OPEN-SOURCE SCRIPT

Yale Confidence Index [nb]

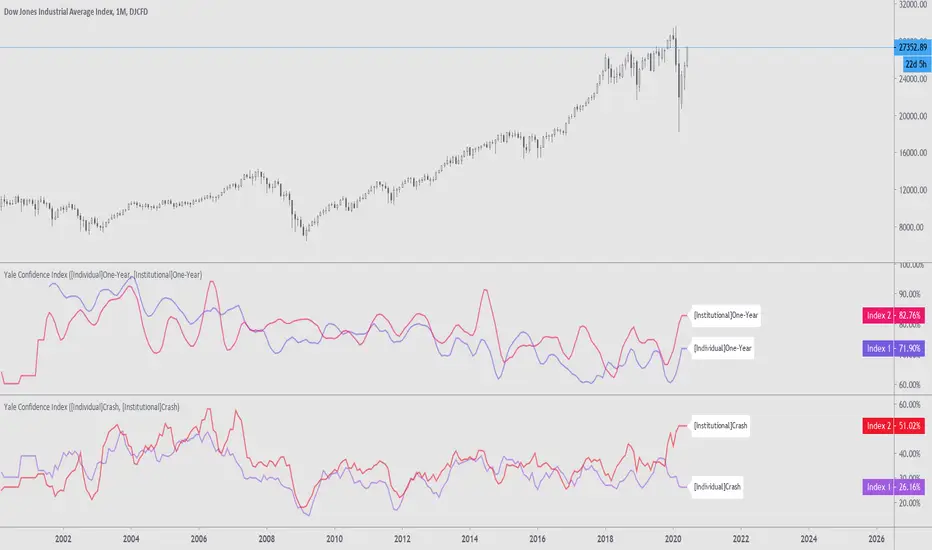

These are the Yale confidence indexes that show individual and institutional sentiment.

Options include:

U.S. One-Year Confidence Index

The percent of the population expecting an increase in the Dow in the coming year.

The One-Year Confidence Index is the percentage of respondents giving a number strictly greater than zero for "in 1 year." Note that the question is worded to mention the possibility that the respondent could predict a downturn, and so this question will obtain more such responses than more optimistically worded questions used by some other surveys. However, the issue is how the answers change through time, and the wording of the question has not been changed through time (except to add the 1-month and the ten-year categories, which were not on the earliest questionnaires).

U.S. Buy-on-Dips Confidence Index

The percent of the population expecting a rebound the next day should the market ever drop 3% in one day.

The Buy-On-Dips Confidence Index is the number of respondents who choose 1 (increase) as a percent of those who chose 1, 2 or 3. This question was never changed.

U.S. Crash Confidence Index

The percent of the population who attach little probability to a stock market crash in the next six months.

The Crash Confidence Index is the percentage of respondents who think that the probability is strictly less than 10%. There were slight wording changes in this question, but inessential.

U.S. Valuation Confidence Index

The percent of the population who think that the market is not too high.

The Valuation Confidence Index is the number of respondents who choose 1 (Too Low) or 3 (About right) as a percentage of those who choose 1, 2, or 3. The wording of this question was never changed, and it was always the first question on the questionnaire.

Source:

som.yale.edu/faculty-research-centers/centers-initiatives/international-center-for-finance/data/stock-market-confidence-indices/united-states-stock-market-confidence-indices

Includes methodology and questions used.

Japanese indexes aren't updated so I did not include them.

Options include:

- showing two different indexes at once

- labels for them

- to filter through a moving average

- highlighting when the first chosen index is greater than the second

- shifting the series 6 months ahead

- showing an average of both indexes

U.S. One-Year Confidence Index

The percent of the population expecting an increase in the Dow in the coming year.

The One-Year Confidence Index is the percentage of respondents giving a number strictly greater than zero for "in 1 year." Note that the question is worded to mention the possibility that the respondent could predict a downturn, and so this question will obtain more such responses than more optimistically worded questions used by some other surveys. However, the issue is how the answers change through time, and the wording of the question has not been changed through time (except to add the 1-month and the ten-year categories, which were not on the earliest questionnaires).

U.S. Buy-on-Dips Confidence Index

The percent of the population expecting a rebound the next day should the market ever drop 3% in one day.

The Buy-On-Dips Confidence Index is the number of respondents who choose 1 (increase) as a percent of those who chose 1, 2 or 3. This question was never changed.

U.S. Crash Confidence Index

The percent of the population who attach little probability to a stock market crash in the next six months.

The Crash Confidence Index is the percentage of respondents who think that the probability is strictly less than 10%. There were slight wording changes in this question, but inessential.

U.S. Valuation Confidence Index

The percent of the population who think that the market is not too high.

The Valuation Confidence Index is the number of respondents who choose 1 (Too Low) or 3 (About right) as a percentage of those who choose 1, 2, or 3. The wording of this question was never changed, and it was always the first question on the questionnaire.

Source:

som.yale.edu/faculty-research-centers/centers-initiatives/international-center-for-finance/data/stock-market-confidence-indices/united-states-stock-market-confidence-indices

Includes methodology and questions used.

Japanese indexes aren't updated so I did not include them.

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

My published indicators: tradingview.com/u/NeoButane/

Sorry if I haven't replied to your message yet, I'm a bit backlogged :)

Sorry if I haven't replied to your message yet, I'm a bit backlogged :)

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

My published indicators: tradingview.com/u/NeoButane/

Sorry if I haven't replied to your message yet, I'm a bit backlogged :)

Sorry if I haven't replied to your message yet, I'm a bit backlogged :)

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.