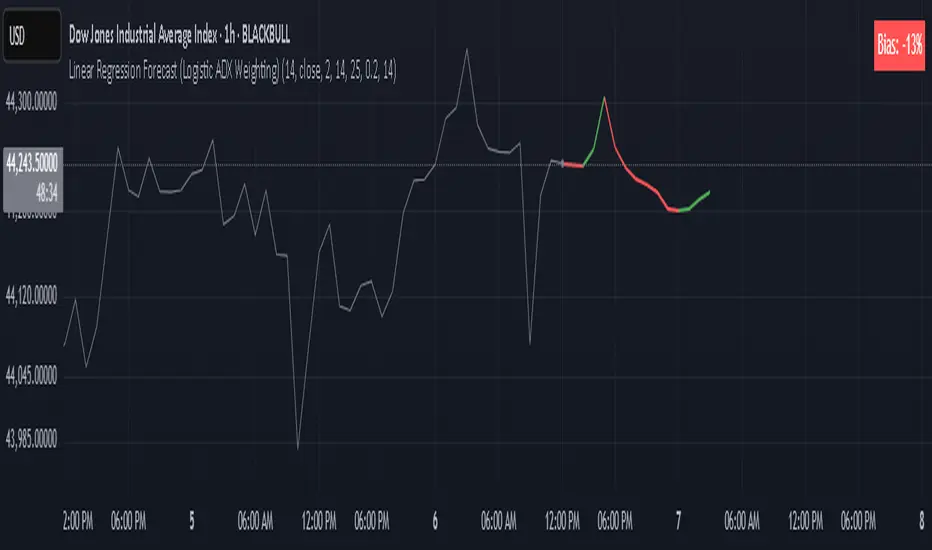

This indicator is a dynamic price projection tool that combines multiple linear regression forecasts into a single, adaptive forecast curve. By integrating trend strength via the ADX and directional bias, it aims to visualize how price might evolve in different market environments—from strong trends to mean-reverting conditions.

Core Concept:

This tool builds forward price projections based on a blend of linear regression models with varying lookback lengths (from 2 up to a user-defined max). It then adjusts those projections using two key mechanisms:

ADX-Weighted Forecast Blending

In trending conditions (high ADX), the model follows the raw forecast direction. In ranging markets (low ADX), the forecast flips or reverts, biasing toward mean-reversion. A logistic transformation of directional bias, controlled by a steepness parameter, determines how aggressively this blending reacts to price behavior.

Volatility Scaling

The forecast’s magnitude is scaled based on ADX and directional conviction. When trends are unclear (low ADX or neutral bias), the projection range expands to reflect greater uncertainty and volatility.

How It Works:

Regression Curve Generation

For each regression length from 2 to maxLength, a forward projection is calculated using least-squares linear regression on the selected price source. These forecasts are extrapolated into the future.

Directional Bias Calculation

The forecasted points are analyzed to determine a normalized bias value in the range -1 to +1, where +1 means strongly bullish, -1 means strongly bearish, and 0 means neutral.

Logistic Bias Transformation

The raw bias is passed through a logistic sigmoid function, with a user-defined steepness. This creates a probability-like weight that favors either following or reversing the forecast depending on market context.

ADX-Based Weighting

ADX determines the weighting between trend-following and mean-reversion modes. Below ADX 20, the model favors mean-reversion. Above 25, it favors trend-following. Between 20 and 25, it linearly blends the two.

Blended Forecast Curve

Each forecast point is blended between trend-following and mean-reverting values, scaled for volatility.

What You See:

Forecast Lines: Projected future price paths drawn in green or red depending on direction.

Bias Plot: A separate plot showing post-blend directional bias as a percentage, where +100 is strongly bullish and -100 is strongly bearish.

Neutral Line: A dashed horizontal line at 0 percent bias to indicate neutrality.

User Inputs:

-Max Regression Length

-Price Source

-Line Width

-Bias Steepness

-ADX Length and Smoothing

Use Cases:

Visualize expected price direction under different trend conditions

Adjust trading behavior depending on trending vs ranging markets

Combine with other tools for deeper analysis

Important Notes:

This indicator is for visualization and analysis only. It does not provide buy or sell signals and should not be used in isolation. It makes assumptions based on historical price action and should be interpreted with market context.

This indicator is a dynamic price projection tool that combines multiple linear regression forecasts into a single, adaptive forecast curve. By integrating trend strength via the ADX and directional bias, it aims to visualize how price might evolve in different market environments—from strong trends to mean-reverting conditions.

Core Concept:

This tool builds forward price projections based on a blend of linear regression models with varying lookback lengths (from 2 up to a user-defined max). It then adjusts those projections using two key mechanisms:

ADX-Weighted Forecast Blending

In trending conditions (high ADX), the model follows the raw forecast direction. In ranging markets (low ADX), the forecast flips or reverts, biasing toward mean-reversion. A logistic transformation of directional bias, controlled by a steepness parameter, determines how aggressively this blending reacts to price behavior.

Volatility Scaling

The forecast’s magnitude is scaled based on ADX and directional conviction. When trends are unclear (low ADX or neutral bias), the projection range expands to reflect greater uncertainty and volatility.

How It Works:

Regression Curve Generation

For each regression length from 2 to maxLength, a forward projection is calculated using least-squares linear regression on the selected price source. These forecasts are extrapolated into the future.

Directional Bias Calculation

The forecasted points are analyzed to determine a normalized bias value in the range -1 to +1, where +1 means strongly bullish, -1 means strongly bearish, and 0 means neutral.

Logistic Bias Transformation

The raw bias is passed through a logistic sigmoid function, with a user-defined steepness. This creates a probability-like weight that favors either following or reversing the forecast depending on market context.

ADX-Based Weighting

ADX determines the weighting between trend-following and mean-reversion modes. Below ADX 20, the model favors mean-reversion. Above 25, it favors trend-following. Between 20 and 25, it linearly blends the two.

Blended Forecast Curve

Each forecast point is blended between trend-following and mean-reverting values, scaled for volatility.

What You See:

Forecast Lines: Projected future price paths drawn in green or red depending on direction.

Bias Plot: A separate plot showing post-blend directional bias as a percentage, where +100 is strongly bullish and -100 is strongly bearish.

Neutral Line: A dashed horizontal line at 0 percent bias to indicate neutrality.

User Inputs:

-Max Regression Length

-Price Source

-Line Width

-Bias Steepness

-ADX Length and Smoothing

Use Cases:

Visualize expected price direction under different trend conditions

Adjust trading behavior depending on trending vs ranging markets

Combine with other tools for deeper analysis

Important Notes:

This indicator is for visualization and analysis only. It does not provide buy or sell signals and should not be used in isolation. It makes assumptions based on historical price action and should be interpreted with market context.

Phát hành các Ghi chú

bias calculationPhát hành các Ghi chú

cleanerPhát hành các Ghi chú

bias calculationPhát hành các Ghi chú

1:1 Gann angle benchmark ratio calculation for Biasbetter bias display

Phát hành các Ghi chú

forecast actually blendsPhát hành các Ghi chú

anti-trend weightingPhát hành các Ghi chú

made logistic range an inputPhát hành các Ghi chú

logistic formula non-flipMã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.