Description:

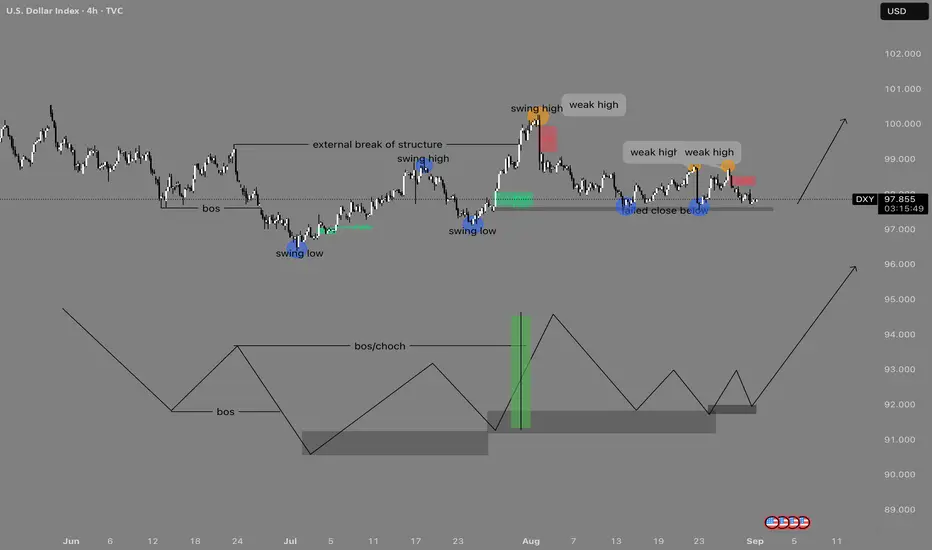

This chart highlights a bullish idea on the Dollar Index (DXY), with structure and liquidity concepts driving the outlook.

Swing Structure:

Price formed a major swing low after a clear BOS (break of structure) to the downside. From there, buyers stepped in, creating a new swing high and pushing into an external BOS, confirming higher-timeframe strength.

Weak Highs & Liquidity Pools:

Multiple weak highs (highlighted in orange) remain unprotected and serve as liquidity targets. These highs are unlikely to hold, suggesting the market will eventually raid them as it seeks upside continuation.

Demand Zones & Failed Close:

Despite temporary sell-offs, the market failed to close below key support (annotated near 97.80–97.00), showing absorption of selling pressure. Fair Value Gaps (FVGs) also act as areas of re-accumulation where buyers can step back in.

Schematic Alignment:

The lower schematic illustrates the anticipated accumulation process: a BOS/CHOCH leading into demand mitigation, followed by higher-lows being built and a final expansion phase. This aligns with the live chart, projecting a bullish run once the corrective phase completes.

Outlook:

As long as price respects the current demand zone, DXY is positioned for continuation to the upside, with liquidity objectives above 99.00 and potentially 100+. A deeper retracement toward 96.00–95.00 would still fit the bullish accumulation model and provide an additional long opportunity.

This chart highlights a bullish idea on the Dollar Index (DXY), with structure and liquidity concepts driving the outlook.

Swing Structure:

Price formed a major swing low after a clear BOS (break of structure) to the downside. From there, buyers stepped in, creating a new swing high and pushing into an external BOS, confirming higher-timeframe strength.

Weak Highs & Liquidity Pools:

Multiple weak highs (highlighted in orange) remain unprotected and serve as liquidity targets. These highs are unlikely to hold, suggesting the market will eventually raid them as it seeks upside continuation.

Demand Zones & Failed Close:

Despite temporary sell-offs, the market failed to close below key support (annotated near 97.80–97.00), showing absorption of selling pressure. Fair Value Gaps (FVGs) also act as areas of re-accumulation where buyers can step back in.

Schematic Alignment:

The lower schematic illustrates the anticipated accumulation process: a BOS/CHOCH leading into demand mitigation, followed by higher-lows being built and a final expansion phase. This aligns with the live chart, projecting a bullish run once the corrective phase completes.

Outlook:

As long as price respects the current demand zone, DXY is positioned for continuation to the upside, with liquidity objectives above 99.00 and potentially 100+. A deeper retracement toward 96.00–95.00 would still fit the bullish accumulation model and provide an additional long opportunity.

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.